The Bitcoin scaling debate is rapidly heating up. The several-year-long confrontation might be reaching a turning point over the coming weeks. With the support for the Bitcoin Unlimited proposal reaching an unprecedented high of over 37 percent of network’s total hashpower, a contentious hard fork of the cryptocurrency, i.e. a hard fork performed without the consensus of the majority of the network, becomes a possible scenario.

The most important question for the average member of the community then becomes “what do I do to minimize my potential losses if a fork does happen?” and that’s what I will be trying to find the answer to in this article. But first, let’s start with a quick refresher on how we found ourselves here.

All Quiet on the Western Front

The beginning of the Bitcoin scaling debate can be traced back to around 2014-15. It is back then that the Bitcoin community at large has started paying attention to the fact that there is a limit to the transaction capacity of the network. That limit is, at the very most, seven transactions per second, and that is entirely too low for a large enough user base.

The fears have justified themselves: two years later, the Bitcoin network is clearly unable to handle the frequency of transactions which is demanded by the fast growing audience. The users have been experiencing incredible wait times for the past several months, as the mempool - the buffer of yet-unconfirmed transactions - is setting new records almost every week.

There is virtually no disagreement that Bitcoin has to be adjusted somehow, in order to make it technically possible for the user base to keep growing. The point of contention - and we are talking about an all-out war of opinions here - is how it should be done.

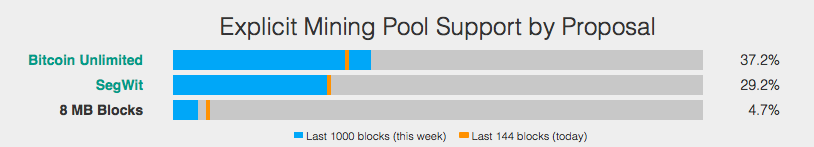

The two main solutions proposed to the scaling problem today are Segregated Witness (SegWit) and Bitcoin Unlimited (BU). Both are already finished, as far as software is concerned. However, before anyone can firmly say that one of them has been adopted by the network, they have to receive the majority of support from the miners. That turned out to be really hard to achieve, as both updates are facing major opposition on different grounds.

As one would imagine, the dispute originally took the form of competition between two rivaling technologies - more on that here. However, it seems that neither of the solutions is perfect from the technological standpoint, and that is reflected by both sides failing to take a decisive advantage in the debate.

After it became clear that a technical consensus might not be achieved, the conflict has become highly politicized. The majority of the decision-makers involved have taken firm sides and are refusing to back down under any circumstances.

One glaring example of the political nature of the scaling debate is the fact that there is not one, but two subreddits dedicated to Bitcoin on the Reddit.com platform: /r/Bitcoin and /r/btc, both communities being vehemently opposed to each other.

The /r/btc community was created as a response to the alleged practice of the moderators of /r/Bitcoin - the original Bitcoin subreddit - of banning members for expressing negative criticism of SegWit and/or support for BU. Today, both pages are filled with mutual accusations of stupidity, immaturity and propagandism.

This whole scaling debate situation looks a lot like a mess, and it is not limited to Reddit. Twitter has become a battleground for prominent community experts from both sides of the fence to proclaim their strong opinions and fling mud at each other, if indirectly.

The recent news of a bug being discovered in the code of Bitcoin Unlimited isn’t helping either. The malfunction cost miners $200,000, and the sloppiness the developers have handled the situation with are not reassuring. This isn’t the first time that a software deficiency has been discovered in BU and possibly not the last one. All that sparks justified doubts regarding whether the technology is really ready to go live.

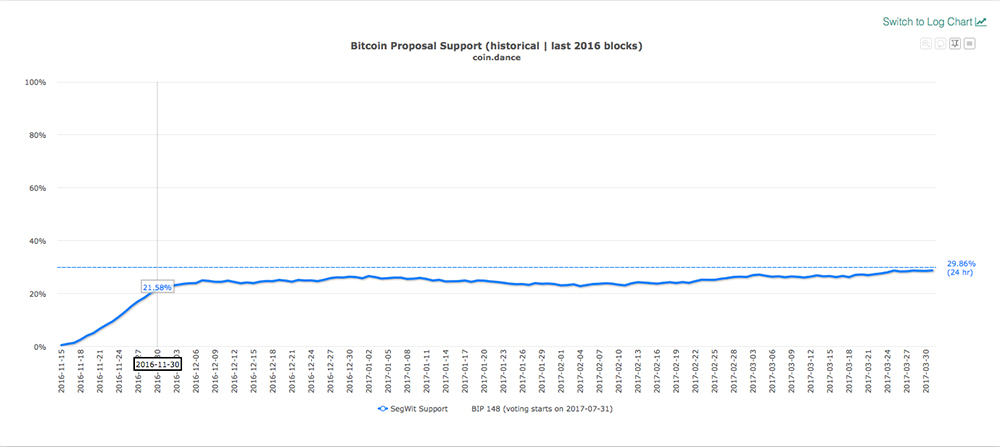

Those doubts don’t seem to be stopping miners, as Bitcoin Unlimited is now the most favored proposal, judging by the share of network’s hashrate signaling for its support - 37.2 percent at the time of writing. If that number reaches 50 percent or higher, it is not unlikely for a contentious hard fork to take place, i.e. the miners deciding to go ahead and switch to BU, hoping that the rest of the community will be basically forced to follow them.

Now, there is a vast number of potential scenarios a contentious fork could result in, and listing them all is far beyond the scope of this article. If you’re interested, feel free to read this great piece, which goes to great lengths to describe the possible outcomes.

We’ll leave judging the prudence of conducting a BU hard fork to the much more qualified technology experts from the community. The question we are going to try to answer is what should the average Bitcoin user do, in order to minimize the damage to their wealth in the case that miners do follow through and split the network via a contentious hard fork.

Contingency measures for everyday users

There are two primary ways in which a potential network split could affect the Bitcoin holders: via the so-called replay attacks and via the value of coins. Consequently, there are several contingency measures which can be used to secure your wealth during the period preceding a potential hard fork and immediately after it.

First, the replay attacks. They are a form of attack on a freshly split network when the two Blockchains are not too different from each other. When a person sends their Bitcoins to someone, an attacker may replicate the same transaction on the other Blockchain - Bitcoin Unlimited, in this case - and it will be accepted by the network.

Thus, the user may unknowingly and unwillingly lose their coins on the alternative Blockchain just by sending transactions across the first one. In order to prevent this, it is advisable to refrain from conducting any Bitcoin/Bitcoin Unlimited transactions at all, until the majority of industry experts confirm that the software vulnerabilities that allow the replay attacks are fixed.

Another important advice is to always be in control of the private keys to your funds - which may mean withdrawing your coins from an online exchange or wallet to a software wallet stored on your PC.

One of the very purposes of Bitcoin is to give its users complete reign over their coins. By delegating that control to any third party, even one you deem trustworthy, such as an exchange, or a web wallet service, you subject your coins to unnecessary risk. Thar risk is even more unwarranted during such a turbulent time as a contentious hard fork.

In fact, that advice can be applied at all times, not just during a hard fork. Here is how Anthony Di Iorio, the CEO & Founder of Jaxx, puts it:

“Most important thing is that users are in control of the key to their funds. Just like what happened with Ethereum, we at Jaxx didn't support [Ethereum Classic] right after the fork but since users are in control of their keys with Jaxx, once we integrated ETC their funds were accessible. If using an exchange or a wallet where users are not in control of their keys, they are at the mercy of the decisions made by the company holding the keys.”

The second potential danger comes from the fluctuating value of the coins. The moment a hard fork takes place, all the people holding Bitcoins receive the equivalent amount of coins on the alternative Blockchain - effectively doubling the amount of coins in circulation. That is because all the records on both Blockchains are identical up until the point of the fork.

Being left with two sets of coins, some people will want to dump the ones they find less promising. That may provoke more people into panicking and also trying to sell before the price - as they expect - drops too much. Speculators may exploit that panic, looking to make a short-term profit. All that commotion creates a lot of uncertainty and volatility on the market, which is bound to last for some time after a hard fork takes place.

Under such conditions, the least risky strategy is to just hold onto your coins on both Blockchains and wait it out. It’s impossible to predict which one of the alternatives will be the most successful, and taking sides may result in a massive loss if you choose wrong. A much safer solution is to wait for the market to calm down, see which coin comes out on top and go from there.

In other words, if you truly believe in the eventual success of Bitcoin, your best bet is to keep holding. No matter how dire the short-term consequences of a fork can be, the community will eventually sort it out, like it always did.

Here is what Bas Wisselink, the co-founder and trainer at Blockchain Workspace, has to say about the value of staying calm in troublesome times:

“Remember that while all of this seems a mess, it's mostly part of being inside the biggest game theory experiment ever. This tug o' war is inherent in a truly decentralized ecosystem. Might be stressful as feck, but the other option is a hybrid where parts are centrally led. That's a choice, but what we are witnessing here is not an anomaly. It's what you get when you are changing something in a running valuable system with no formal leader.”