Let's cut right to the chase: the 17-month-long Bitcoin price drop has not spelled the slow death of the currency. Quite the contrary.

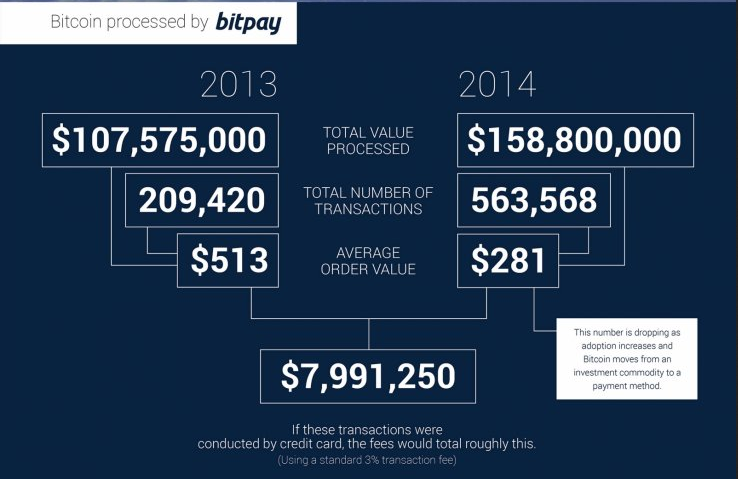

The price fall has coincided with a literal doubling of the network's transaction volume. This means that Bitcoin is no longer a speculative investment, but is becoming an everyday payment method.

Or so says the BitPay team, who recently spoke with IBTimes UK on why the currency's price drop is a natural and even predictable result of Bitcoin's serious growth.

Early on in Bitcoin's timeline, there was hardly anywhere to spend it, so users bought far more than they spent. But now that bitcoins can get you a hotel, flight, shoes, and an apartment in San Francisco to boot, they're being spent – that is, sold – at a much higher rate.

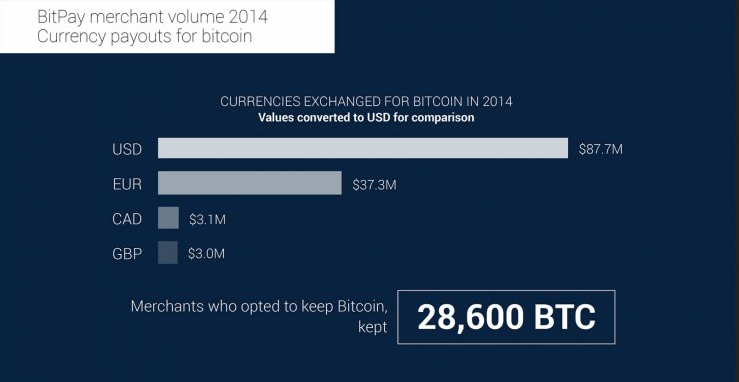

And BitPay would know. At the beginning of 2015, over 100,000 merchants around the globe accepted Bitcoin for payment, and over half of them used BitPay to do so. Though many of BitPay's merchants keep a portion of these payments in bitcoins, most of them convert a good portion of it to fiat. This accounts for the massive downward price swing, because there's just more bitcoins going around.

But the next bitcoin reward halving is set to take place in 2016 – from 25 bitcoins every 10 minutes to only 12.5. At this point, the number of new and available bitcoins will decrease substantially. If transaction volume is still increasing in 2016, we can expect Bitcoin's price to go up as a result.

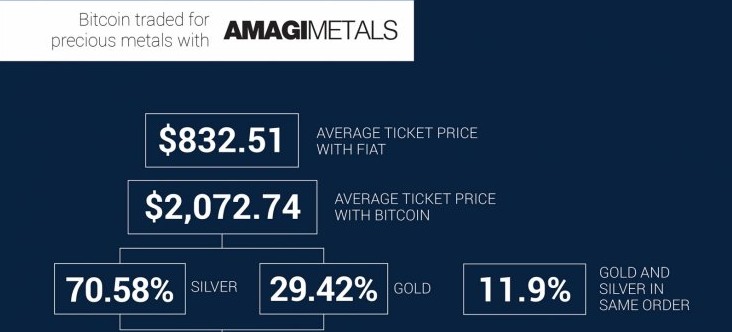

Here are some highlights from the infographic that BitPay shared with IBTimes UK:

The full infographic, which contains more interesting statistics, can be found here.

Did you enjoy this article? You may also be interested in reading these ones: