For timely updates on price updates, follow me @sammantic.

BTC price at press time: US$288

Last week’s price alert began with:

“Price has retreated in the wake of a Greek Deal, a DDOS attack on OKcoin, and a PBOC that is attempting to stabilize the Chinese markets. Over the last few days, price has traded in a tight range below US$280, unable to remain above. The price fell below a few levels identified as support, i.e. US$300, US$289, and US$280. Price continues to consolidate in the wake of the big June run-up. The big test that must hold is ~US$272, which is the 200 day Exponential Moving Average (EMA).”

Price went right down to US$272, the 200 day EMA and consolidated above it before jumping as high as ~US$293. That US$272 area is now providing big support. Getting to and staying above $300 is the real test as this mark has been quite elusive so far.

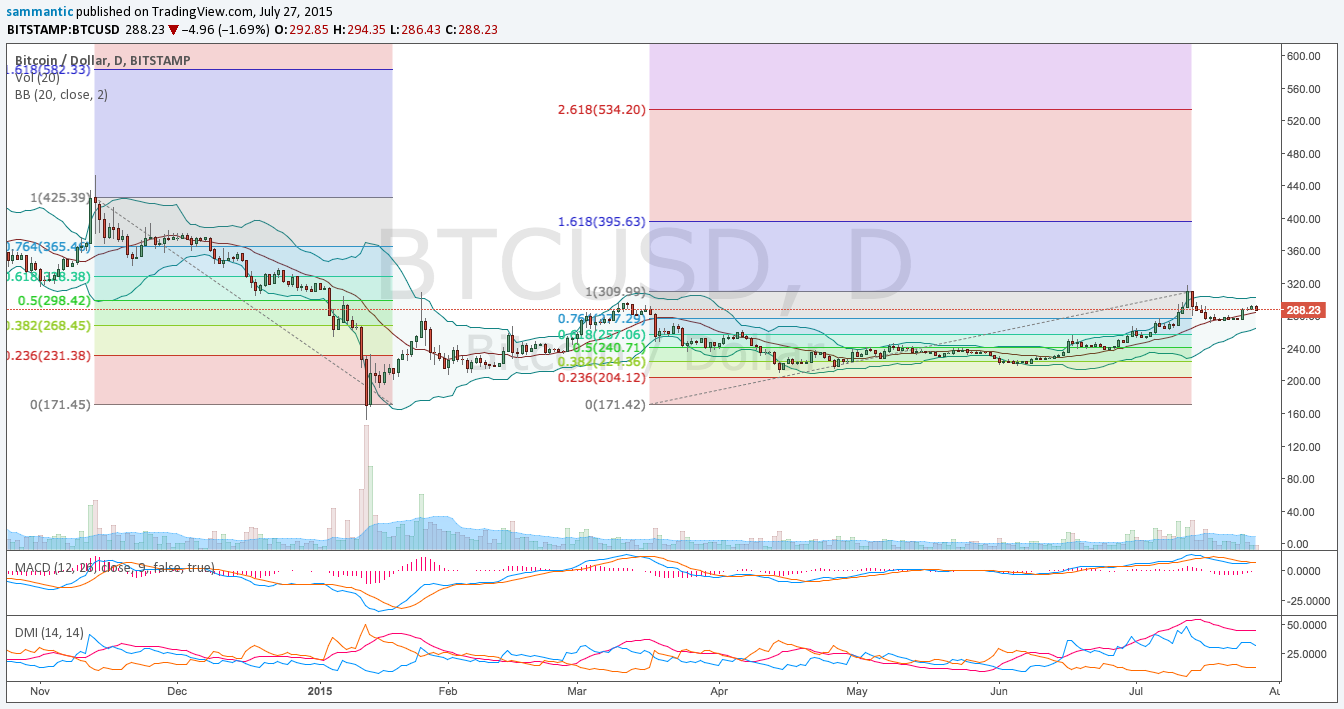

Long Term

After the big run-up in price, a successful consolidation and test of new found support was successful near the 200 day EMA at ~US$272. The RSI has held above 50 even as the price went lower: 50 is the support level of RSI as the price is now above it and looking bullish.

The Money Flow Index has been bearish here for a few weeks as volume has weakened. It has since started to tick up but remains on a sell signal.

On Balance Volume (OBV) has never confirmed the move up and sustained volume on these up-moves has not happened, which has been a cause for worry for months. A rise in volume confirming the price action would allay much of these worries. OBV tried to break above resistance multiple times and failed. Without volume, it is hard to see how the price will get above US$300.

The daily chart price has successfully tested support and has subsequently risen. While the price has fallen since the highs in this latest move, the long term picture continues to get bullish.

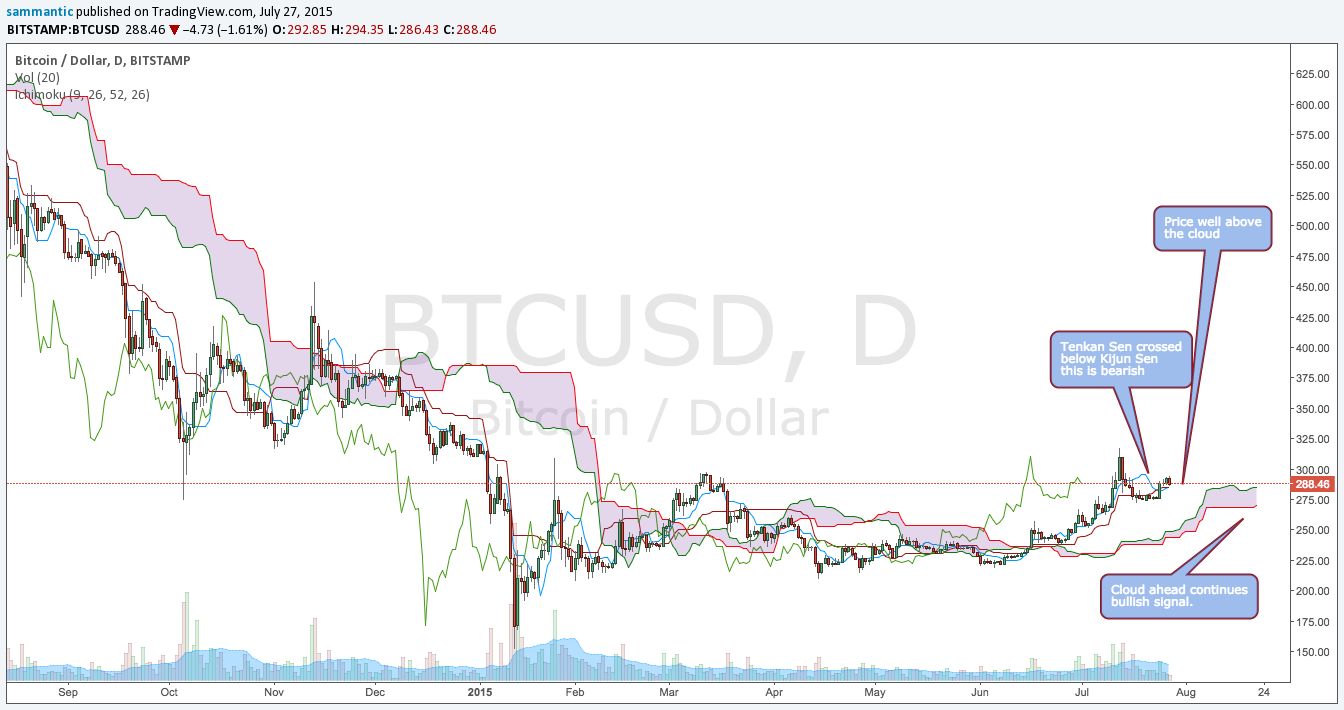

Ichimoku

The one-year Ichimoku (cloud chart) shows price remaining well above the cloud (the trend is bullish) and in bullish territory. Last week the price has crossed below the Tanken Sen and Kijun Sen, indicating that momentum had begun to wane. It has since crossed back above it. However, the Kijun Sen has crossed below Tenken Sen and this is bearish.

The Chikou San (Lagging Line) is also signaling lower. The price has resumed its uptrend despite its moderate speed and the clouds below should act as support. Some areas to watch are ~US$276 and US$267. The cloud ahead remains bullish as well, so price action also remains bullish.

For further definitions of what is being discussed, please refer to this previous post on Ichimoku cloud charts.

Intermediate-Term Trend

Fibonacci retracements have been drawn from two price tops: the mid-November high of ~US$424 and the July 12 high of ~US$310.

Price is holding above support and will look to try and gain some upside momentum and break above US$300.

The MACD has been correcting ever since it reached an overbought signal at the beginning of July. It appears to be turning bullish here.

Included is the Directional Movement Index (DMI), which looks at buying and selling pressures. The blue line indicates buying pressure, the red line indicates selling pressure, and the orange line is the ADX, which indicates the strength or weakness of a trend.

Last week’s price alert noted:

“The price has come off that extreme reading after the cascading price action last week. Buying Pressure remains above Selling Pressure and the ADX is above both lines but looks to be correcting from an extreme level. The action is still bullish here, but was due for a snap back.”

The ADX line remains above both Buying Pressure and Selling Pressure. These two lines continue to converge as selling pressure has picked up and buying pressure has tapered off. The ADX line continues to be at a very high level indicating that price action and volatility are still at play. DMI remains bullish here.

Last week it was said

“Price is sitting on the middle band right now, and if it falls below price could follow. Price needs to stay above the middle band.”

Price held right above and bounced higher, which should remain as support for now. While the Bollinger bands have begun to narrow, they are still wide indicating price has some room to move. The Bollinger Bands are in upward channels, which is bullish as well. The top band is US$300, indicating that this is resistance which needs to be broken through with ~US$282 serving as the Bollinger support.

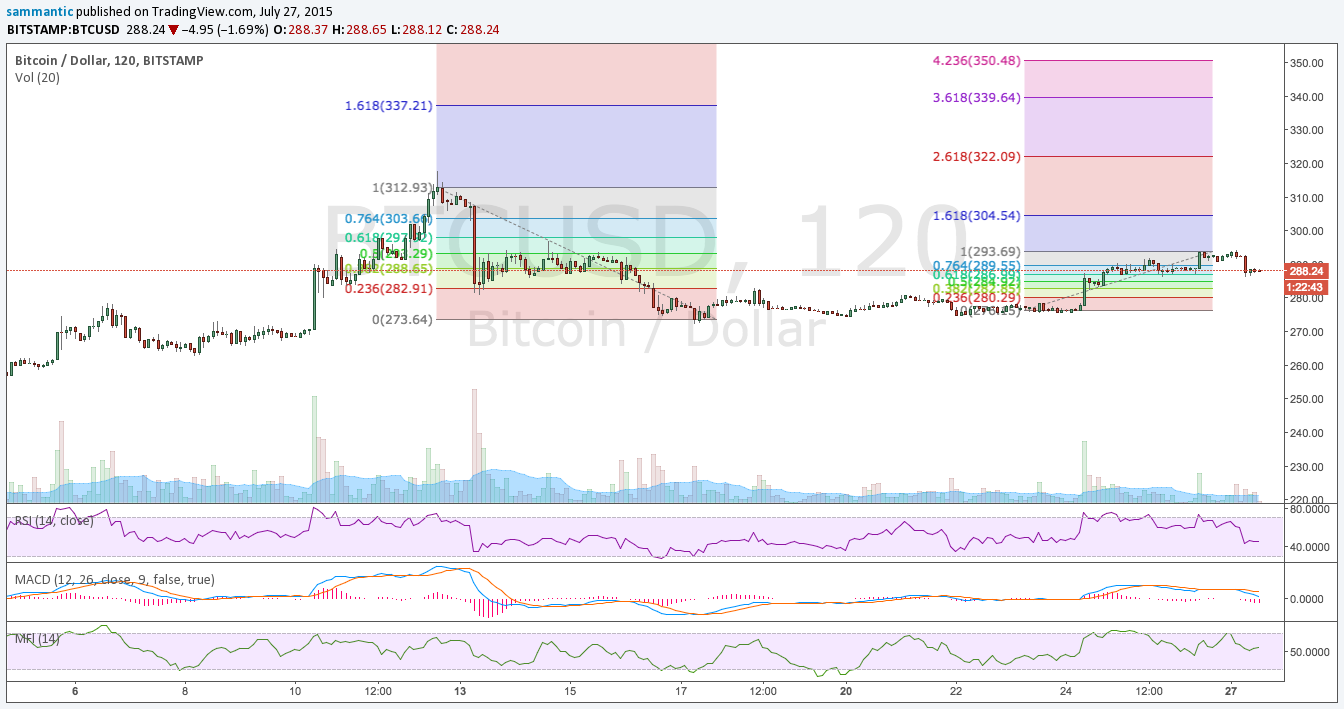

Short Term

The short term indicators are bearish. Both the RSI and the MACD are on short term sell signals while the MFI is diverging and flashing bullish. Price may be attempting to bottom here. The levels of support to watch are: ~$286, ~$284 and ~$282.

Getting above ~US$293 and ~US$297 should pave the way for a retest of US$300, which needs to be broken or that may prove the end of the up-move.

The bulls remain in control for now. Price breaking above ~US$300 on big volume would mean this move is legitimate and we should then begin to see some upside targets hit. Surpassing the ~US$300 mark should reignite the bulls.

Disclaimer: Articles regarding the potential movement in cryptocurrency prices are not to be treated as trading advice. Neither Cointelegraph, nor the author, assumes responsibility for any trade losses, as the final decision on trade execution lies with the reader. Always remember that only those in possession of the private keys are in control of the money.