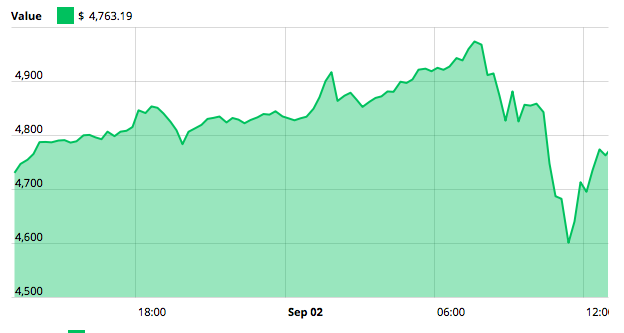

Bitcoin just crossed the $5,000 mark in trading today, fulfilling the expectations and predictions of a number of industry insiders. The rise was fueled by recent news regarding geopolitical instability and the search for a safe haven other than gold. Investors have been removing funds from other stock indices as well as precious metals, and shifting them into cryptocurrencies, driving prices higher.

Peak and sell

However, the peak price point was immediately followed by a substantial sell-off, as some large-scale traders sold large blocks in quick succession.

Prices stabilized near the $4,700 mark after dropping as much as $400. The sell off may well be linked to some substantial BTC holders selling large blocks. The pullback is to be expected, as many sell orders likely had $5,000 as a price point, with investors and individuals taking profits at the high point.

The advice to ‘buy the dips’ has been much touted, and this may well be just such an example.

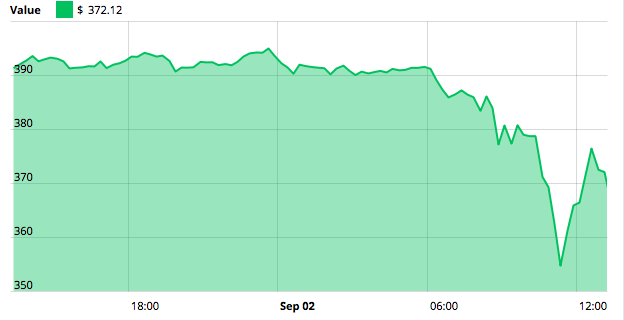

ETH follows

Ethereum followed a similar pattern, moving lower on large volume, though not having hit an ATH during the course of trading. At one point a block of $730,000 was sold in the space of five minutes alone.

Bull run

Cryptocurrency has been on a tear this year, with the total market cap of all digital currencies soaring from $16 bln to over $170 bln in just nine months. Bitcoin’s bull run actually starts a bit earlier, with prices trending upwards since their August 2016 low of $465.

Commentators such as Max Keiser and John McAfee had predicted Bitcoin would hit the $5,000 mark this year, though other analysts have sometimes been much more conservative. Many believed that Bitcoin was already in a bubble when it cleared $3,000. Though Bitcoin may well be bubbling, it’s worth noting that bubbles often last for longer than anybody might expect.

Increasing mainstream attention

Today’s price performance comes as Bitcoin has been getting significantly more mainstream media attention. CNBC, for example, recently aired a segment advising viewers to buy Bitcoin at what the network considered its new price floor - $3,600. Numerous other mainstream media outlets have run stories on Bitcoin, and venerable investment firm Goldman Sachs even began issuing price targets for the currency.

In recent months, Bitcoin has met with a spate of good news. Segregated Witness was finally formally locked-in and activated, putting to rest a contentious debate over Bitcoin’s scalability. The currency also survived a hard fork, when Bitcoin Cash forked away from the main network.

Additionally, the Commodity Futures Trading Commission (CFTC) made headlines recently when they authorized LedgerX to create a regulated Bitcoin futures market. This increases the odds that the SEC, which had rejected two Bitcoin ETF proposals earlier this year, might reconsider its stance.

Further good news came today when the SEC announced that it was hiring Ropes & Gray attorney Dalia Blass to head up the division which regulates ETFs. Ropes & Gray is the law firm used by the Winklevoss twins to advise them on their Bitcoin ETF proposal. While Blass apparently did not work on the twins’ ETF proposal, she is undoubtedly familiar with it and may be more favorable than her predecessor.

Where to from here?

With $5,000 being such a profoundly important barrier, Bitcoin may find itself rocketing even further. Media outlets will undoubtedly run even more stories, as $5,000 is a much more interesting number than the $3,000 or $4,000.

Many traders were concerned about profit-taking once Bitcoin tapped the $5,000 level. If the expected level of selling does not occur, the market may find the confidence to boost prices even higher.

Legendary trader masterluc recently predicted a near-term top of $15,000, followed by a giant bull run to $40,000+. Some have suggested even higher numbers - possibly $1 mln or greater - might be possible in the distant future.

Price increases this year have contributed to a snowball effect for consumer adoption, with exchanges announcing surges in user numbers often topping 600 percent since January.