Analysts are concerned that Bitcoin and cryptocurrency mining centers are spending too much electricity, and that the process of verifying cryptocurrency transactions could worsen the global environment.

Justification of mining in Bitcoin and cryptocurrencies

In December 2017, several analysts criticized the electricity consumption of Bitcoin and cryptocurrency mining centers, calling the mining process an “environmental disaster.” Earlier Cointelegraph reported that cryptocurrency mining will likely exceed electricity consumption of households in 2018.

Smari McCarthy of Iceland's Pirate Party stated that excessive consumption for Bitcoin mining is not practical because the main use case of Bitcoin is for “financial speculation.”

"We are spending tens or maybe hundreds of megawatts on producing something that has no tangible existence and no real use for humans outside the realm of financial speculation. That can't be good.”

If environmentalists and analysts perceive the main use case of Bitcoin and other cryptocurrencies to be financial speculation, the consumption of a massive amount of electricity could be considered impractical. However, the main application of Bitcoin is not financial speculation. In countries wherein the underbanked struggle to gain access to financial services, Bitcoin operates as an efficient currency.

In Venezuela, for instance, local residents are using Bitcoin to order food, basic goods and medicine from outside of the country because the Venezuelan bolivar, the country’s national currency, has lost almost all of its value, and has become virtually worthless.

Bitcoin’s proof-of-work (PoW) consensus algorithm uses global computing power to verify transactions and produce new cryptocurrencies through a mathematical system. The PoW system of Bitcoin disallows hackers from gaining access to the decentralized protocol and enables the Bitcoin Blockchain network to settle transactions on a peer to peer basis without intermediaries. Hence, to undermine the consumption of electricity to power decentralized currencies that are imposing a major impact on the global economy is illogical, and it is especially ill-judged to claim that the applicability of cryptocurrencies and Blockchain technology is limited to financial speculation.

Speculation exists in any sector that is in the early stage of growth. In the beginning, investors are going to speculate on the value and price trend of cryptocurrencies and crypto-assets. However, as the industry matures and the market evolves, investors will inevitably move on from speculation to utilization of tokens for utility and fungibility.

Is electricity consumption a problem? Probably the one that market solves

Evidently, electricity costs contribute significantly to the operating costs of mining centers and facilities. As such, cryptocurrency miners focus on reducing its operating costs and maximizing its profit margins by using cheap sources of electricity.

In regions like northeastern China, Peru and Chile, the supply of electricity generated from renewable sources is so abundant that electricity is distributed for free. Chile for instance, in 2016, produced so much solar energy that it had given away most of it for free. Since then, the government of Chile has constructed more solar plants and focused on building infrastructures to generate enough clean electricity to power the entire country without additional costs.

It is important to acknowledge that minimal consumption of nonrenewable and expensive electricity is in the interest and benefit of cryptocurrency miners. It is for this particular reason that many miners have relocated to regions like northeastern China, Chile, Norway and Iceland wherein miners can obtain cheap electricity from renewable sources and naturally cool down their facilities with cold climate.

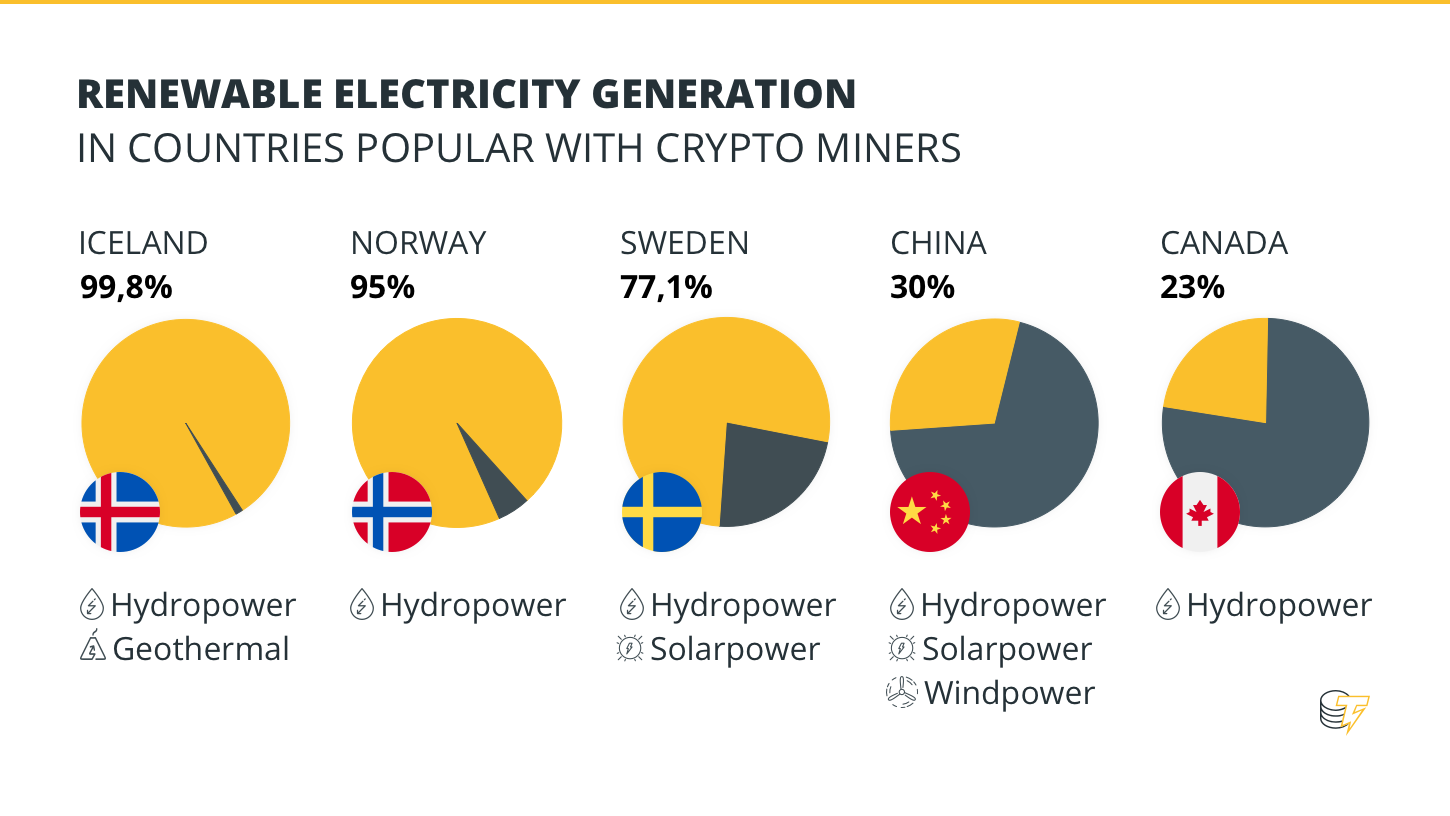

In Iceland, according to NEA, the National Energy Authority of the country, almost 100 percent of energy and electricity are generated from renewable sources. Hydroelectric power and geothermal energy account for 99.8 percent of Iceland’s electricity. In Norway, another popular country for cryptocurrency miners, hydropower accounts for a staggering 95 percent of electricity generated by the country. In both countries, electricity used by households and facilities are almost entirely generated by clean and renewable energy.

It is beneficial for miners to relocate to countries like Iceland and Norway because cheap electricity substantially decreases operating costs. As such, miners always search for regions with cheaper electricity and as a result, target renewable sources of electricity in countries with abundant supplies of energy. If cryptocurrency miners are using leftover electricity in regions with abundant supplies of renewable electricity, then it is a non-issue for both the miners and the global environment.

In an interview, Johann Snorri Sigurbergsson, an HS Orka spokesman, stated that if all cryptocurrency mining facilities relocating to Iceland permanently settle down in the country, the region will not have enough energy to support these centers.

“If all these projects are realized, we won’t have enough energy for it. What we’re seeing now is…you can almost call it exponential growth, I think, in the [energy] consumption of data centers.”

There’s no reason not to believe in that scenario. But let’s not forget how does the market economy functions. If energy becomes expensive in Iceland due to scarcity, cryptocurrency miners will inevitably relocate to other regions with cheaper electricity.