Strict financial regulations imposed on local traders and investors in China disallow investments in assets outside of the country’s borders. High profile traders and traditional investors are turning to Bitcoin as an alternative asset.

Unlike most traditional forms of assets and investment tools in China, Bitcoin is unique in a way that investors and traders can simple move the Cryptocurrency out of the country without any borders or boundaries. Since smuggling the Chinese Yuan, gold, or any other precious metals is strictly illegal in China, investors often struggle to deal with issues in moving their wealth out of the country.

More importantly, the instability of the Chinese stock market has moved a substantially large number of investors away from local investment opportunities, stocks, and assets, opening a huge opportunity for high liquid international asset like Bitcoin that carries significantly high exchange rates around the world.

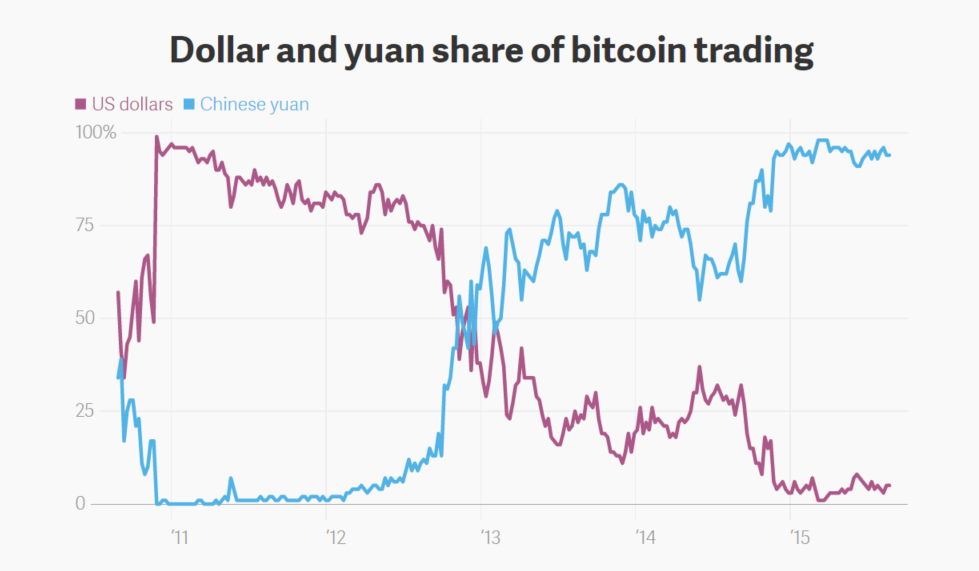

As a direct result of the tightened financial regulations in China, the Yuan began to dominate Bitcoin exchange markets globally, accounting for 94% of Bitcoin trading in August.

According to Bitcoinity’s comparison chart designed by Quartz’ Joon Ian Wong between the US dollars and Chinese Yuan − the two most dominant currencies in the Bitcoin exchange market − the Chinese Yuan took over the US dollar-to-Bitcoin pair in late 2012, and continued to dominate the market since 2015.

OTC Market & Undervaluation

This excludes an even bigger over-the-counter market in China, which experts believe is even larger than the exchange market. Civic CEO and Bitcoin expert Vinny Lingham states that the OTC market is substantially larger than the exchange market, where 9 figure purchases of Bitcoin is common.

“Typically, this year has been largely 66% buyers — 33% sellers in the OTC market according to my sources, but since the Brexit last week and the recent run-up, even more buyers have entered the OTC market — which is not being reflected in the price. My key point is that exchange volume doesn’t represent true market based Bitcoin demand and supply,” stated Lingham.

If the Chinese over-the-counter market were to be added to the exchange market, Bitcoin trading would be even more heavily dominated by Chinese buyers and investors.

Furthermore, Chinese miners which obtain the market’s majority share of Bitcoin, sell their Bitcoin through brokers in large sums. Thus, the sum of the over-the-counter market in China and the Bitcoin exchange market would suggest that the value of Bitcoin is significantly undervalued as of now.