Digital currencies, especially Bitcoin as it reaches a new all time high, are stronger than ever - this in the face of governmental regulation and hardline crackdowns.

However, although Bitcoin’s price seems unaffected by the control that Russia and China is trying to wrest from the decentralized digital currency ecosystem, trading volume and global demand has taken a hit.

Sudden shifts

Looking at a graph of the Bitcoin price it would be hard to find an influence of major factors such as the Chinese ban on exchanges, and the recent Russian ban on access to exchanges.

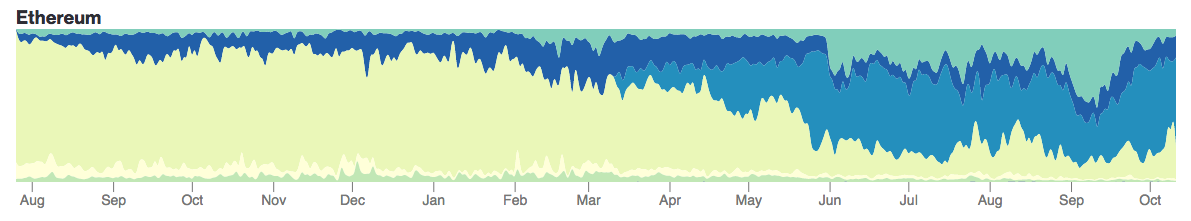

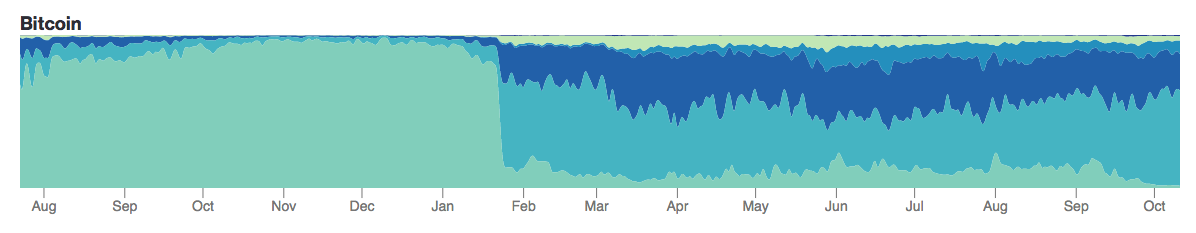

However, looking at a graph that illustrates the share of trading by currency, there are some noticeable swings. These swings indicate the high volatility that comes with cryptocurrencies, more than just in price.

From the graph above, the Chinese yuan was competing with Bitcoin for the share of trading, but as regulation in China started to gain traction in the early part of this year, Bitcoin quickly took over as it boomed.

Recent regulations have seen the yuan shrink further as others, like Korea and the US, take larger shares.

Reaction to China ban

Bitcoin trading against the Chinese yuan used to account for most of the volume. That changed early this year when regulators started to clamp down on digital currency exchanges. Japan’s yen took over as the biggest trading pair, as regulators there took the opposite approach, adopting digital-friendly rules.

In the case of Ethereum, the Korean won has become prevalent, as rules that limit access to more traditional assets are driving Korean investors to mine and trade the second-biggest cryptocurrency. As for trading in a wider group of cryptocurrencies, Bitcoin takes the place of fiat currencies as the biggest trading pair.