Sandeep Goenka, the co-founder of Zebpay, one of India’s three leading Bitcoin exchanges, believes that Bitcoin price can reach $3,500 by the end of 2017.

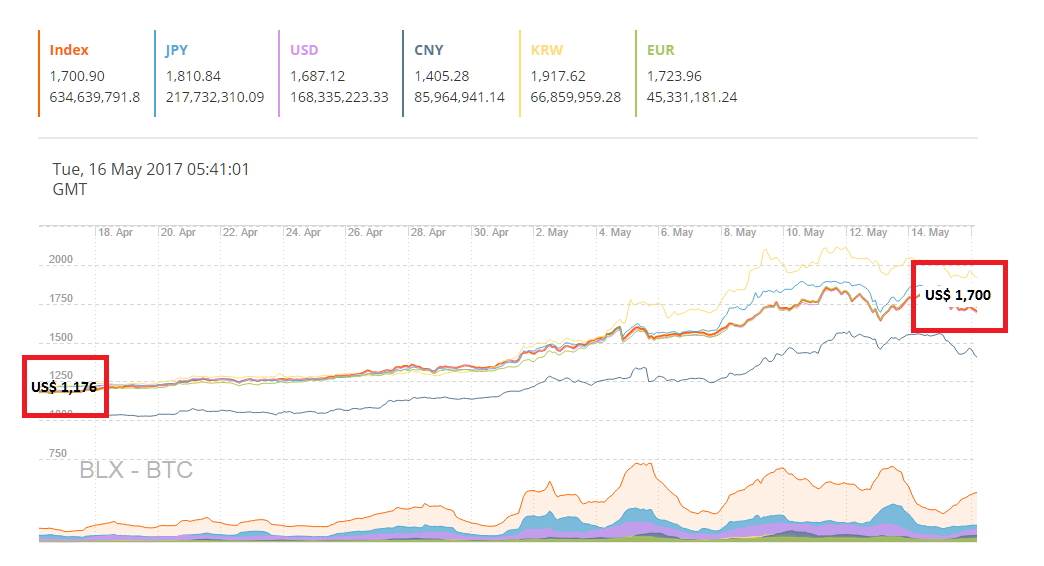

Despite a few setbacks, Bitcoin price has maintained a strong rally over the past few months. While Bitcoin is struggling to re-enter the $1,800 region after it experienced a correction on May 11, on a monthly basis Bitcoin price has still managed to record a 30.8 percent surge, increasing from around $1,176 on April 16 to $1,700 on May 16.

After recording a 30 percent monthly increase in value, Bitcoin price has continued to maintain stability in the $1,700 region for around two straight weeks. Such stability in value should be considered as an optimistic outlook on the mid-term growth of Bitcoin price.

Growing demand

According to Goenka, the current Bitcoin rally isn’t necessarily defined by certain events. In fact, Bitcoin price is able to grow at a stable rate because global awareness toward Bitcoin is increasing and the demand from institutional investors is rising.

Goenka stated in an interview:

“Current bitcoin rally is due to increasing awareness and demand for bitcoins globally. Positive news of regulation in major countries like China, Japan and Russia have added fuel to the current rally.”

As Cointelegraph explained in a series of extensive analytical articles, Japan has played a key role in maintaining the strong rally of Bitcoin price. Japan has also established a platform for institutional investors by announcing Bitcoin as a legal currency. Such clarity on the regulatory side of Bitcoin and digital currencies in general allowed institutional investors and multi-billion dollar corporations to participate in the Japanese Bitcoin industry.

Japan’s ecosystem

Most notably, the $1.5 bln Japanese Internet giant GMO announced in January that it is officially entering the digital currency trading business and market by launching its own digital currency and Bitcoin trading platform.

“Just the beginning”

In a statement, the GMO Internet Group stated that it sees highly of Bitcoin’s ability to process both domestic and international remittances with low costs and fast speeds in a secure ecosystem, similar to the Bangko Sentral, the central bank of the Philippines.

Goenka reaffirmed that the Bitcoin exchange market and industry will see the entrance of more institutional investors by offering an entirely new investment category in digital assets. He said:

“Since the supply is limited and demand is increasing, prices are moving upwards and touching all time highs almost every year. Bitcoins represent a new investment category called digital assets. This industry is exploding in usage and innovation. We believe this is just the beginning.”