For timely updates on price updates, follow me @sammantic

Price at the time this article was written is: US$235.69

Last week the article began with:

“The indicators continue to remain in neutral territory. This move still appears to have limited upside and appears to be topping out as volume and momentum have not followed the price higher and many of the indicators have flattened out.

While there have been some improvements in price in the short term, nothing has changed as far as the long-term trend goes. The price broke through 240 only to come back down and now sits right below the 50-day EMA, which once again is proving to be big resistance. If price were able to break above and hold right, 250-255 looks like it would be the top of this move. The weight of the evidence says this move should not be trusted and is nothing more than a countertrend rally. This could change if the indicators and volume were to confirm an upward price move.”

This continues to be the case. The price had a move to break nicely above the 50 day EMA but could not hold and has since retracted. The trading range continues to get tighter and a move should be expected very soon one way or the other.

More good news has continued to come in and not much in the way of bad news (Nasdaq OMX using the bitcoin blockchain, and others looking to use the technology including Honduras), and yet the price continues to be less and less reactive.

The good news continues to be discounted, which generally isn’t indicative of a move higher. On the other hand, there’s an old adage which applies here:

“Never short a dull market.”

Resolution of this range should come soon and it could be a big move since there is less and less on-exchange liquidity in recent months.

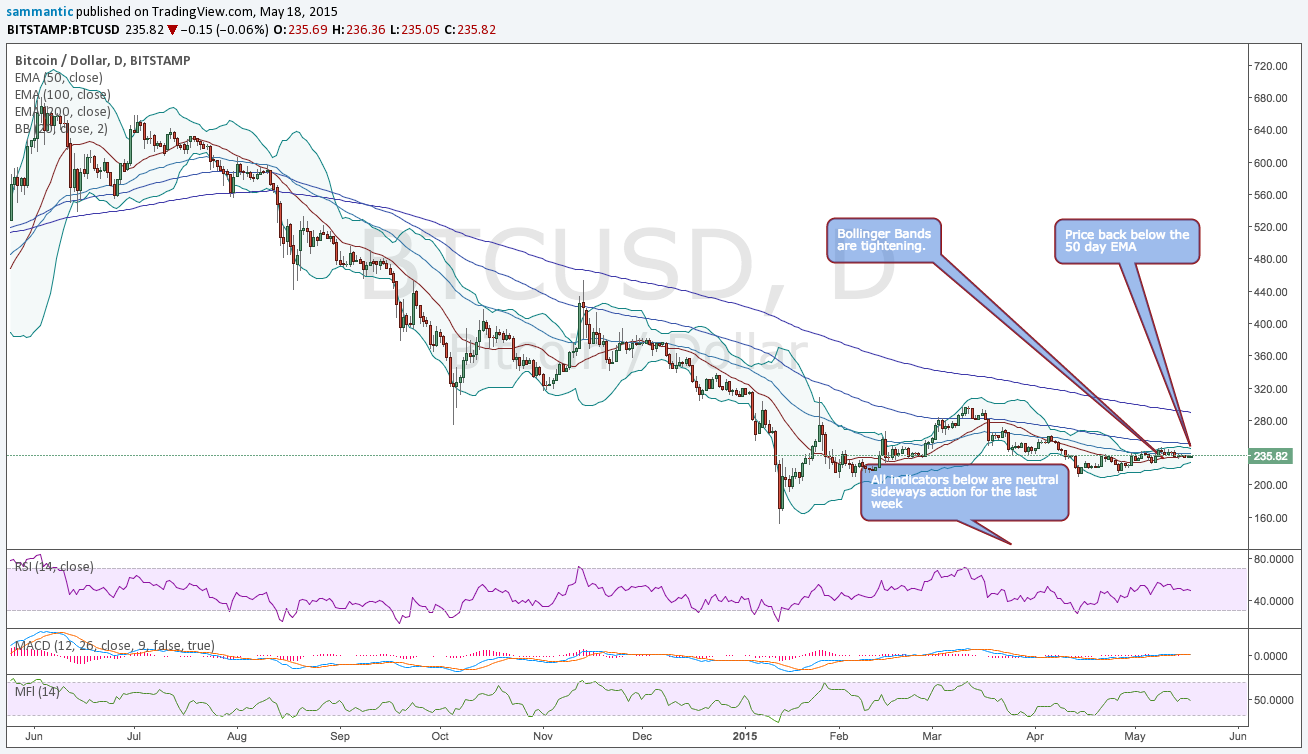

Technically we are pretty much in the same place with perhaps a more bearish leaning slant since price is having so much difficulty staying above its 50 day EMA (Estimated Moving Average). As has been mentioned in previous articles, the slope of all the EMAs (50, 100, and 200) is sloping downward, however they are sloping less so. The 50 and 100 day EMA’s are starting to tighten as well. This all is setting up for a move.

Long-Term

The 1-year chart (long-term) for bitcoin remains bearish. Price continues to be range bound. The price remains below all 3 of its EMAs. The 50 day EMA is still proving to be a major resistance area at approximately ~US$237. Price has been rejecting higher levels for a few weeks now.

As mentioned above, the slopes of all 3 EMAs are bending downwards as well. Moving Average Compression is also starting to happen and, if it continues, this will set off a move in the price. This is a condition that occurs as the EMAs start to tighten, which the 50 and 100 day EMAs are currently doing. This happens as the variance between the moving averages (highest and lowest) decreases leading to decisive movements in price one way or the other.

Bollinger Bands have also been added and they are tightening as well. This happens when volatility declines as it has in the bitcoin price. Thus, another indicator of a potential move is when these Bollinger Bands continue to tighten and coil. This is similar to pressing down on a spring until it eventually recoils.

The Money Flow Index (MFI) and the Relative Strength Index (RSI) continue to be relatively flat and at neutral levels, although they are starting to turn downwards. Momentum is waning and a lot of energy has been expended trying to get above the 50 day EMA. There doesn’t appear to be much more strength left. Also note that the MACD is sitting on the zero line and has essentially remained flat for an extended period. All of this has happened on very low volume. These are not signs of a trend change.

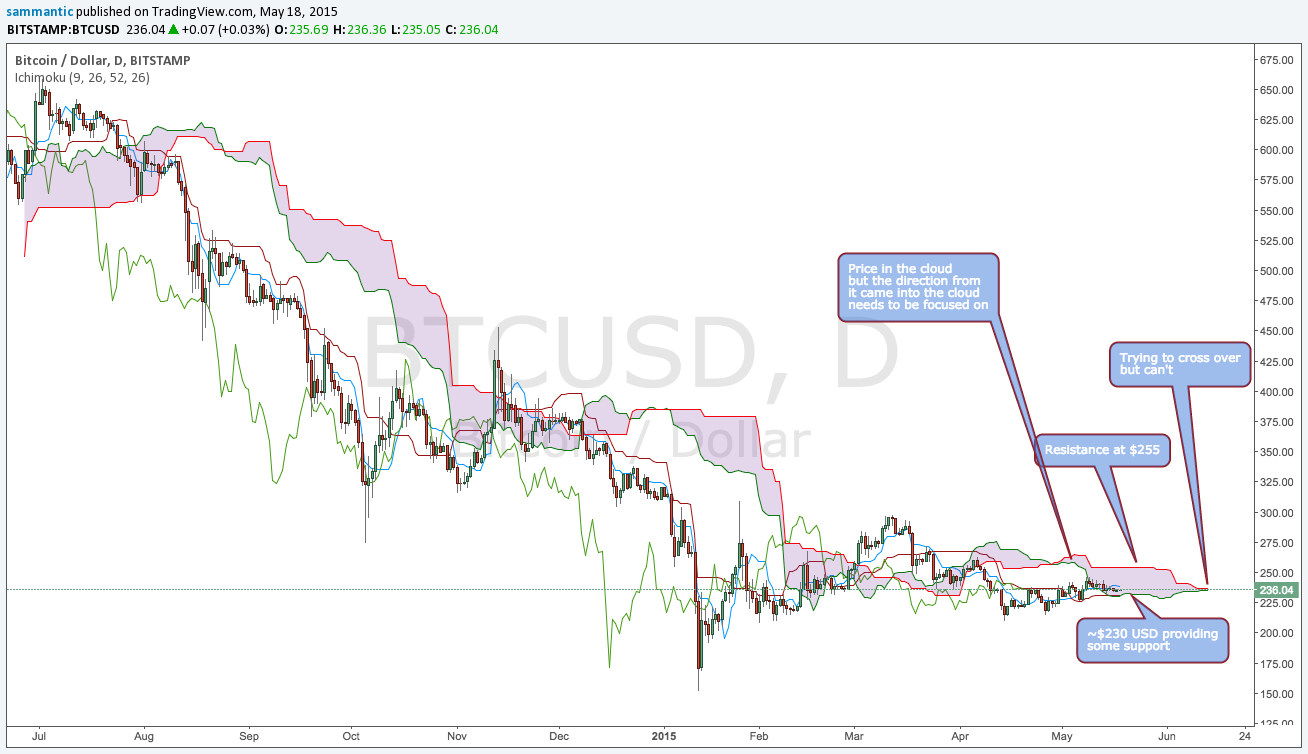

- Ichimoku Clouds

The 1-year Ichimoku (cloud chart) essentially remains the same. Price has entered the bottom of the cloud and continues to stay near the lower bound of the cloud. ~US$230 is now providing some support for the price.

When looking at the clouds, it’s important to remember which direction price enters the cloud from. Since it entered from below, the cloud should continue to be resistance for the price and the ~US$255 (which is the top of the cloud) will be a major test if price ever gets there. Since it entered from below, we should be on guard that it will be a continuation of a pattern lower.

The cloud ahead in the future is becoming more neutral and flattening out. It has also attempted to make a bullish crossover, which has been rejected thus far. For now there isn’t much of a signal to take from this, except a continuation of the trading we have seen lately.

Aside from the price below the cloud, the Chikou Span (Lagging Line) is below the cloud, along with the Tankan Sen (Conversion Line) and the Kijun Sen (Base Line). The Tankan Sen and the Kijun Sen have pierced the cloud but are also dragging down the lower bounds. While it’s positive that they have entered the cloud, there doesn’t appear to be enough momentum behind this move to propel them higher.

We are still range bound and watching for a break below or above the cloud is what one should be looking for to gauge a trend. For further definitions of what is being discussed, please refer to this previous post on Ichimoku cloud charts.

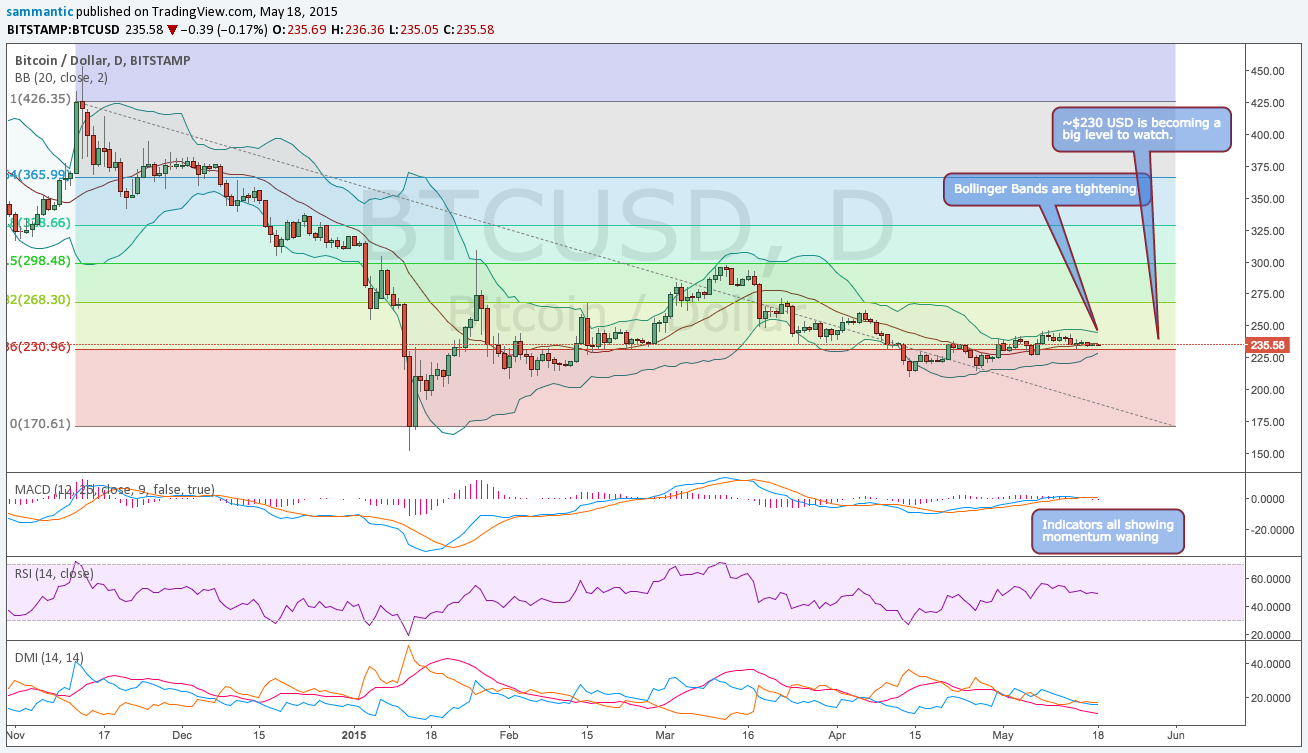

Intermediate-Term Trend

Using Fibonacci retracements from an intermediate-term price high of US$427 recorded back in mid-November, we see that the price is above the support at ~US$230. This is becoming a big area on multiple time frames and using different technical indicators.

Having failed (yet again) to break above resistance (50 day EMA) and hold, a test of US$230 is likely. If it falls below this level, there are some minor support levels below but the US$210-215 looks like it will provide major support.

The RSI and MACD are both flat and appear to be topping out. This continues to show that momentum is stalling.

Included is the Directional Movement Index (DMI), which looks at buying and selling pressures. The blue line indicates buying pressure, the red line indicates selling pressure and the orange line is the ADX, which indicates the strength or weakness of a trend.

As one can see, selling pressure has fallen with the ADX line indicating selling pressure has receded in the last few weeks. Buying Pressure and Selling Pressure continue to fall and are both below the ADX. This is yet another sign that momentum has topped out and price is range bound on very small volume. This is happening at low levels, which means volume and momentum are not confirming the higher move that occurred to the top of the price range. This again confirms that price is getting ready to make a move one way or the other.

Bollinger bands are confirming this too. All the indicators and time frames are showing this squeeze. A resolution should come within days.

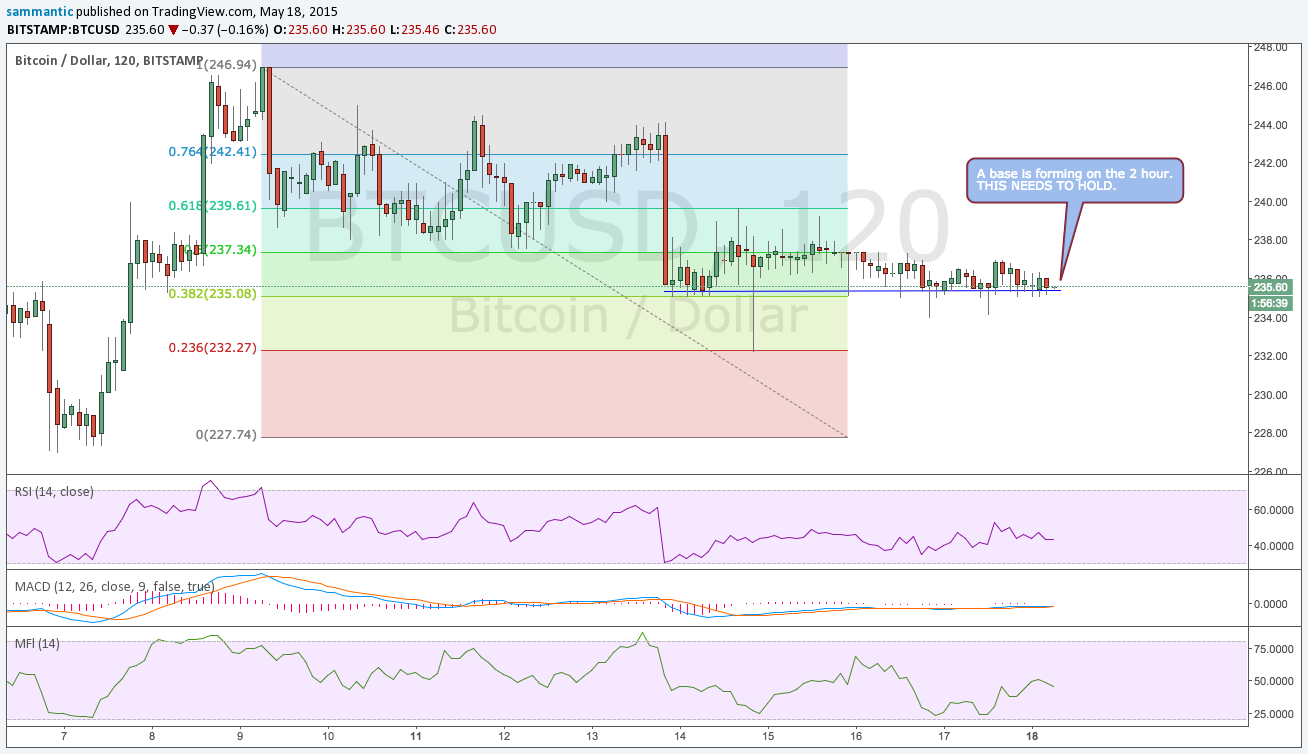

Short-Term Trend

Looking at the short-term trend (May 9 price high of ~US$247) using Fibonacci retracements, it looks to have topped out at ~US$247 where it couldn’t hold above the 50-day EMA and now appears to be heading lower.

A big base has formed and US$235 level is now providing support. This needs to hold otherwise a test of that ~US$231 level will happen imminently. This area is becoming more and more important. Short term, US$235 and US$231 are really big areas. If these should break down the US$225 and US$221 come into play, but will probably be stops on the way to testing the ~US$210 level. The RSI and Money Flow are both heading down confirming the price. MACD could not be more flat at the zero line.

Big move imminent

The primary downtrend continues. It’s looking like the price is getting ready to make a big move. All of the indicators are compressing around the same key levels mentioned above.

The price has moved lower this week and some big support areas need to hold. Momentum and volume are at low levels. The 50-day EMA continues to be very big resistance as price has continuously failed to stay above it. It still looks like there are lower levels to be tested. Every rally in price in recent months has been at lower levels and this latest one demonstrates that point. A retest of the ~US$210 area continues to look like a real possibility.

Disclaimer: Articles regarding the potential movement in crypto-currency prices are not to be treated as trading advice. Neither Cointelegraph nor the Author assumes responsibility for any trade losses as the final decision on trade execution lies with the reader. Always remember that only those in possession of the private keys are in control of the money