It seems as if a Bitcoin scaling solution is urgently needed to process transactions more efficiently.

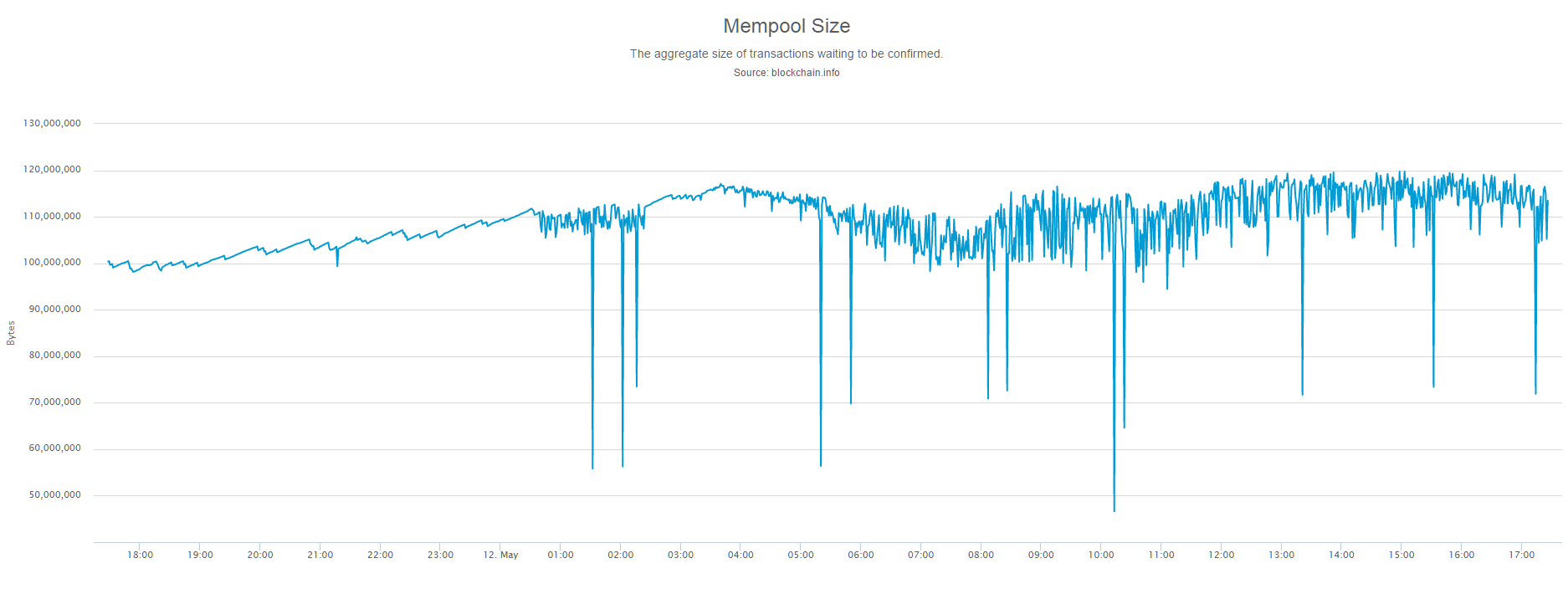

Earlier today, on May 12, the Bitcoin network’s mempool, the holding area for all pending and unconfirmed transactions, achieved an all-time high size of 110 mln bytes or 110 MBs. For two days, the size of the mempool remained in the 100 MBs region, which meant that many transactions were left unconfirmed and weren’t broadcasted to the Bitcoin Blockchain.

More to that, the average size of Bitcoin blocks increased to around 0.988 MB, getting closer to the Bitcoin network’s 1 MB cap. Based on the growing mempool size and the average Bitcoin block size which is a few kilobytes away from maximizing Bitcoin’s block size cap, a scaling solution is urgently and evidently needed in order to scale the Bitcoin network proportionally to its growth.

Integration of Lightning

In April, Bitcoin Core developer Luke-Jr claimed that the legitimate use of the Bitcoin Blockchain amounts to only 750 KB or 0.75 MB per block on average, assuming that the rest are spam transactions initiated to mislead the community into thinking that a scaling solution must be urgently adopted. Luke-Jr wrote:

“All legitimate uses of the blockchain currently amount to approximately 750k/block average. If inefficient and microtransaction usage is put aside, likely below 500k would be sufficient. No block size increase is likely to be needed in the near future. Before we reach the point that 1MB is insufficient, we are likely to have the Lightning protocol working in production. This improves efficiency of blockchain usage by magnitudes, possibly reducing 1 MB block usage to ~10k.”

He further emphasized that the integration of Lightning would optimize Bitcoin blocks by up to 90 percent by enabling cheap and secure micropayments with lesser fees. Whether only 750 KB of transactions in each block are legitimate and authentic is difficult to prove and conclude based on the current circumstances.

However, as Luke-Jr noted in his comment about SegWit and Lightning, the activation of SegWit on Bitcoin will most likely lead to an immediate implementation of the Lightning network, as seen in Litecoin’s most recent facilitation of a Lightning micropayment.

1.3 cents transaction in less than a second

According to Blockstream developer Rusty Russell, Litecoin processed its first SegWit-based Lightning transaction that is worth about 1.3 cents. The transaction was settled in less than a second on a non-test network initiated by fellow Blockstream developer Christian Decker.

The effect of Lightning on the optimization of Bitcoin blocks is still speculative, mainly because Litecoin’s blocks are almost 90 percent empty and Lightning could have an entirely different impact on Bitcoin. For instance, Litecoin was designed to process transactions on a 2.5-minute basis, while Bitcoin settles transactions or grants confirmations every 10 minutes. Hence, the speed of Lightning micropayment settlement on Litecoin could significantly differ from that of Bitcoin.

Either way, based on Bitcoin’s growing mempool size and the exponential growth in daily transactions, a scaling solution is needed. At this point, SegWit seems like the most viable mid-term scaling solution as it offers infrastructure for two-layer solutions and offers fixes to existing issues such as transaction malleability.