The price of Bitcoin in China went past $990 this afternoon, as Chinese investors continued to push high volumes in local exchanges.

Most investors at this time of the year are hoping to evade capital controls and circumnavigate cash restrictions, as noted by Holger Zschaepitz, financial author and editor of Welt.

Further yuan devaluation and tightening of capital controls

Analysts revealed that Bitcoin hit record high volumes this past week, which ultimately led to its price rally and pushed the price of Bitcoin to increase by over 20 percent. Zero Hedge suggested that Chinese investors are anticipating further yuan devaluation and the tightening of capital controls, caused by the rising rates of the Federal Reserve and increasing cash outflow as the New Year approaches.

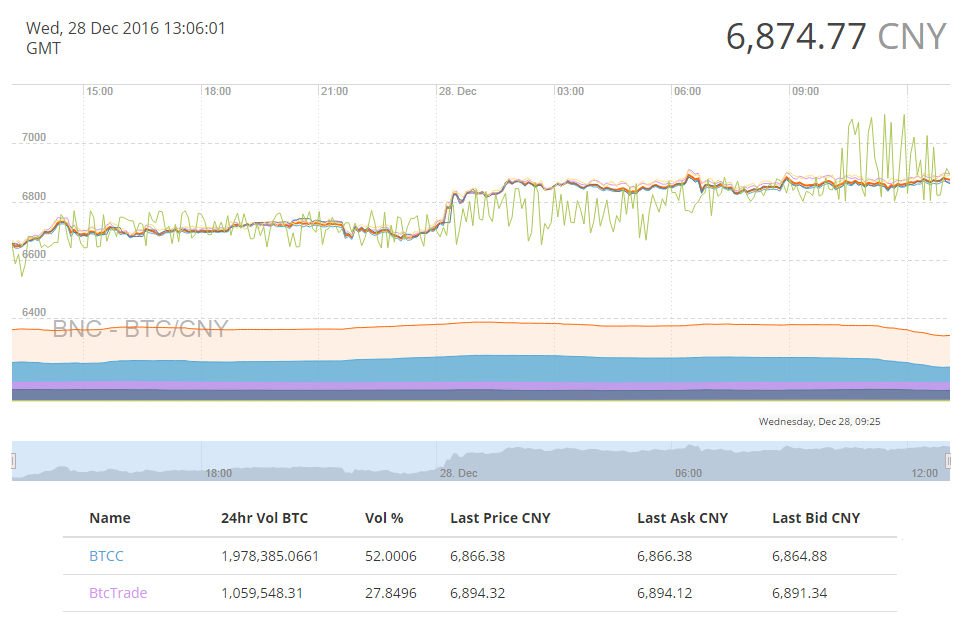

Major Bitcoin exchanges including BTCC have consistently displayed a price of $990 per Bitcoin on the Chinese market throughout the day, as Bitcoin trading volumes continue to rise. BTCC, which effectively settles nearly 45 percent of global Bitcoin trading and 52 percent of the Chinese Bitcoin exchange market, recorded a 24-hour volume of 1.9 mln Bitcoin.

$1,000 before New Year?

Based on this trend and price rally, it is likely that the Bitcoin price in China will surpass $1,000 before the New Year.

Last week it was also revealed that China hit an all-time weekly Bitcoin trading volume on exchanges, as investors began to panic purchase Bitcoin amid a well-performing price rally. However, the drastic increase in trading volumes suggests that the devaluation of the yuan is foreseeable in the short-term.