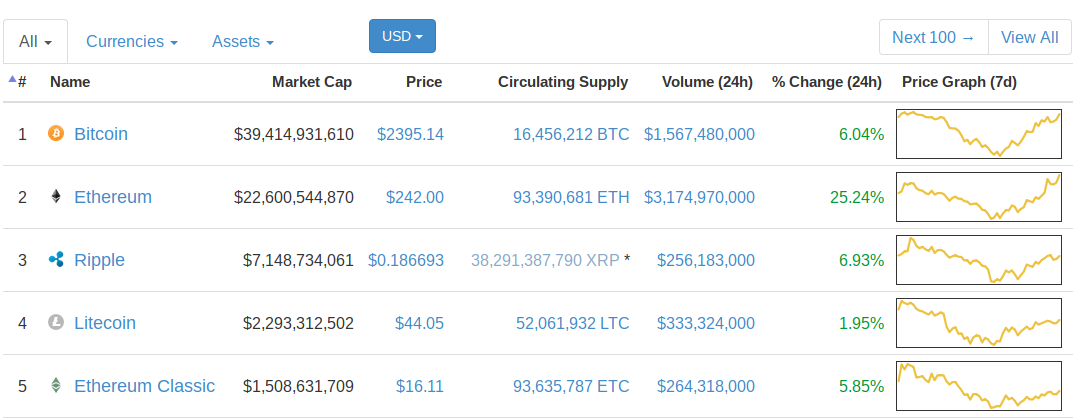

Bitcoin has rebound to $2,400 and Ethereum is up 25 percent in a day as optimism returns to cryptocurrency markets in a big way.

The shift into the green coincides with reaching the required consensus for BIP 91 to lock in for Bitcoin. This paves the way for SegWit activation without the need for a hard fork.

Meanwhile, Ethereum has recovered spectacularly from last week’s seismic losses, currently trading at an average of $242 according to Coinmarketcap.

Reacting to the price performances, traders and commentators alike were buoyant.

Coincidence? Perhaps. Or perhaps the Bitcoin market is speaking. pic.twitter.com/n2s7U9G6jW

— Jameson Lopp (@lopp) July 18, 2017

Bitcoin had been tipped to decrease further in the run-up to Aug. 1, the date when the likeliness of a hard fork occurring would become clear.

Despite the overwhelming support for BIP 91, however, business are still announcing preparations for mitigating against problems arising from a hard fork.

13 Japanese exchanges have now joined Chinese heavyweight OKCoin in announcing they will halt trading from July 31 to protect users from the possible fallout.

“...We have decided to suspend withdrawals and deposits at each exchange until the issue surrounding the Bitcoin fork is resolved,” a statement from the umbrella Japan Cryptocurrency Business Association confirmed.