Crypto markets are on an upswing today, July 16, as data from Coin360 shows, with Bitcoin (BTC) reclaiming the $6,600 price point.

Today’s notable market growth is likely bolstered by news that the $6.3 trillion asset management heavyweight BlackRock –– the world’s largest provider of exchange traded-funds (ETF) –– is beginning to assess potential involvement in Bitcoin, according to reports from Financial News.

Market visualization from Coin360

Today’s solid market gains are poised to turn around negative momentum that has thwarted price performance since market descent that began July 10. Yesterday saw the first signs of a budding positive trend, and as of today, virtually all of the top 100 coins by market cap are seeing significant growth on the day to press time.

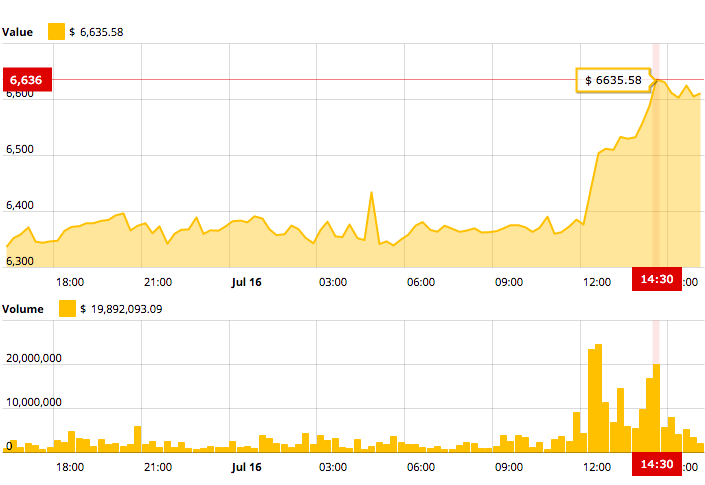

Bitcoin is trading around $6,607, up a little over 4 percent over the 24-hour period to press time. The top cryptocurrency gained over $200 in the space of a few hours this morning, hitting a peak of $6,635 before falling slightly to its current position. Bitcoin is still down around one and a half percent on the week, yet to top its outstanding rally July 8 when the coin hit almost $6,800.

Bitcoin price chart July 16. Source: Cointelegraph Bitcoin Price Index

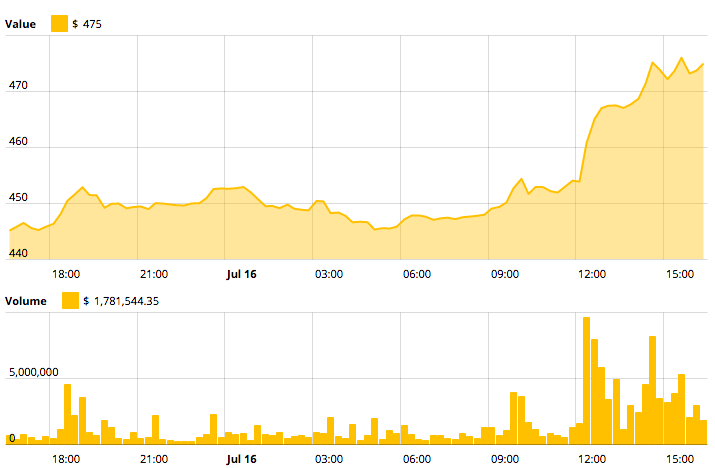

Leading altcoin Ethereum (ETH) is trading around $474 to press time, up over 6 percent over the past 24 hours to press time. The coin’s strong ascent has not yet brought its mid-term price performance back into net positive territory, with its weekly and monthly losses still at 1.25 and 4.8 percent respectively.

Following Bitcoin’s spike, Ethereum also saw a sharp upward turn earlier today, growing about 4.6 percent in two and a half hours to peak at $475, before proceeding to trade sideways to press time, holding today’s gains so far.

Ethereum price chart July 16. Source: Cointelegraph Ethereum Price Index

On CoinMarketCap’s listings, all of the top 10 coins by market cap –– excluding stablecoin Tether (USDT) –– have seen impressive gains of between 4 and 9 percent over the past 24 hours to press time. Of the top 100 ranked crypto assets, just five are in the red, including Tether.

EOS is the strongest performer of the top ten cryptocurrencies over the 24-hour period, up a hefty 8.55 percent and trading at $7.75 to press time.

EOS 24-hour performance. Source: CoinMarketCap

Other sweeping gains have been claimed by Stellar (XLM), Cardano (ADA) and IOTA (MIOTA) –– all of which have seen positive growth of 7-8 percent over the 24-hour period, according to CoinMarketCap.

Total market capitalization of all cryptocurrencies is now at around $266.9 billion to press time, gaining over $12 billion on the day. The markets are nonetheless just shy of their intra-weekly high of $274.7 billion in the early hours of July 10.

Weekly high in the total market capitalization of all cryptocurrencies from CoinMarketCap

Today’s significant news from BlackRock is likely to invigorate the narrative that institutional investors have been biding their time to enter the cryptocurrency markets at an opportune moment. Over the weekend, CNBC trading advisor Ran Neuner went so far as to venture that once the institutional behemoths are in, 2017’s bull run for crypto would come to “look like a warm-up.”

Ran Neuer has today added today that the indications that BlackRock could now enter the crypto space potentially heralds an “exciting” and transformational moment for the markets –– a position that echoes the long-held view that crypto-based ETFs would be a ‘holy grail’ for the crypto industry.

In its own bid to provide infrastructure to facilitate institutional entry, major U.S. crypto wallet provider and exchange service Coinbase has said that it expects that such moves –– rapidly being mirrored across the crypto space –– will “unlock” the “$10 billion” of institutional capital that has until now been “sitting on the sideline.”