Bitcoin is awaiting hard fork. What does the current growth actually mean? Where will the price go after Aug. 1?

How scaling influenced the price

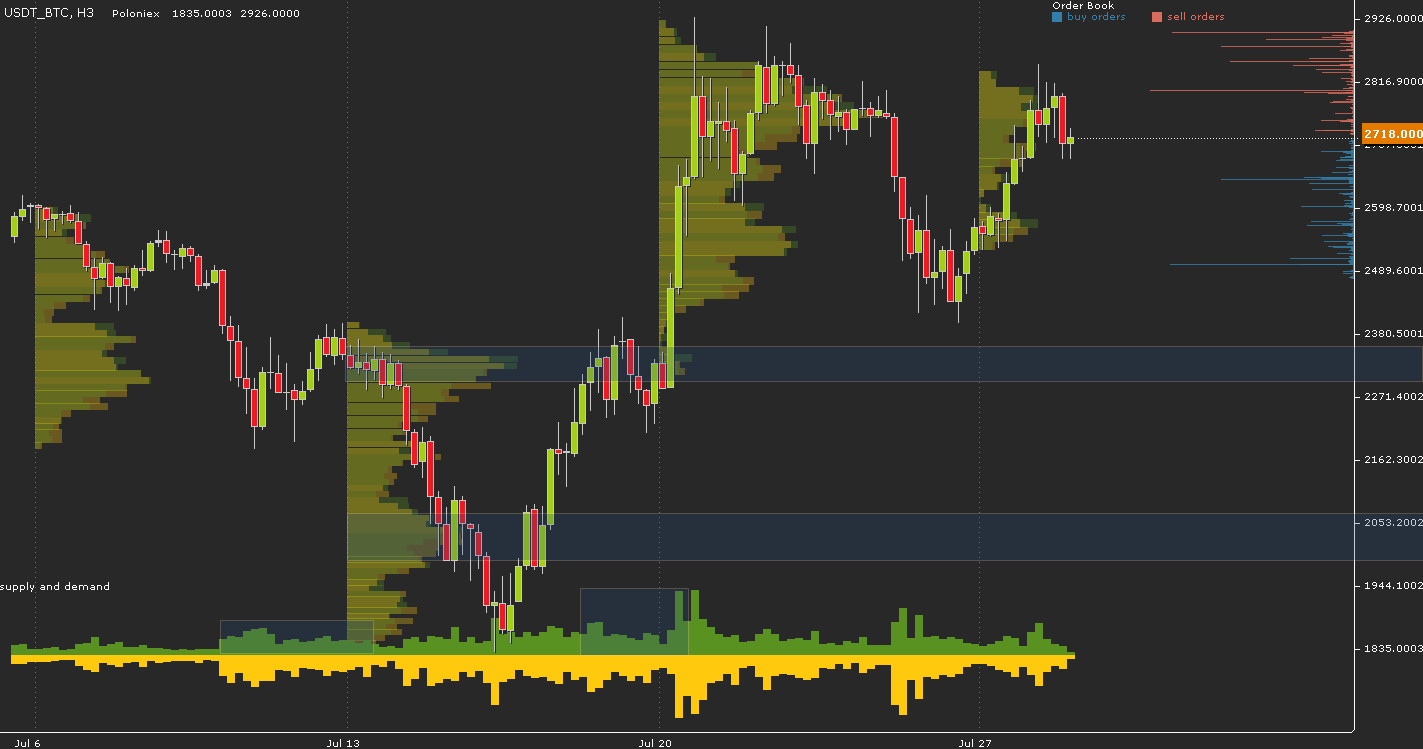

For several months, the main topic of discussion has been the hard fork case. In early July, before SegWit2x implementation, Bitcoin price dropped significantly from $2,600 to $1,600. But less than a week before the transition, we see a price rise from $1,835, along with an increase in demand. The main bulk of purchases are concentrated at the $2,000 mark. Strong growth from the peak of long-term correction suggests that there is support for investors. The $2,300 level shows us the next confirmation for the uptrend and the price settles. If you evaluate the demand, you’ll see that its volume is much larger, compared to July 13, when Bitcoin was trading at the same levels. The large buyer holds its main positions at $2,000, $2,300 and $2,500, which is backed by the price rise before SegWit2x.

What happens next?

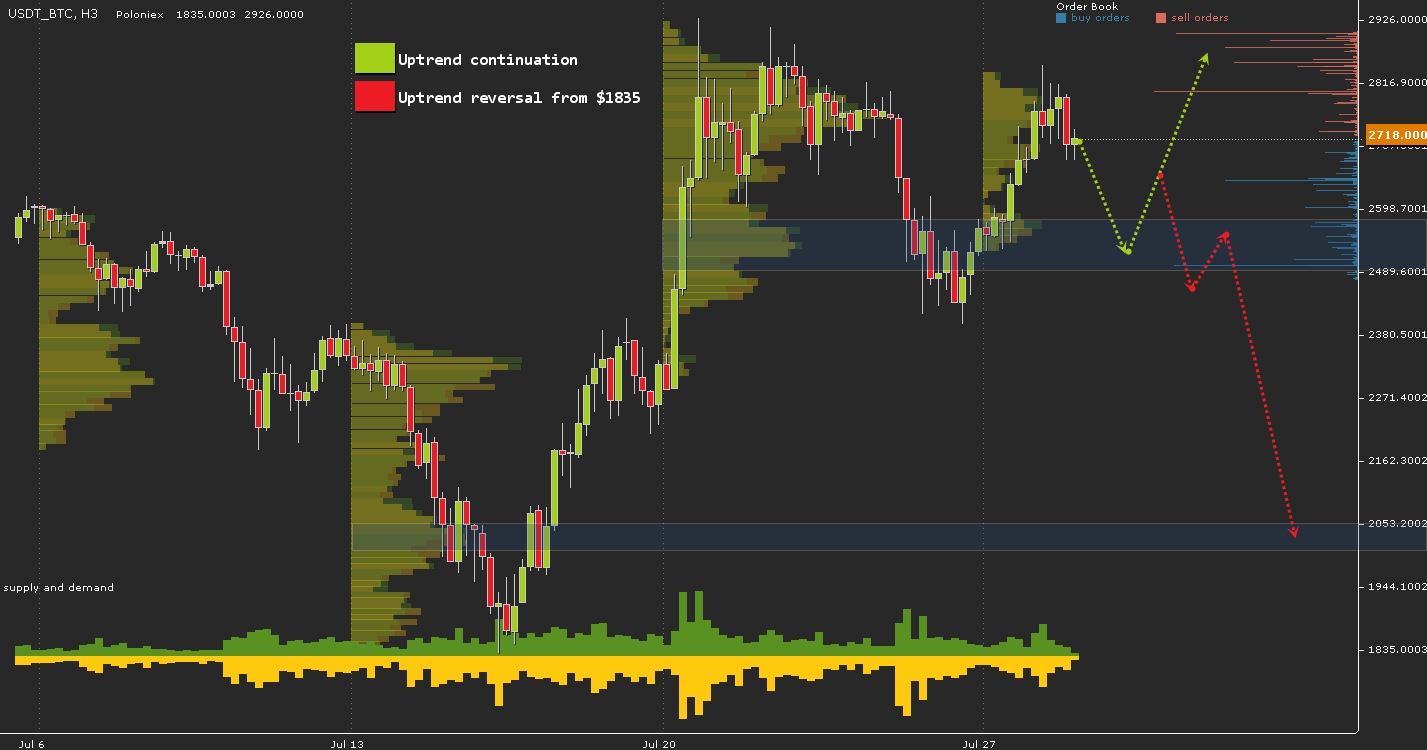

To determine what will happen with the uptrend from $1,835, we need to define the point where a large buyer can emerge from the trend or fix profits. Thus, if there is no support for the trend and a large player fixes profits, the fall is almost inevitable. The $2,500 point will be a turning one because this is the exact point where the largest volume of purchases from $1,835 is concentrated. You can also see a large amount of pending buy orders at this point. Therefore, if the current growth is supported, there will be no turn down at the $2,500 point. Then it is very likely the price will go up more than $3,000. At the same time, in the case of turn at $2,500, Bitcoin might break down to $2,000, or lower.

Most likely scenarios

There is a possibility of a price correction to the $2,500 level before Aug. 1. In case this happens with no downtrend reversal, Bitcoin is likely to go over $3,000.