Fundstrat’s Robert Sluymer weighed in on Bitcoin (BTC) charts, saying a short-term breakthrough $6,300 is “critical” to reverse its downtrend, on CNBC yesterday, June 27.

Analyzing Bitcoin’s 15-day moving average charts as of May ‘18, he said:

“It really is a no-man’s land from a trading standpoint. I think if you’re a very short-term trader… we have a critical stop level at the $5,800-6000… with a resistance level of $6,300-6400. If it can rally through that, I think there’s a chance Bitcoin could start to turn.”

The 15-day moving average (MA) chart is a “pretty good” proxy for whether the market’s trend is positive or negative, Sluymer suggested, and he turned to the 15-day charts spanning back to late 2017.

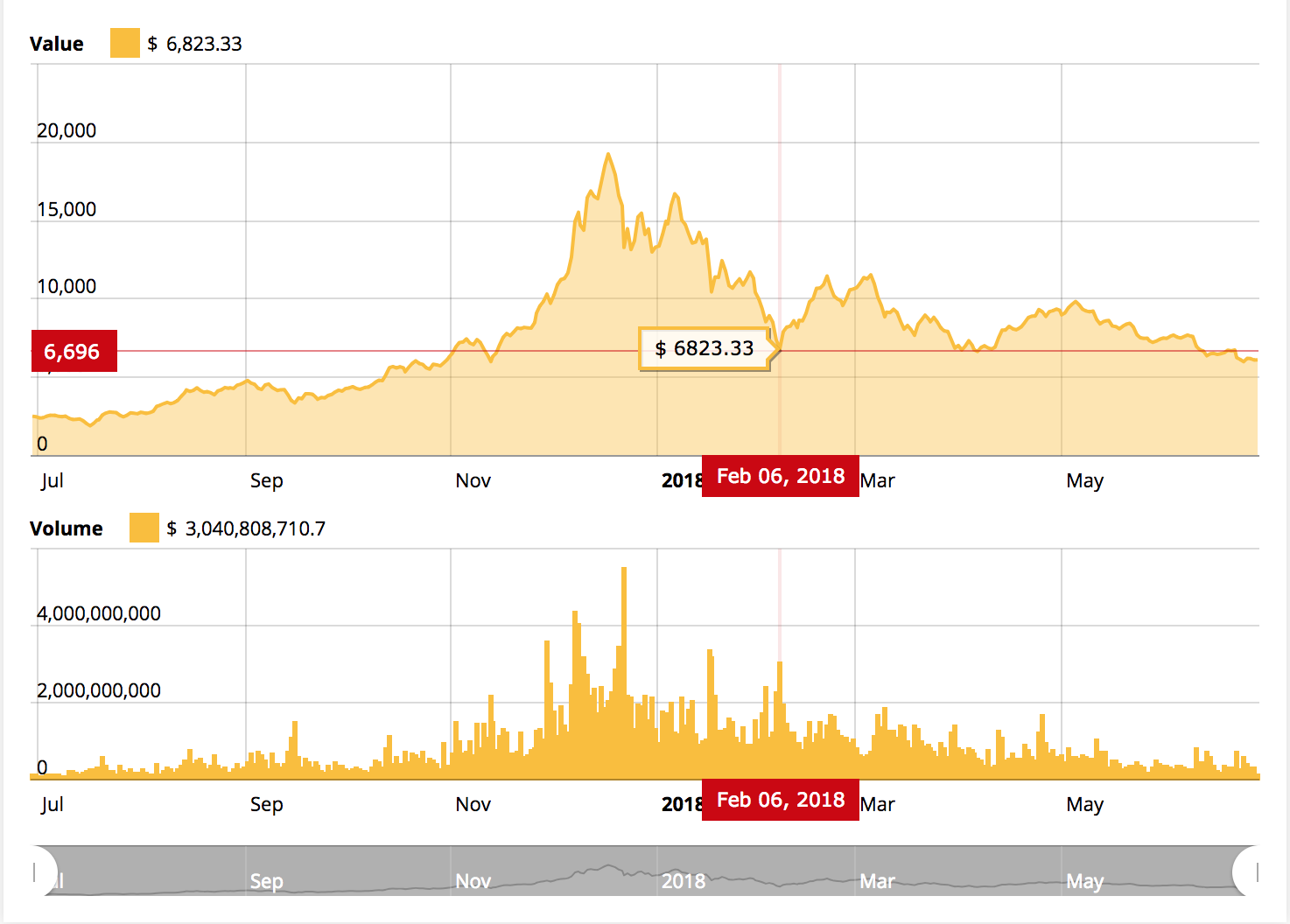

These indicate that crypto markets have been showing progressively higher lows, but Sluymer halted at the $7,000 level on this year’s chart, which he says had been a “very critical support” until now.

With Bitcoin losing this support and failing to break the $7800 resistance on the upside at the time, what we now have are inevitably “lower highs” and an overall downtrend, with Bitcoin currently trading at below its 15-day MA trendline for late 2017-18.

Sluymer said that in the medium term, $5,800-6000 is now the “absolutely critical” support level for Bitcoin to prevent it from plummeting yet further to the $5000-5500 range. “Until then, the downtrend’s intact,” he added.

“At this point we’re just seeing recovery rallies back to the 15-day, back to the downtrend, and it’s failing.” He conceded that “it’s going to be tough” to realize Fundstrat co-founder Tom Lee’s prediction that Bitcoin will reach $25,000.

Bitcoin is currently trading at around $6,100, down 9 percent on the week and 15 percent this month. June has in fact seen the leading cryptocurrency trading below its formerly lowest 2018 levels back in February: