Bitcoin has fallen 11.23 percent in the 24 hours to press time Monday, Feb. 5, dropping below support at $8000 as its price continues to dictate altcoin performance.

Data from Coin360 Monday shows a continuation of lacklustre price action for the largest cryptocurrency, which saw its slight rebound Saturday, Feb. 4 all but erased over the weekend.

Image source: coin360.io

On Coinbase, Bitstamp and some other exchanges, Bitcoin failed to maintain $8000 into Monday, hovering at around $7900 at press time, about $275 off Friday’s multi-month lows of $7625.

Friday’s dip triggered a short-term uptick that saw prices gain over $1200 in a single hour, enthusiasm appearing to dampen once again after passing $9000.

Traders offer perspective

On social media, cryptocurrency traders remained more steadfast than ever in their faith about both Bitcoin and altcoin perspectives.

John McAfee, who has championed Bitcoin and recently begun focussing on specific altcoins, told Twitter followers to “get a perspective” in the face of falling value.

“In a long term view, (Bitcoin) is still climbing. Forget about these short term ups and downs,” he continued.

Please God people - get a perspective about the market! The price of Bitcoin today is still higher than it was just three months ago! In a long term view, Bicoin is still climbing. Forget about these short term ups and downs. If you are a short term investor, you need to get real

— John McAfee (@officialmcafee) February 4, 2018

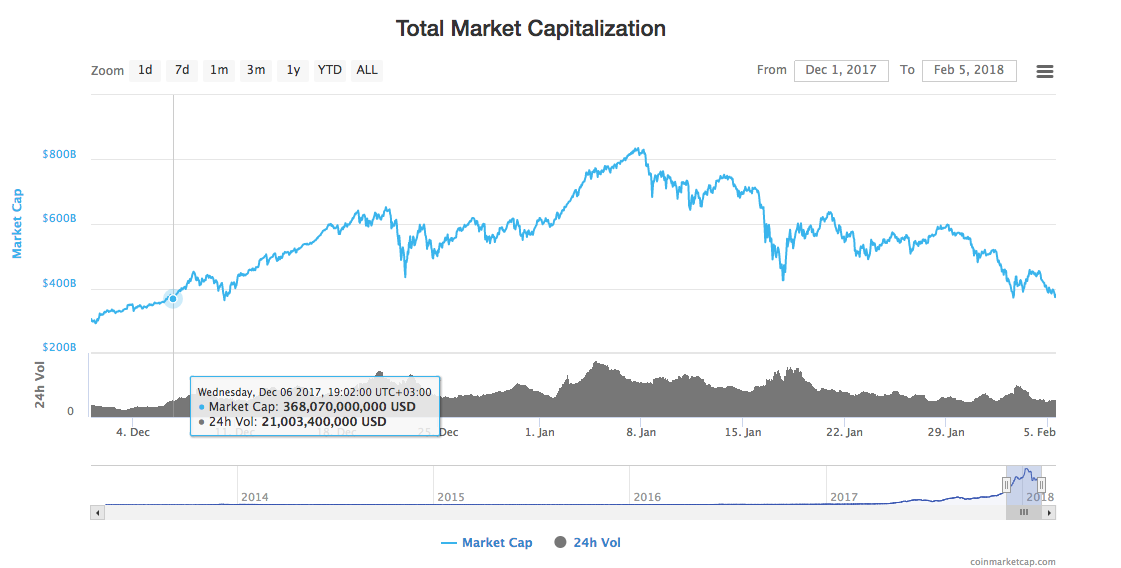

Adding some perspective on the overall red-washed market, CNBC’s Ran Neuner tweeted yesterday that the combined market cap of all cryptocurrencies today is the same as it was in December, 2017:

Worried that the market is crashing? Bear in mind that today we are at a market cap of $400bn and that the first time the crypto market hit $400bn was 6 December. So we are back at levels from 2 months ago. The market cap is also up 20x since this time last year.

— Ran Neuner (@cryptomanran) February 4, 2018

At press time, the total market cap according to CoinMarketCap was around $369 million, about the same level as it was Dec. 6, 2017:

Altcoin-focused accounts also cautioned traders against paying attention to coins’ value in USD or other fiat currency terms. Others were more bullish, using various methods as proof a more serious upturn was the most likely short-term future for Bitcoin.

There are two cases of Elliot Wave that can both be correct. We must state both cases and differentiate the two, while finding similarities. Both cases have an uptrend regardless, so we must assume an uptrend is imminent either way. pic.twitter.com/U2uuQEZUvz

— Philakone (@PhilakoneCrypto) February 5, 2018