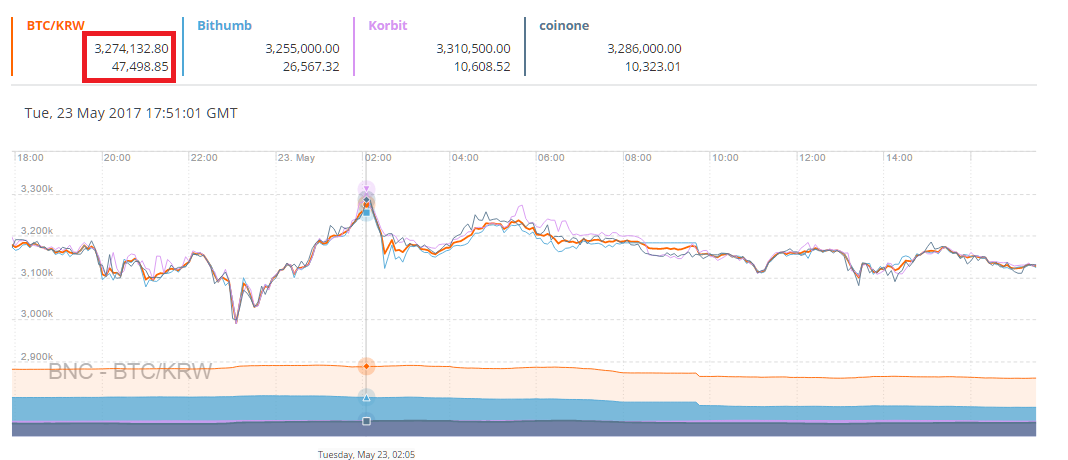

Bitcoin price reached $2,850 in South Korea on May 23, due to the rapidly rising demand for Bitcoin and other digital currencies such as Ethereum’s Ether (ETH).

While arbitrage opportunities in South Korea always existed since the launch of Korbit, Coinone and Coinhumb, the three leading Bitcoin exchanges in the country, the premium rate rarely went past 10 percent.

On May 23, the premium rate on South Korean Bitcoin exchanges nearly reached 30 percent, demonstrating a trading value of $2,850 for Bitcoin, while Bitcoin was being traded in the US and China for around $2,100.

The driving factor of this massive arbitrage opportunity and premium rate in South Korea is the country’s strict anti-money laundering policies. In South Korea, any type of gambling is illegal and because a large amount of black money consisted of revenues from overseas casinos and other businesses are sent back to South Korea on a regular basis. Authorities are strict on any transactions which goes past $10,000 in total value.

Hence, even with a South Korean bank account, it is incredibly difficult to take advantage of the South Korean Bitcoin exchange market’s arbitrage opportunity and huge premium rate. If any business or individual sells more than $10,000 worth of Bitcoin at any of South Korea’s strictly regulated Bitcoin exchanges, by law, operators of Bitcoin exchanges are required to contact the user for additional verification.

Usually, such strict AML and Know Your Customer (KYC) policies drive away Bitcoin investors to over-the-counter (OTC) markets such as LocalBitcoins, a peer to peer Bitcoin trading platform wherein buyers and seller directly initiate deals to purchase or sell Bitcoin.

For instance, when the Chinese authorities suspended the withdrawal of local Bitcoin exchanges, LocalBitcoins China saw a massive spike in its weekly trading volume. At this period of time, the Chinese regulators also implemented strict KYC protocols for exchanges and required Bitcoin traders to engage in face-to-face interviews and submit financial documents to trace the origin of user funds.

In South Korea, the implementation of strict AML and KYC systems had exactly the opposite effect. The legalization of Bitcoin trading and the strict regulatory framework for Bitcoin trading platforms further validated the Bitcoin exchange market and industry in South Korea. As a result, the demand for Bitcoin has continued to rise despite the premium rate that is currently being demonstrated by South Korea’s top exchanges.

The South Korean Bitcoin exchange market are operated by three powerhouse exchanges supported by some of South Korea’s largest multi-billion dollar conglomerates and financial institutions. Thus, liquidity and options are limited. As the supply of Bitcoin has been limited and the demand continued to rise, Bitcoin always traded with a premium rate in South Korea.