Earlier this week, the People’s Bank of China (PBoC) invited Chinese Bitcoin exchanges to discuss Anti-Money Laundering (AML) policies and the margin trading. Upon the release of the central bank’s official statement, the Bitcoin price has dropped by three percent.

Bitcoin price immediately recovered within a few hours after the initial drop in value, bouncing back from $1,020 to $1,040. The Bitcoin price is close to reaching its previous weekly high of $1,080 and has already surpassed the $1,070 trading value.

US panic

While it is quite evident that the announcement of the central bank caused the short-term decline of the Bitcoin price, it is important to note that investors and traders on US-based Bitcoin exchanges have panicked.

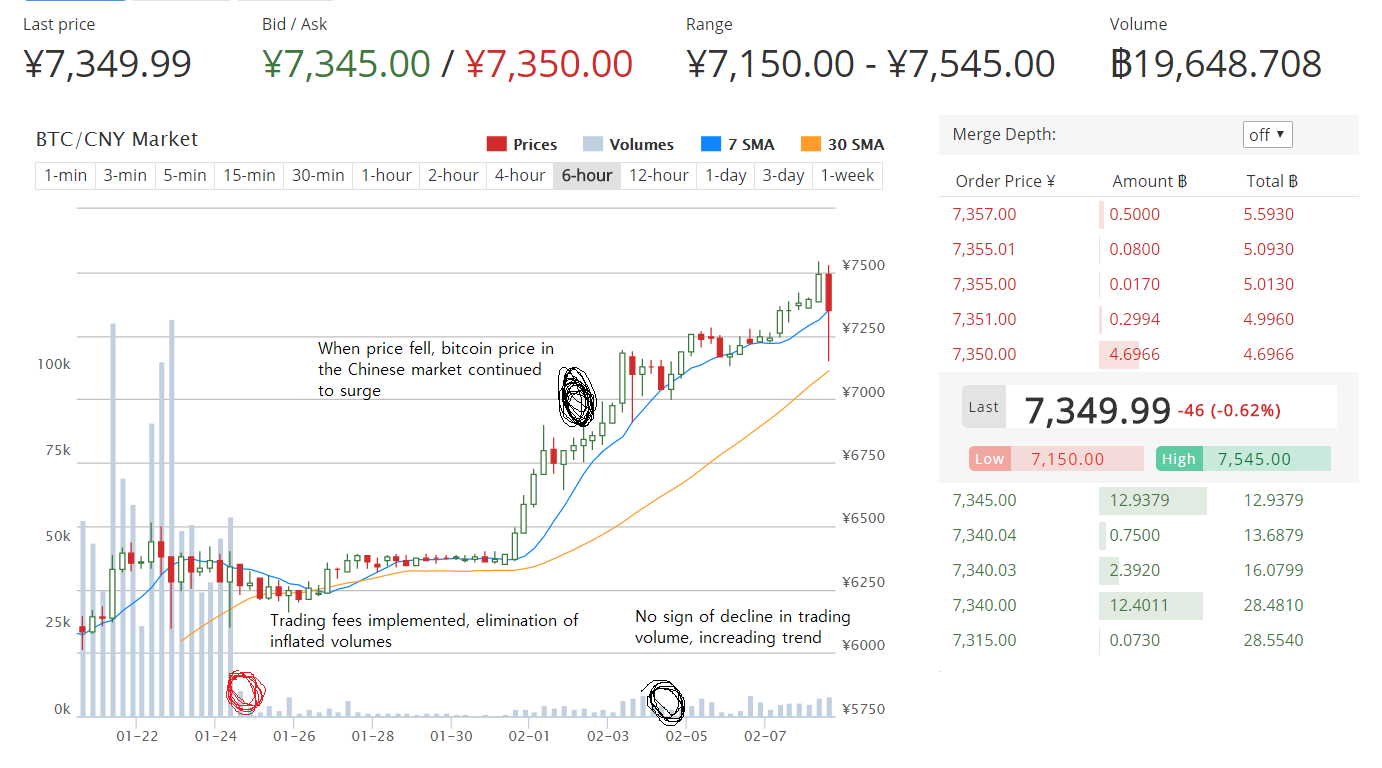

On Wednesday afternoon, the Bitcoin price on Chinese Bitcoin exchanges continued to surge, as shown below. Trading volumes maintained its increasing trend since Feb. 1 and the value of Bitcoin has been continuously increasing since Feb. 2.

China resilience

As shown on the chart above, trading volumes and Bitcoin price were increasing during and after the announcement of the Central Bank of China, which means that Chinese investors and traders aren’t necessarily that concerned with regards to the approach of the central bank. The People’s Bank of China and Chinese Bitcoin exchanges have a tight and strong relationship and it has shown nothing but productivity and efficiency so far.

In contrast, the trading volume and Bitcoin price charts on major US Bitcoin exchanges like Bitfinex showed a rapid decrease in price and trading volumes. In the Bitfinex trading chart shown below, the price of Bitcoin reached a low of $1,000 immediately after the announcement of the People’s Bank of China.

US investors and traders panic sold Bitcoin under the assumption that the announcement of the People’s Bank of China could lead to a decline in the Bitcoin price. Many believed that Chinese traders would panic sell Bitcoin as well. However, it was exactly the opposite, as major Chinese Bitcoin exchanges including BTCC, OKCoin and Huobi showed strong performances.

The resilience of the Chinese Bitcoin market and trading platforms towards speculative news and misinformed coverage of the local Chinese market has allowed Bitcoin to bounce back and recover relatively quickly.