Bitcoin reached its all time high daily trading volume at $5 bln earlier this week, primarily because of the current regulatory policies on Wealth Management Products in China. The rapid surge in daily trading volumes allowed the Bitcoin price to reach a multi-month high, surpassing $733 in most markets.

The power of buyers in China

Various investors and experts including Chris Burniske, analyst and Blockchain products lead at ARK Invest, suggested that the majority of high-value trades are initiated by buyers in China.

Of late, #bitcoin's reported daily trading volume > $5 billion USD. All time highs, China driven. https://t.co/fYcPH76v0F pic.twitter.com/H65u4dfWQT

— Chris Burniske (@ARKblockchain) October 31, 2016

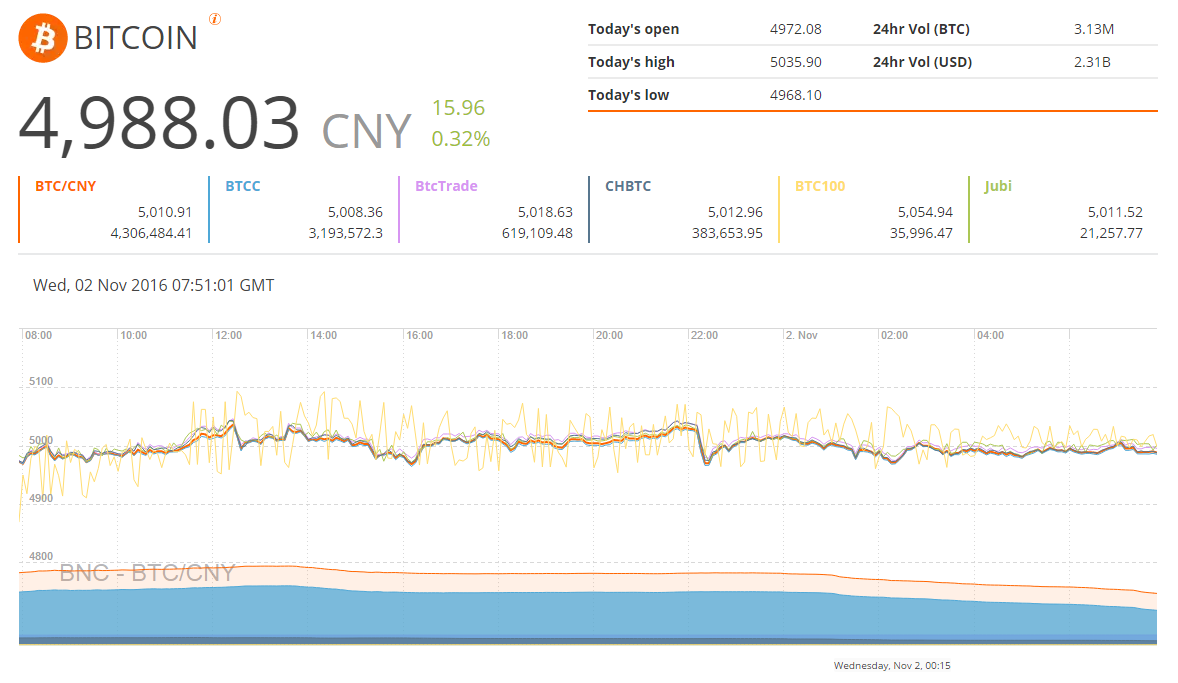

At the moment, most, if not all, Bitcoin price valuations are based on US and European markets. BraveNewCoin (BNC) is a digital currency data provider that offers a balanced overview of global Bitcoin market data. On BNC and leading Chinese Bitcoin exchanges including OKCoin and BTCC, the price of Bitcoin has remained consistent at 5,000 CNY over the past few days. Its neighboring markets and countries including Japan and South Korea demonstrate a substantial difference in value compared to the US and Europe.

Regulations on wealth-management products

One of the major factors that are pushing Bitcoin trading volumes and price range to all time and multi-month highs is the tightening of regulations on wealth-management products in China.

Due to strict currency and capital controls, Chinese investors often prefer to invest in wealth management products (WMP). With the attempt of the Chinese government to steer investors away from its real estate bubble, the popularity of WMPs has never been higher.

However, the government has begun to crackdown on these WMPs as well recently, which caused investors to search for other alternatives.

Bloomberg states that around $1.9 trln of assets are currently invested in Chinese WMPs. If a small portion of those investors decide to store their in Bitcoin, a staggering amount of $1.9 bln will be injected into Bitcoin trading.

Although, most of these multi-million dollar trades are processed in over-the-counter (OTC) markets, the rapidly increasing trading volumes and market cap of Bitcoin suggests that the demand for the digital currency in China is steadily increasing.