Bitcoin dipped back below $5,500 Wednesday as a three to six percent downturn hit the majority of cryptocurrency markets.

36 hours after Bitcoin Gold became the second fork of the Bitcoin network, Bitcoin prices came down from their $6,100 highs to hit a low of $5,479, according to data from Bitstamp.

$10 bln has also disappeared from Bitcoin’s market cap since hitting the highs, with market dominance remaining above 56 percent.

In line with current trends, mainstream media picked up on the downturn, with CNBC sounding the alarm about a Bitcoin low of $5,374 and a “plunge” in Bitcoin Gold of 66 percent since it began trading on Bitfinex.

We have finished the BTG snapshot & have assigned BTG to users with a BTC balance at the time block 491406 was mined. (10/24; 01:17:35 UTC)

— Bitfinex (@bitfinex) October 24, 2017

Electric fabric startup Loomia’s Blockchain director told the publication:

"These forks are very bad for Bitcoin. Saturating the market with different versions of Bitcoin is confusing to users, and discredits the claim that there are a limited number of Bitcoins - since you can always fork it and double the supply.”

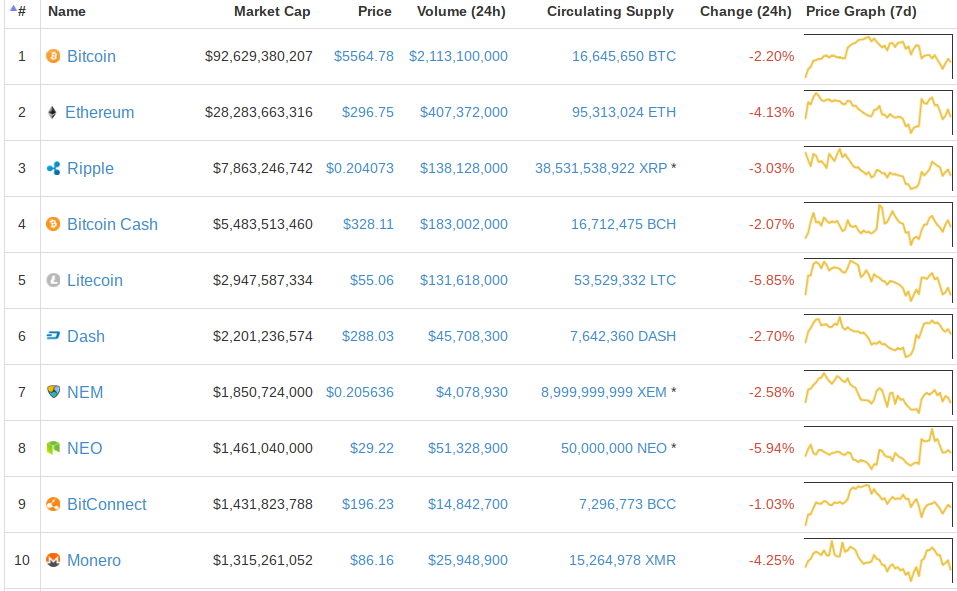

Turbulence in Bitcoin is having a knock-on effect across major altcoins, with the top ten losing up to 5.85 percent in the 24 hours to press time.

In the latest developments on SegWit2x, instant exchange platform Changelly told Cointelegraph it would consider the longest chain with the most accumulated difficulty to be ‘Bitcoin’ following the fork.

Joining Coinbase and Xapo in its perspective, Changelly nonetheless added it “hoped” the legacy Core chain would remain that which exhibited the desired characteristics.

“In case of chain split we most likely integrate B2X fork as an altcoin for exchange,” CEO Konstantin Gladych added.

Competitor ShapeShift’s CEO Erik Voorhees has been a long-time proponent on SegWit2x.