A price crash lays bare some of the strangest aspects of people’s personalities.

When I went to bed Friday night, 1 bitcoin was threatening to break through the US$360 floor. When I awoke Saturday morning, the price was in the 330s. By Sunday afternoon, I saw sell prices on some exchanges around US$280.

That range encompasses a 22% drop in Bitcoin’s exchange value against the US dollar.

By Monday morning, the price had rebounded to near the US$330 mark, where it is sitting at the time of writing (10:30 GMT; this volatility makes me think a precise timestamp is necessary for context).

Cointelegraph’s Price Predictions

For the record, Cointelegraph’s in-house Wall Street veteran Tone Vays forecast these price drops with pretty amazing accuracy. Here is what Tone wrote just before 4 a.m EST the morning of Saturday, October 4, when the price sat at US$358 on Bitstamp:

“Bearish: In case prices break down bellow the US$340-350 zone, it would most likely go down to the US$260 area with the round number of US$300 perhaps slowing down the slide a bit.”

Tone admitted in his analysis he was short-term bullish on Bitcoin, but his bearish scenario played out pretty much as he described, although that US$260 number was blessedly a bit too low.

Outing Traders

Since Sunday, there has been an ongoing whale hunt among redditors on the /r/bitcoin and /r/bitcoinmarkets subs. This all started when someone noticed a massive sell-off of bitcoins around the US$300 mark.

We won’t link to those posts because some people are actually trying to identify the trader(s) responsible for the bitcoin sells, which is unethical and defeats the whole notion of financial privacy.

Also, Reddit doesn’t have the best track record in its users’ witch hunts.

Still, this whale hunt behavior highlights an odd emotion. What is the point of outing someone for exiting his/her/their Bitcoin position? Because it puts downward pressure on the price and affects the value of all our Bitcoin wallets?

OK, great. Now what? Do we grab our torches and pitchforks and go after individual traders?

I understand the argument that whale hunting is useful in spotting market manipulation, but again, I defer to the mob with pitchforks image.

Also, as /u/saibog38 points out in one of those bear whale threads:

“If it's obviously manipulation, then who's the sucker selling 60 million OTC at a 50% discount? They can set whatever price they want. Or are they not as clever as reddit detectives when it comes to spotting obvious manipulation? You'd think if anyone was well versed in how this works, it'd be the big OTC dealers, no? Your profit scenario basically relies on them being huge suckers, which leaves me a bit skeptical.”

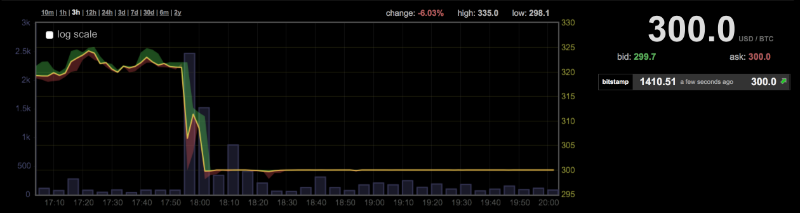

That US$300 Flatline

That whale graph has another feature that might be even more interesting. Look at how long the price held at US$300 on Bitstamp on Monday morning (GMT):

Altcoin Markets

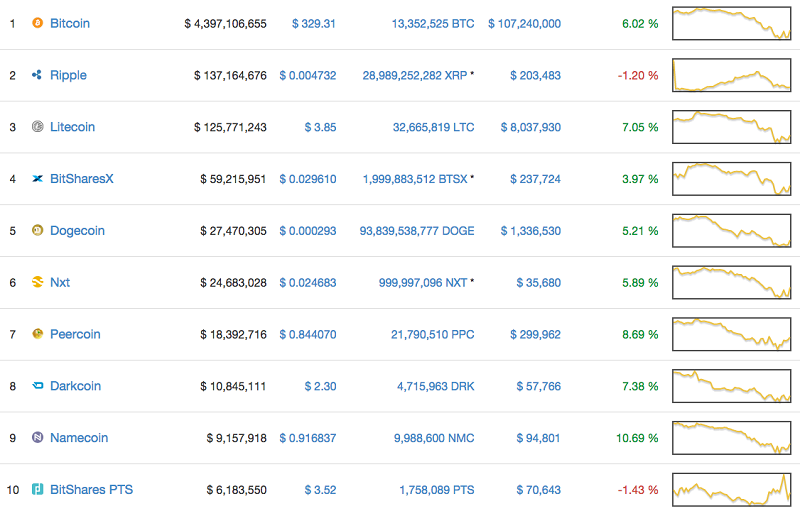

The past seven days haven’t been kind to the exchange rates of most cryptocurrencies, as the following screenshot of the top 10 coins from coinmarketcap.com demonstrates:

Pay attention to those seven-day graphs in the right column. Most of those lines start in the top-left corner and end in the bottom-right corner.

New York Times’ Coverage

The New York Times featured some pretty even-handed coverage of the weekend’s price drop, pointing out objectively the various things people have discussed as putting downward pressure on the Bitcoin rate against the dollar.

“Bitcoin’s recent price decline can appear jarring, but it is nothing new. Indeed, some say the wild price swings have hindered the virtual currency’s widespread adoption.

[...]

“One reason for the drop could be uncertainty over potential regulations. In July, New York became the first state to propose regulations for Bitcoin companies. The comment period for the regulations, which were introduced by the Department of Financial Services, is set to end on Oct. 21.

[...]

“The increase in the number of merchants now accepting Bitcoin could also be affecting the price. These merchants, including Overstock and Dell, use third-party payment processors like Coinbase to immediately convert Bitcoin to dollars. This means there are more Bitcoins in circulation, which could be helping to drive down the price.”

If there is a silver lining to this weekend’s crash, it’s in that block quote above. Even when bitcoins lose 22% of their value against the dollar, the New York Times covers it the way its reporters might cover a gold price drop or a bad day for the Nikkei — objectively and without alarm.