Last week’s article stated:

“If price gets back above US$270 and takes out US$273, a run for the US$290-$300 area is the next target. This is major resistance and as has been stated many times: if price fails to break this area, expect major downside. It’s also possible that US$300 gets taken out and overshoots to the US$320-$330 level. This is a target that has to be taken out for a true bull run to start, which the price hasn’t yet been able to reach.”

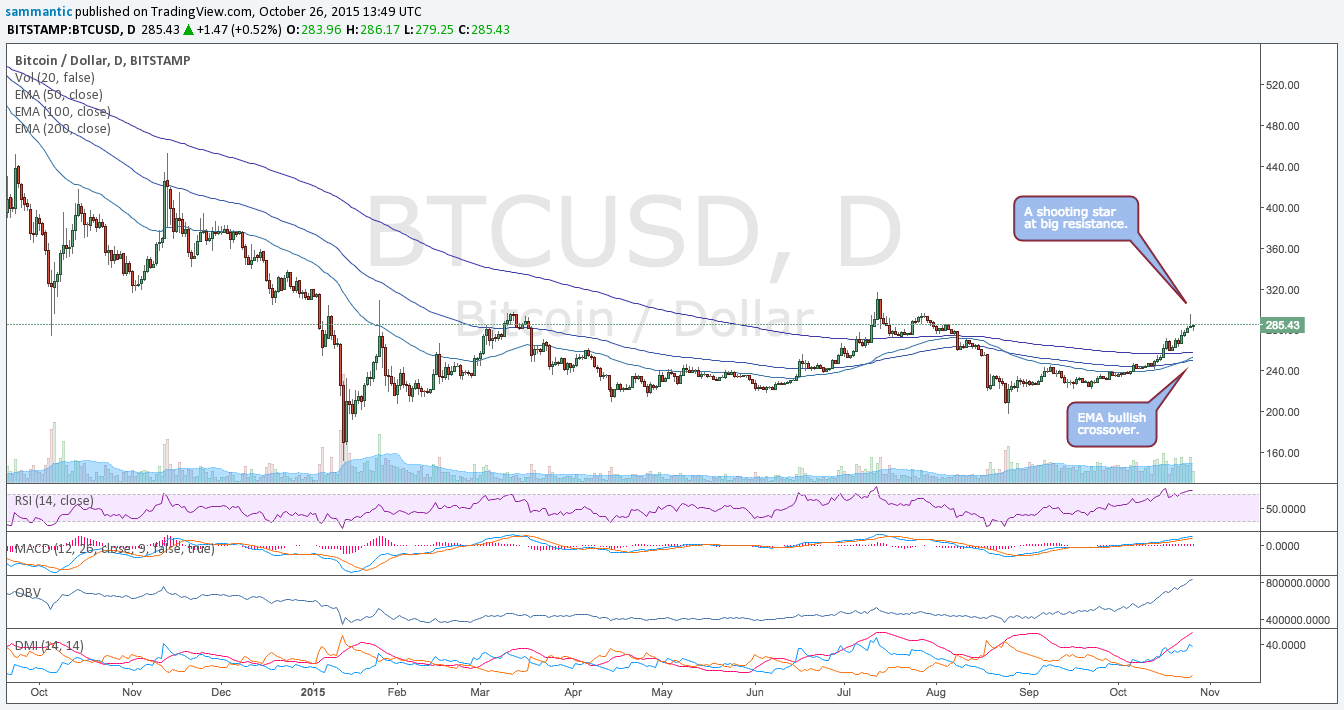

The price ran right up into that resistance area, reaching a high of ~US$295 before retreating to its current price of ~US$285. It should find near term support at US$280.

As price has risen, a bullish crossover occurred between the 50 & 100 day EMA’s, which gives further support the bullish trend. Although to get really bullish, the 50 day EMA needs to be above the 100 day EMA, which needs to be above the 200 day. That’s a real bull trend in the making.

As the chart above shows, price ran up as high as US$295 before forming a shooting star candle pattern, which is a topping formation, and makes sense after a big initial run up straight into major resistance.

For now, price will consolidate below resistance and unwind some pretty extreme readings in the Indicators. The RSI is overbought, OBV is at its highest levels since the price crash of August 2014, when the price was much higher and volatility was commonplace, and Directional Movement is also at an extreme high based on buying pressure. Even the MACD has moved above the zero line, but is not in an extreme position like some of the other indicators.

Right now, price needs to rest and consolidate before regaining energy to try and break above US$300.

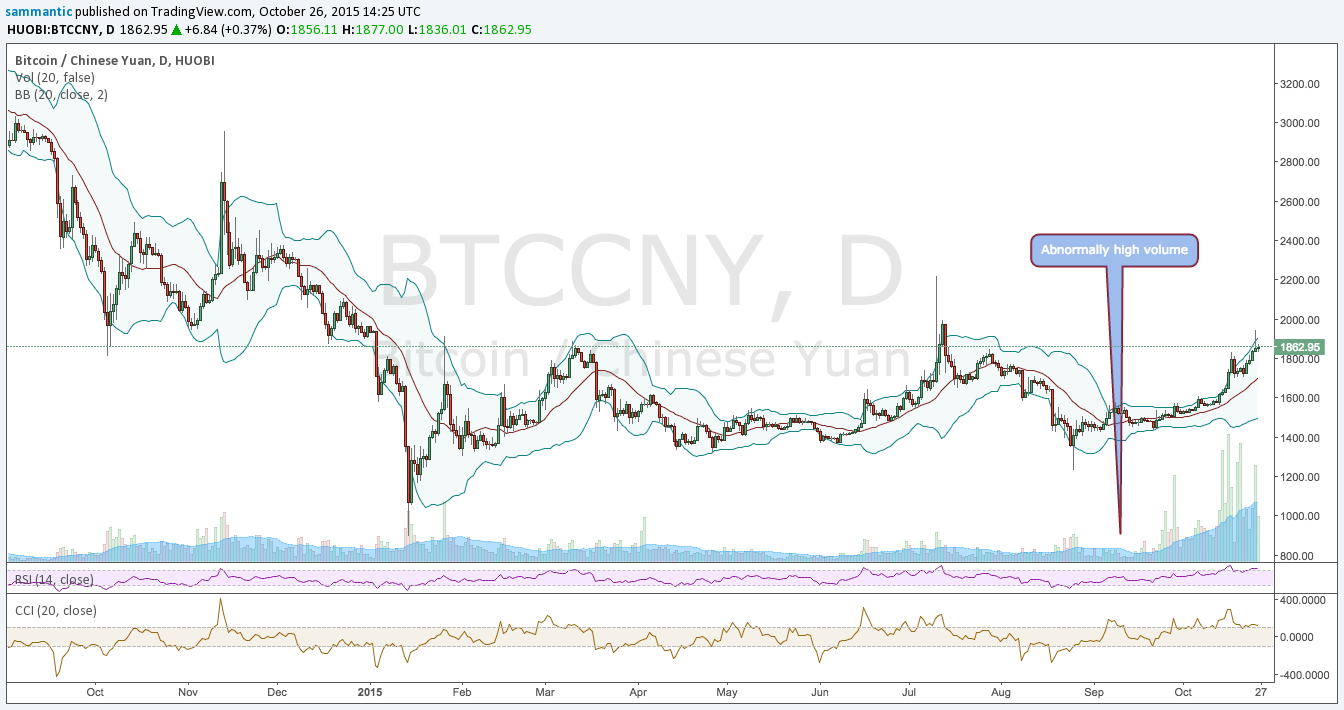

The Bollinger Bands have begun to widen as volatility has returned and the price has been moving upward. The price has been walking the upper band in the entire move but has been repelled in an attempt to break through it. This confirms strong resistance above. It is also worth noting it hasn’t breached the middle band yet, a sign of a strong uptrend.

Also the Commodity Channel Index (CCI) has been consistently topping in the 240-250 area. Look for price to back off the top Bollinger Band in the coming days and have a regression towards the middle band.

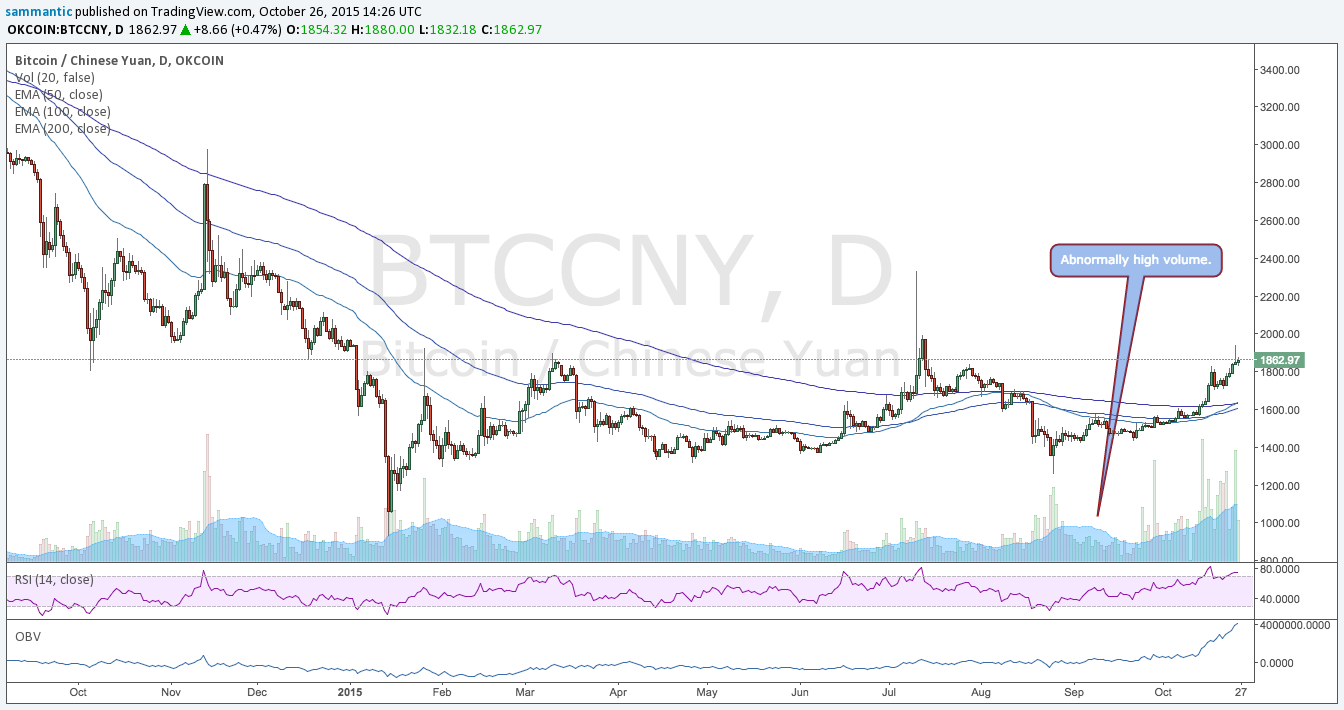

Finally, the Chinese exchanges continue to have volume running at huge levels, and the volume washing mentioned continues. Looking further into this, perhaps part of it is hot money from China moving into and out of bitcoin as a way of getting around capital controls as the Chinese crackdown continues. As the 2 charts below show, the Chinese exchanges have an abnormally high volume since some time in mid August.

After a big run up in price to major resistance, a pullback looks very likely from here. A shooting star combined with extreme readings in the indicators means consolidation should begin to form. US$280 is the first area of resistance followed by US$273 and US$270. Depending how price acts as it consolidates, a retest of major resistance could happen. As mentioned many times, a failure to break above and STAY above the US$290-$300 area will have major downside implications for the price.