Will Bitcoin growth slow in 2016? BargainFox and Georgi Georgiev do not think so. In fact, they have even put together an infographic presenting 33 indicators that bitcoin growth is not slowing down this year. However, as we looked closer, only some can be considered indications of growth in 2016 - more than half are merely FYI facts, others are open to interpretation.

We contacted the author to clarify his intention, but received no comment. What follows is our brief overview of the infographic. We divided the indicators into those that are likely to mean continued growth of bitcoin, those that are questionable, and those that are informative facts without a clear link to bitcoin growth in 2016.

Indicators that bitcoin will continue to grow

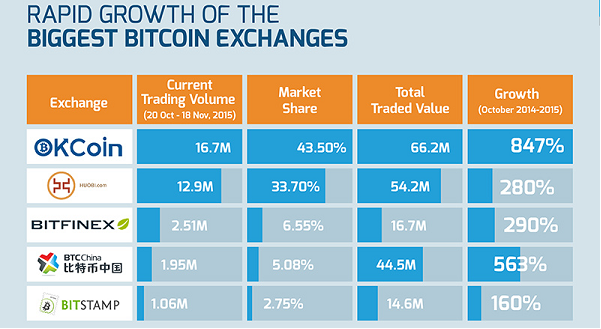

Five major exchanges have multiplied their volumes up to 8 times and have traded almost $200 million worth of bitcoin in total. While this is still a drop in the ocean, slightly above the GDP of Marshall Islands, the speed at which this drop is getting bigger is an indicator of continued growth in 2016.

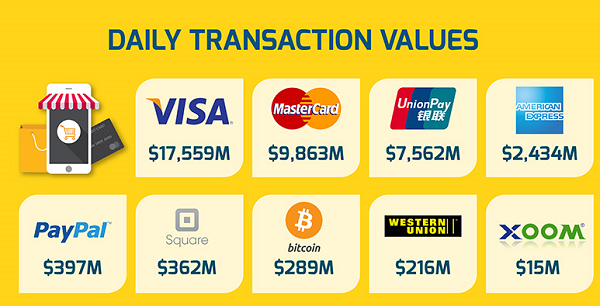

Daily transaction volumes in 7-year-old Bitcoin have surpassed 164-year-old giant Western Union. Next in line are Square valued at $5 billion in its last funding round and PayPal whose growth versus Bitcoin is slowing down.

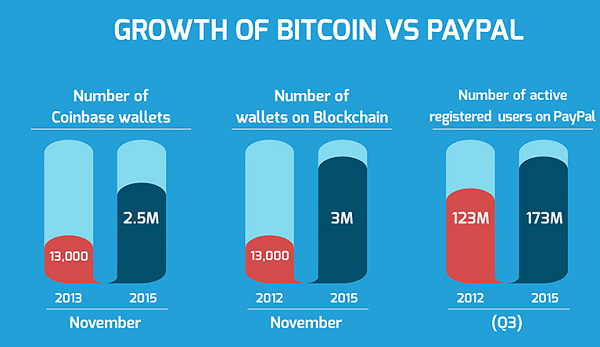

While we must note that Bitcoin and PayPal are in astronomically different weight categories as to absolute volume, they are pretty close on daily transaction volume, thus comparing their user growth rates is an interesting indicator.

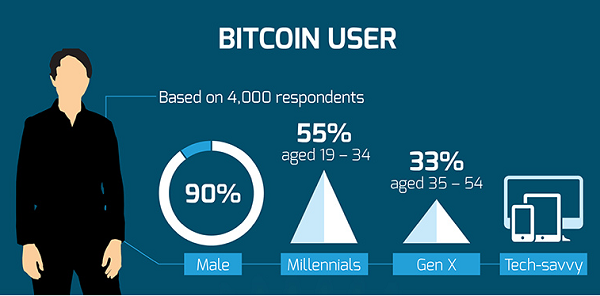

Bitcoin is still in its hyped early adopter phase, growing fast among tech enthusiasts and slowly but surely attracting brave businesses over recent years. PayPal is already a behemoth convincing more conservative potential users and battling difficult legislations to fuel their growth.

However, what this indicator says is that if you rely on historical data and predict continued growth of PayPal in 2016, it is consistent to expect the same for Bitcoin, whose growth is even faster.

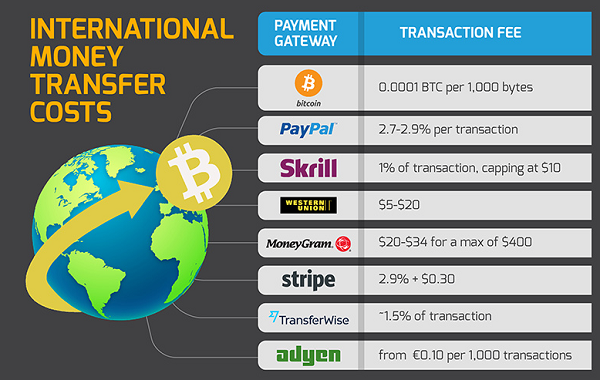

Transaction fees are one of the main teasers for pragmatic Bitcoin adopters. Since major wallet services started hedging users against exchange rate volatility, bitcoin has become a viable, and even attractive alternative payment method.

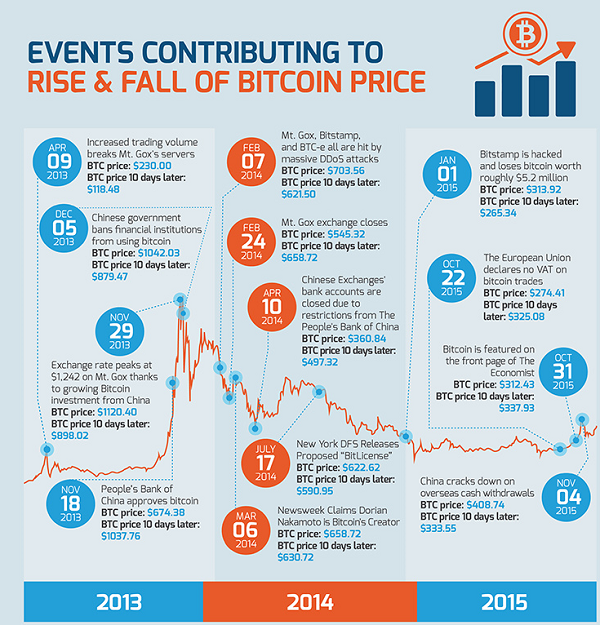

If 2014 was a bloody massacre for Bitcoin price and confidence, 2015 yielded slow but steady stabilization. In 2014 Bitcoin enthusiasts were trying to uphold the hype by quoting tech giants Dell, Microsoft and Overstock.com who accept bitcoin, even if their settlements with Coinbase and BitPay were still 90-100% USD-based. After the currency lost over half of its value, volatility was quoted as the main reason why Bitcoin would never be accepted without immediate conversion into fiat. In 2015, the volatility subsided, which could be stretched into a positive argument: less volatility = higher user confidence.

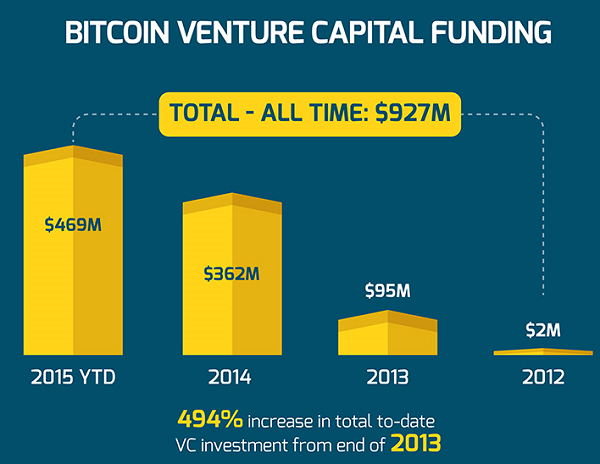

Bitcoin-based innovations have attracted almost $1 billion in venture capital investment to date, more than half of that coming in 2015. While the growth has slowed down in 2015 due to a rough 2014, the trend did not reverse and investors continued to put their money in Bitcoin-based businesses, reaching a record amount.

While a notable portion of it was invested in previously held companies to fuel further growth, the very fact that investors still believe it is worth financing these businesses in 2015 is a bet for a favourable 2016.

Questionable indicators

As expected, the first investment in 2013 was received by developed countries with strong tech talent. However, the trend over the next two years includes more and more developing states with smaller economies but emerging tech hubs like Kenya or Netherlands, as well as politically and economically unstable Argentina. With Bitcoin investments now reaching countries on all continents, the trend is positive.

However, although the number of new countries receiving Bitcoin VC investments continued to grow in 2015, it halved from what it was in 2014. Together with a slowdown in the total volume of VC investments mentioned earlier, this may be an indication that investors are being more cautious with bets in new markets than in 2014.

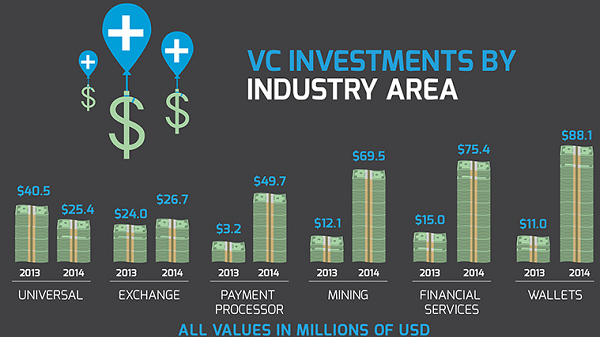

In 2014 VC investment has grown in all major industry areas, except universal businesses. Venture capitalists are placing the heftiest bets on wallets and financial services, followed by mining and payment processing. It would be interesting to see the stats for 2015, as there have been several notable rounds, including $116m for 21 Inc Bitcoin computer for developers, $75m for CoinBase wallet and $25m for bitcoin miner BitFury, which made it the most funded miner to date.

Without data for 2015, it is hard to say whether this trend is applicable to predict a rise in 2016, as growth of other VC indicators has slowed down in 2015.

Investor names range from relatively new VCs specializing in the sector like Digital Currency Group to well-known professionals with pedigree like Andreessen Horowitz that have grown and exited Skype, Instagram, Groupon and other well-known companies.

This is a positive fact in general, and could be stretched to say that these investors are likely to attract more prominent names in 2016, however, it does not directly imply more investment in 2016.

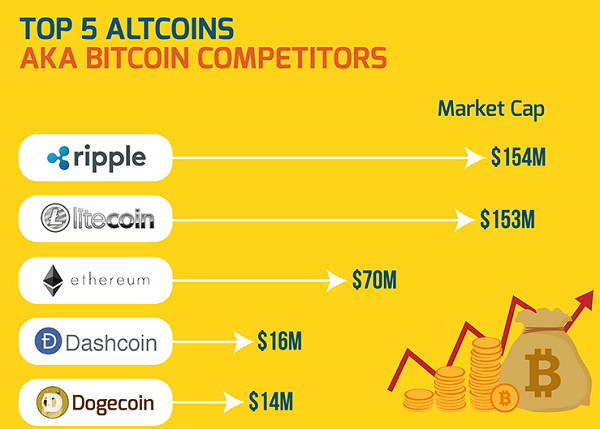

Competition to Bitcoin is emerging and growing. The 5 most popular alternative cryptocurrencies (altcoins) have a market cap of $407 million. This indicates that competitors see a lucrative market opportunity.

However, using absolute values of market cap without a timeline, this does not show whether competitors slowed down in 2015, as did many other indicators. Notable total market cap does not automatically mean that they will continue to grow in 2016.

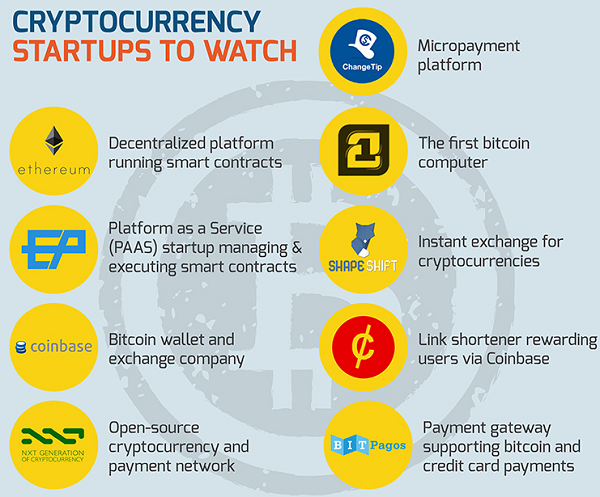

Exciting bitcoin-based startup companies are emerging. Here are some highlights. Does it necessarily mean growth in 2016? No. It means that startups and their investors believe they will be successful in 2016. But have we seen a year when they wouldn’t? Exciting companies were emerging in 2013 as well, everyone was cheering for a whooping 2014 and we saw a major crash.

Great startups are an indicator of excitement in a generally hot scene, which is not directly indicative of growth in 2016. Slowing growth in VC investments, while bitcoin penetration is still so low, tells us something else.

FYI facts

Now these 12 indicators are further stressed by just as many FYI facts from the past to build a positive context around Bitcoin, without any particular link to 2016.

Over 7,000 merchants accept bitcoin as mode of payment. Even though most convert it to fiat at a 100% rate right away, this incentivizes individuals to adopt bitcoin as a mode of payment, and not just as a speculative tool.

But does a list of top merchants indicate anything about growth in 2016? Right in the next graphic we see that the number of major merchants that started accepting bitcoin in 2015 has shrunk more than 3x since 2014. It is a positive fact that new merchants are joining, but due to the slower rate it cannot be used as an indicator of growth in 2016.

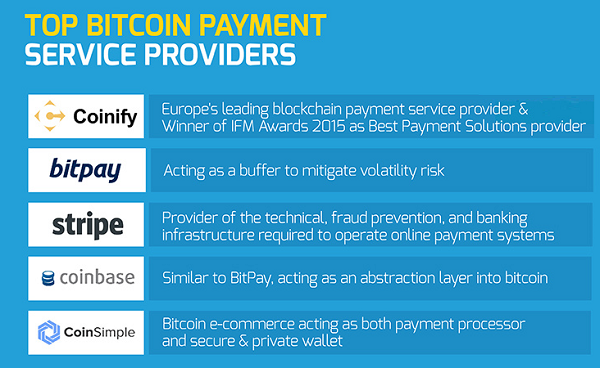

It is generally positive to see 5 top bitcoin service providers. However, since they were not established in 2015, it is hardly an indication of growth in 2016, particularly. The only relevant fact in this graphic is that Coinify was the Winner of IFM Awards as Best Payment Solutions provider.

Not mentioning that most of these retailers convert all bitcoin into fiat right at the moment of purchase, what does this fact tell us? There are many retailers accepting bitcoin worldwide. None of the Top 10 has joined in 2015. It is not clear how this indicates growth in 2016. We could flip it and say that none of the ten dumped bitcoin in 2015. However, that would still not mean more growth in 2016.

The incentives for merchants and retailers go beyond following the latest fad and attracting tech-savvy customers. Not having to bear the losses from fraudulent payments is another strong argument. But it was true in 2015, just as it was in 2013. This fact should not fuel extra growth in 2016, unless we factor in that notably more merchants would suddenly become aware of it this year. Which the graphic doesn’t.

8 industries are most actively using bitcoin. However, the link between listing these 8 industries and projecting bitcoin growth in 2016 is unclear.

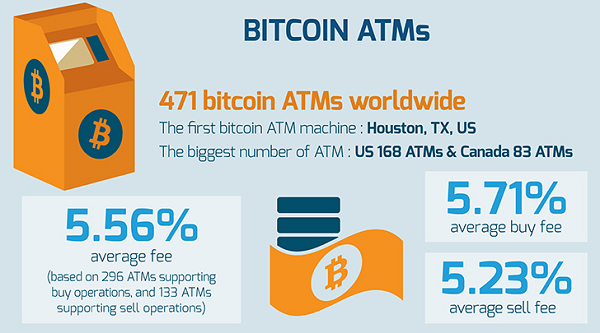

A rising number of Bitcoin ATMs are being installed letting users convert cash into bitcoin. 471 Bitcoin ATMs worldwide is surely better than none. However, if we compare that to at least 3 million regular ATMs, it is still a drop in the ocean. Even more so, if this drop is spread across just 2 countries. This fact indicates user interest and it indicates potential, but it does not indicate growth of bitcoin in 2016, particularly.

This sure is an interesting fact. The presence of at least 5 competitors also indicates that they see a market opportunity. However, is it relevant to talk about market shares if there are just a few hundred ATMs on the market? More importantly, without a timeline this fact does not indicate much about growth of bitcoin in 2016.

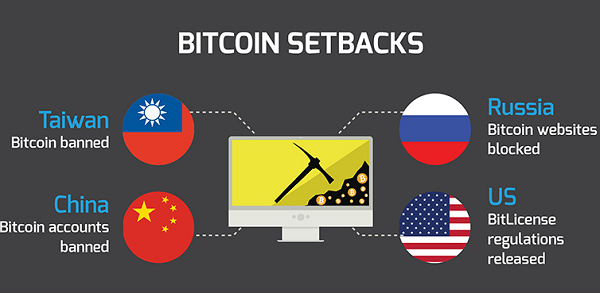

There is no way that bitcoin setbacks could be used as indicators of bitcoin growth in 2016.

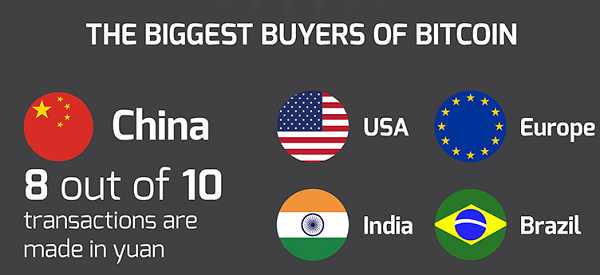

This is informative, but does it indicate continued growth in 2016? All these economies have problems. More importantly, if 8 of 10 transactions are from China and the country is banning bitcoin accounts, it is unclear how it indicates growth of bitcoin in 2016.

Their investments back into bitcoin and related companies could be used as indicators, but only the fact that some individuals became rich in the early days of bitcoin hardly means continued growth in 2016.

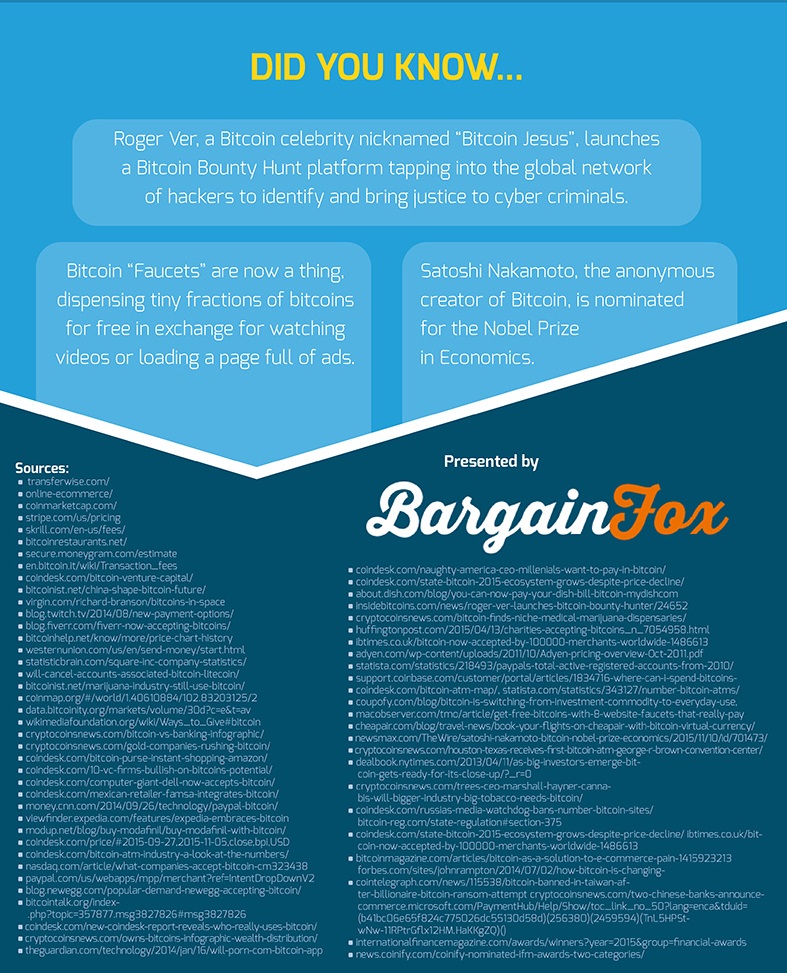

Three interesting facts that clearly emanate positive sentiment about bitcoin, but do not indicate growth in 2016 just as clearly.

We know there is a lot of speculation about the rise or fall of bitcoin every December-January. We just tried to deconstruct one of them. What interesting pieces of analysis have you recently seen? Please, share in comments: