For anyone not involved in mid-90s cypherpunk scenes or early e-cash projects, the term “digital currency” probably never came up in conversation until quite recently, after the advent of Bitcoin.

But Satoshi’s white paper did not invent digital money; that’s an idea as old as mainstream internet usage itself. Bitcoin, and the altcoins it spawned, just happened to be so revolutionary that all those electronic currencies pre-2009 get overshadowed.

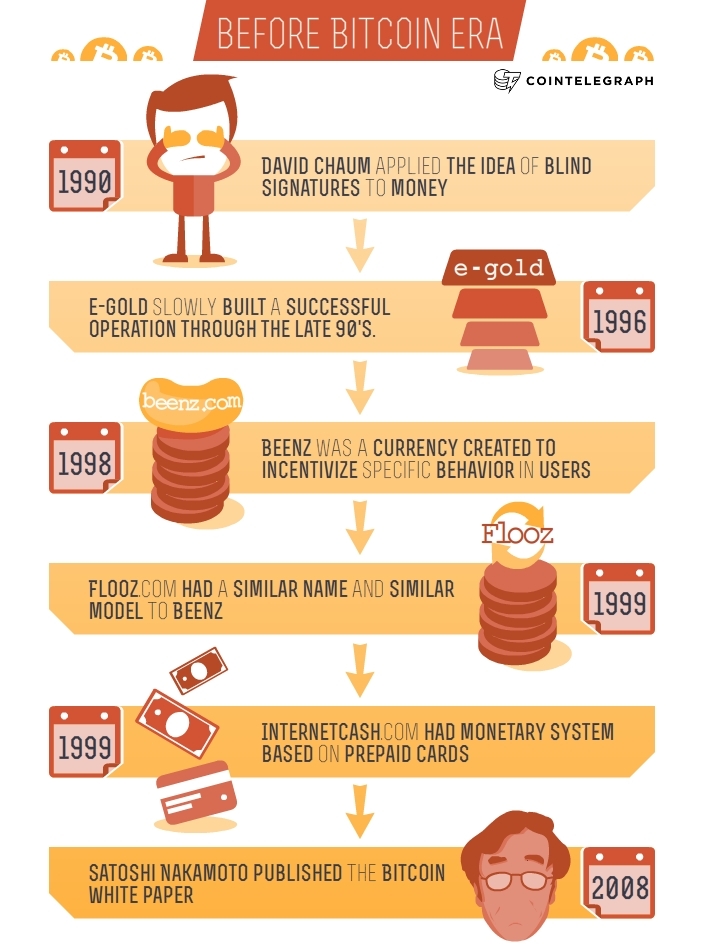

It’s like the Christian calendar. There is before-Bitcoin (BB), and then there is the current era, (AB).

Let’s take a look at some pre-Bitcoin technologies to get an idea of how far cryptocurrencies have come since.

1990: DigiCash

In 1982, cryptographer David Chaum applied the idea of blind signatures to money in his paper “Blind Signature for Untraceable Payments.” Eight years later, he took these cryptographic protocols to market with DigiCash, a company that ultimately went bankrupt in 1998.

1996: E-Gold

E-Gold sounded like a fine idea at the time: Create an account, send in your gold or silver, and your accounted would be credited. Those credits could then be easily transferred among accounts. The company slowly built a successful operation through the late 90s.

By 2001, E-Gold was running into problems, however. The US Patriot Act, first of all, tightened regulations on businesses that could be classified as money transmitters. Gaining money transmitter licenses for all 50 states proved too big of a hassle for E-Gold and its competitors.

Furthermore, a campaign began to grow against E-Gold that marked it as the currency of money launderers and child pornographers. A federal indictment followed in 2005, which marked the end of E-Gold as a meaningful alternative currency.

1998: Beenz.com

Beenz was a currency created to incentivize behavior such as visiting specific websites, logging on through specific ISPs or shopping at certain stores. This was back before the dot-com bubble burst, when bored teenagers could take online quizzes, and marketing companies would send them free stuff in the mail.

But the fetten Jahren ran their course, and Beenz.com was gone by 2001.

1999: Flooz.com

Flooz had a similar name and similar model to Beenz: Users were rewarded for activity with flooz, which served as a medium of exchange among its network of partners. Like Beenz, also, Flooz went bust in the dot-com crash.

1999: InternetCash.com

InterenetCash.com filed a number of patents to protect its monetary system based on prepaid cards, and it also relied on a network of participating merchants where that cash could be redeemed. The company ultimately raised $10 million in funding and had a staff of about 70 employees before the dot-com crash forced the company to close in August 2001.

After 2001, when economic realities hit many internet startups hard, digital money never really caught on again, beyond some niche users, until Nakamoto published the Bitcoin white paper in 2008. Of course, it took a few years for most of us in the cryptocurrency community to catch on, at which point cryptocurrencies took off far beyond what their predecessors did.

We asked some community experts what present feature or present reality in cryptocurrency tech today we will find funny and old-fashioned in 15 years or so?

Aleksey Bragin: “So many useless (or sometimes funny, as DogeCoin for example) alt cryptocurrency clones emerged so quickly. That would go out of fashion quicker than within 15 years, I suppose.”

Gideon Gallasch (coinsulting.eu): “I think mining - so much power and electricity is not sustainable long term.”

Lech Wilczyński (Co-Founder/CEO / Developer at InPay S.A.): “Centralized exchanges.”

J. Ryan Conley (CEO & Founder at Ryan Conley Marketing & Training and CEO & Founder at Team Extreme Worldwide): "That the banks were last to catch on to this awesome concept! Staged viral video marketing platform."

Patrick Dugan (CIO of Crypto Currency Concepts): “Centralized exchanges for sure, mining possibly.”

Lech Wilczyński (InPay.pl): “Bitcoin payment gateway.”