As Adam Back and Bruce Fenton debated the possibility of $20 – or even $100 – Bitcoin transaction fees this week, it's easy to forget that once upon a time, most people would have read those tweets with incredulity.

While no one would dispute that immutability and the ability to secure the network are key to Bitcoin's future as digital gold, rising transaction fees are changing the landscape for early adopters, both individuals and businesses.

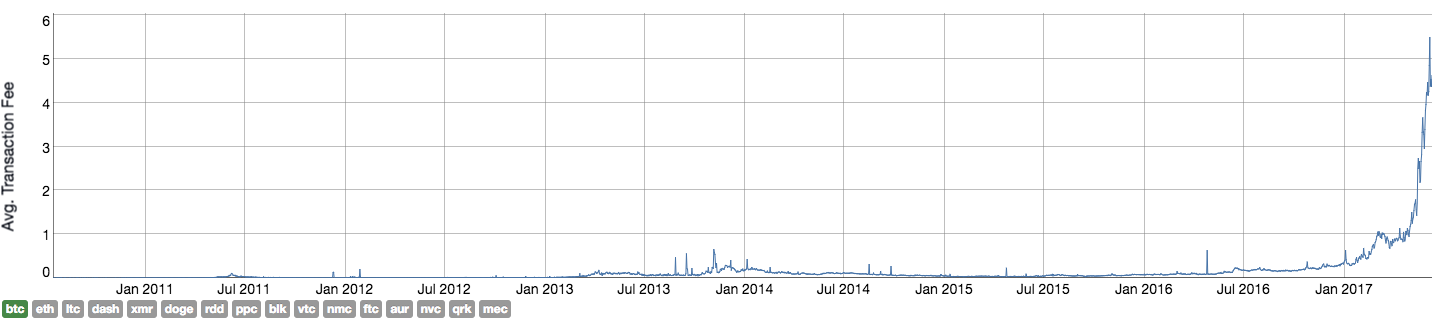

Average transaction fees increased by 155 percent in Q1 of 2017 alone. The blockchain.info chart tells its own story:

Suddenly, the figures bandied about by Back and Fenton don't sound outlandish anymore. Such fees are obviously a drop in the ocean for any individual or corporation wanting the ultimate in secure, trustless storage and transactions, but it's easy for some of us grass-roots Bitcoiners to feel nostalgic for the days when fees were close to zero.

On June 10, 2014, I was sitting outside Fabelhaft Bar in Berlin. I tweeted about how cool it was that I could pay for my beer with Bitcoin, and some kind dude in Philadelphia noticed my tweet and sent 0.006 BTC to the bar's address for me so I could have another beer.

The low fees at that point made it possible for this kind of spontaneous fun stuff. It was also a great opportunity to show some of the less crypto-literate people at the bar how you could cut the banks out of the loop and send payment across the world with ease and speed.

Yes, I know the Bitcoin network was never designed for buying coffee or beer, or for sending two-cent tips on social media and it's no huge loss for me, with my UK bank account, if I have to use fiat instead. But what happens to startups who founded their enterprises on Bitcoin payments at a time when fees were much lower?

I asked two entrepreneurs how the rapid changes had affected them.

Sheryl Carr, co-founder of Quid Smart Vendor, a point-of-sale solution for merchants worldwide, did not particularly see high fees as an issue, especially in the context of bank charges for international payments.

“A lot of our merchants do business in international destinations - that's why we integrate a currency converter in our register,” she explains.

“So again, the cost of transacting by accepting foreign currency and exchanging that money still may be higher or equivalent to the “high” transaction fees of Bitcoin - which means accepting BTC is still competitive. Some of those exchange rates from the Cambio can be as high as 17 percent.”

Instead, Carr views the reluctance of consumers to spend Bitcoin as the major blocker to progress.

“Unfortunately, we are seeing low Bitcoin usage from our clients - it really doesn't have traction. Merchants, as we know, are not accepting Bitcoin, but mainly because the customers are not spending it. Believe me - ANY merchant would gladly accept Bitcoin if someone was willing to spend it! Wouldn't you? I think it's more a consumer issue than a merchant issue.”

In contrast, startups specializing in Bitcoin micropayments are perhaps disproportionately affected.

Neha Murarka is founder and CEO of smoogs.io, who offer micropayment solutions for digital content creators.

“The current rise in Bitcoin fees has dramatically affected our business model,” she says.

“I'm sure a lot of companies whose products are built around Bitcoin are facing some interesting challenges, especially the ones using Bitcoin solely as a mode of payment from their customers. Essentially in many circumstances, it has become cheaper to accept a credit or debit card. This effect is even more acute for startups like us who are working with small-value payments.”

But Murarka, like Carr, is keen to emphasize that it's not just about the transaction costs:

“We must remember that Bitcoin was not made to simply lower transaction costs, and this keeps us on our toes to continue innovating and finding more interesting ways to use Bitcoin.”

While innovations such as the Lightning Network may ultimately provide a solution for companies offering lower-value cryptocurrency payments, few would deny building a business on such a rapidly evolving platform is akin to constructing a house on shifting sands.

One thing is certain: those companies who are tenacious enough to adapt, and to see the clear benefits of Bitcoin even in an ecosystem of higher transaction fees, will have proved they are capable of surviving and thriving in even this most challenging of environments.