Analytics provided by BBA

Bitcoin looked poised for the return of at least some volatility last week, however none materialized. Now that price is back above the $600 level on what are still mixed technicals, we think another week or two of sideways chop is most likely in terms of price action over the short-term.

Last week we made a point of discussing price volatility, or the lack thereof, because we thought there was a decent chance it could make a return to the Bitcoin markets in the not too distant future. Well, apparently we are not there yet given that the $590 support held over the weekend and we are now back in the old $600 – 610 trading range. This tells us that we may be in store for another week or two of choppy consolidation prior to the upside resolution we have been anticipating for quite some time. Despite the fact that this lack of movement is an active trader’s worst nightmare, it will give longer term players more time to accumulate, which should make the eventual breakout even greater in magnitude. “The longer the base, the higher in space”, as they say.

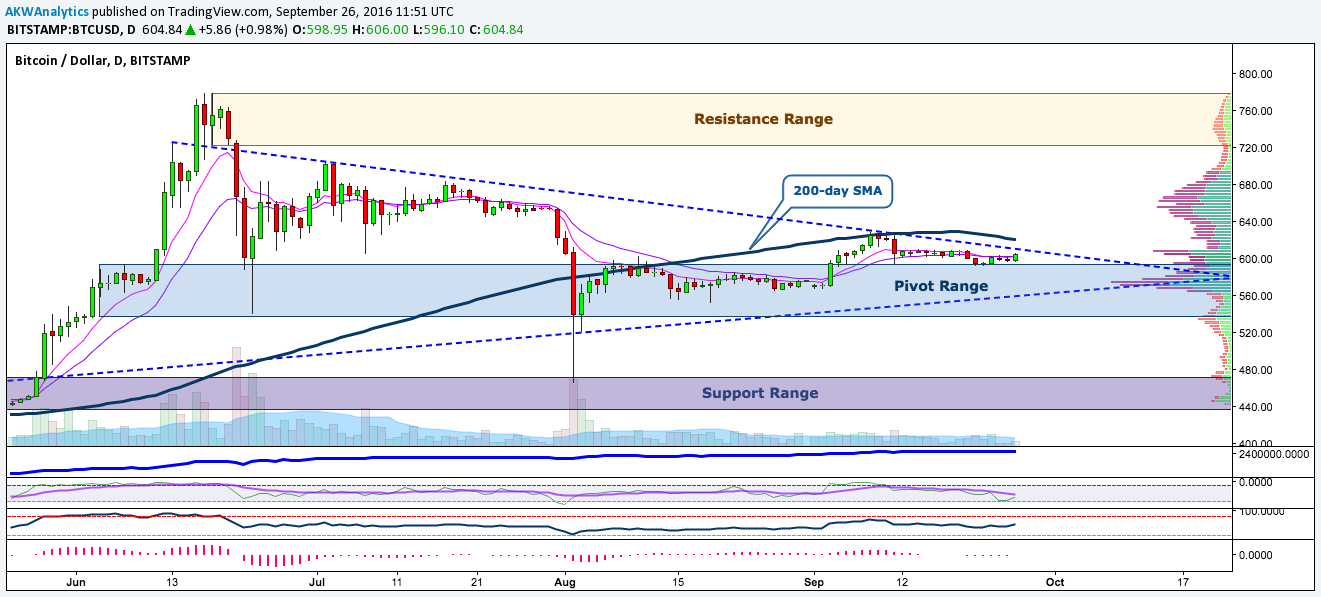

Seeing as though there is not much to discuss on the fundamental side of things this week, we will jump right into the daily chart below for a look at the medium-term technicals. We can see that the price remains in the symmetrical triangle formation, although it continues to hug the upper half which is a pretty good sign for the bulls. Also, notice how the price dropped down to the top of the pivot area but was rejected, which tells us that the bulls are stronger at the current levels than previously expected. This is confirmed by the A/D line which remains in a steady uptrend, as well as Willy which continues to recharge while the price stays relatively stable. Lastly, on the bull side, the near term EMA’s have yet to cross over to the downside despite the recent stagnation, and RSI and MACD are painting small bullish divergences.

On the other hand, the 200-day SMA has rolled over and is now heading lower to provide resistance around the $625 level, which is also where the SCMR dynamic resistance (not shown) and a moderate volume profile notch both sit. Additionally, the downtrend line of the previously mentioned symmetrical triangle is coming into play around $610, which should put at least a near-term halt to the current mini-rally, although if broken we could see some FOMO up into the $620 – 630 region. Finally, the market structure remains anaemic, as do trading volumes, and the price action continues to be unimpressive, therefore we will remain neutral and patient until the market gives us better opportunities than it recently has.

Generally speaking, we think Bitcoin remains in a favorable technical position from a medium to long-term perspective considering all the signs are still pointing to this being an extended period of sideways consolidation off of the $800 highs from earlier in the summer. For this reason, among many other technical ones, our inclination is still to be buyers of corrective dips down into key support levels, however, we are unlikely to hold these positions until we get clearer evidence that a breakout move is imminent. Having said that, for now we do not see it yet so we will continue to play the ranges the market is giving us. Remember, in these market conditions the old Wall Street adage is: “buy the dips and sell the rips.”

BullBear Analytics 20% Discount

BullBear Analytics is the longest-standing cryptocurrency forecasters in the market. They started in 2010, doing technical reports in bitcointalk.org, and have evolved into a buzzing community of traders. Adam is BBA’s chief analyst. We are offering a special discount to our CT followers, enter ‘SUMMER1’ at checkout for a 20% discount on all packages! (If you’re interested in paying in BTC, contact us here). Cheers!

Disclaimer: Please always do your own due diligence, and consult your financial advisor. Author owns and trades bitcoins and other financial markets mentioned in this communication. We never provide actual trading recommendations. Trading remains at your own risk. Never invest unless you can afford to lose your entire investment. Please read our full terms of service and disclaimer at the BullBear Analytics Disclaimers & Policies page.