The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The market data is provided by the HitBTC exchange.

After the clampdown in China and South Korea to cryptocurrency trading, there were fears that the US will also follow suit.

However, the testimony of Jay Clayton, chairman of the Securities and Exchange Commission (SEC) and Christopher Giancarlo, chairman of the Commodity Futures Trading Commission (CFTC) has allayed these fears.

They were much more realistic and supportive of cryptocurrencies than what the market had expected. As a result, most cryptocurrencies are currently in a sharp pullback, after days of weakness.

Even after the recent plunge, some analysts believe that the cryptocurrencies will enter into a strong bull market that is forecast to be at least as strong as 2017.

Let’s see if we can find signs of bullishness in the top cryptocurrencies by market capitalization.

BTC/USD

We had previously recommended buying Bitcoin in the range of $5,500 to $5,800 on panic selling. It came close to our buy level, but did not reach there. It bottomed out on February 6 at $6,075.04.

The cryptocurrency is finding buyers at lower levels who are using the sharp plunge in prices to buy for the long-term.

So, is the downtrend over or will the market resume its fall after a short pullback?

During a strong downtrend, a 1 to 3-day pullback can be expected. The counter-trend move usually faces selling at the 20-day EMA or at previous supports, which now act as resistance.

The BTC/USD pair is likely to face resistance at $9,500, which was the high on February 3. Above this, a move to $9,920 can’t be ruled out, but we expect the range of $9,920 to $10,700 to act as a strong resistance.

We believe that the cryptocurrency will turn down from one of the above-mentioned levels. If the retest of the lows is successful, we may add long positions for the long-term.

If the lows break, we’ll have to wait for a few more days.

ETH/USD

In our previous analysis, we expected a strong support at the $611.34 to $640 zone. Ethereum bottomed out at $565.54 on February 6.

This pullback is likely to face resistance at the current levels. If the ETH/USD pair breaks out of the downtrend line, we might see a rally towards the $967 levels, where both the 20-day EMA and the 50-day SMA converge. We anticipate a turnaround from one of these levels.

If the next downward trend takes support between $770 to $640, it will indicate a bottom. However, if the bears breakdown below $565, a fall to $390 can’t be ruled out, but we consider this unlikely.

BCH/USD

Bitcoin Cash bottomed out at $778.2021, just below the critical support of $854. However, the pullback from the lows does not instill confidence.

After the steep decline, we believe that the BCH/USD pair will enter a period of consolidation before embarking on an upward trend. The current pullback is likely to face resistance between $1150 and $1325 levels, from the 20-day EMA and the downtrend line.

We should turn bullish in the long-term only on a sustained move above the downtrend line.

XRP/USD

Ripple broke below its critical support of $0.61, but quickly recovered from $0.5627 levels. The pullback might face resistance at the previous support of $0.87.

Above this, the XRP/USD pair will face a strong resistance at the downtrend line. We’ll look to buy if the downward trend finds support between $0.87 and $0.61 levels.

XLM/USD

Stellar broke below the $0.296 critical support on February 6, but it did not fall to the support line of the descending channel.

Similar to the other cryptocurrencies, the XLM/USD pair is currently in a pullback, which will probably face resistance at $0.41; this level was previously acting as strong support.

We may have a positive outlook on Stellar once it breaks out and sustains above the descending channel.

LTC/USD

We mentioned in our previous analysis that the recovery in Litecoin was stronger than other cryptocurrencies. While the other cryptocurrencies broke to new lows on February 6, the LTC/USD pair held on to its February 2 lows, which is a sign of strength.

If the recovery breaks out of $175, it will indicate a double bottom in the short-term, which gives it an upside target objective of $243.

At the same time, the cryptocurrency has a slew of overhead resistances between $168 and $185. Hence, we anticipate a few days of range bound action between $107 and $175.

We recommend looking to buy once the pair moves above $185.

XEM/USD

NEM fell to a low of $0.36476 on February 6, close to the critical support of $0.31672.

Currently, it is close to the downtrend line, which will probably offer strong resistance. The downtrend will be over once the XEM/USD pair sustains above the downtrend line. We recommend waiting for a buy setup to form before making any purchases.

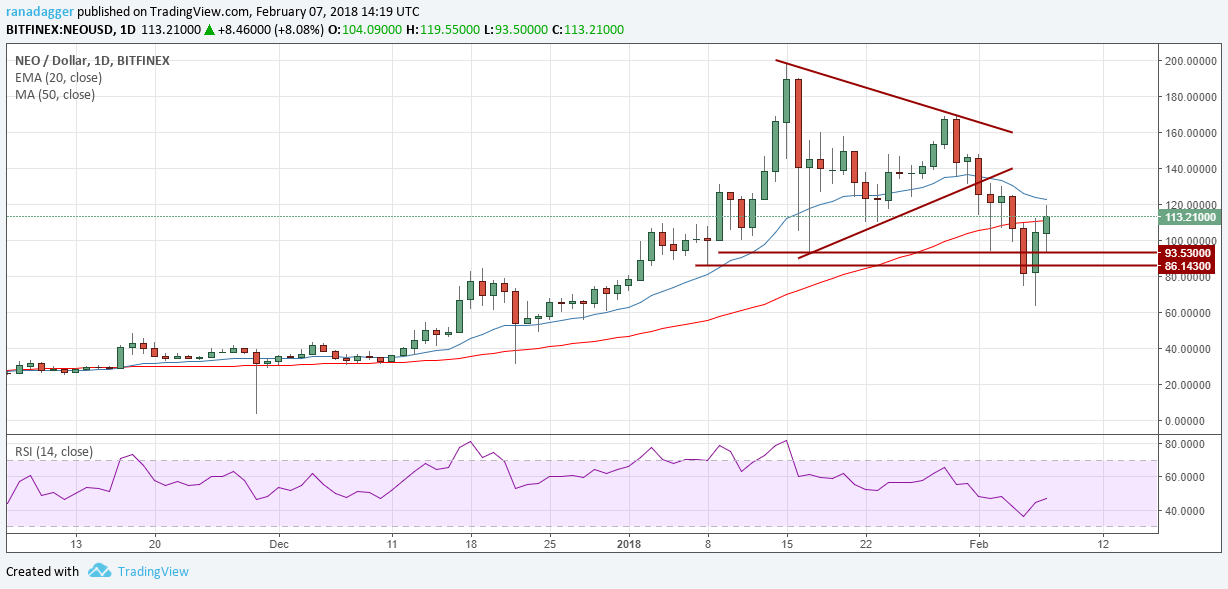

NEO/USD

We had forecast NEO to fall to $64.83 levels in our previous analysis and on February 6, it bottomed out at $63.62.

NEO has seen one of the sharpest pullbacks among the top cryptocurrencies. Still, it can face resistance between $111 and $123, from the moving averages.

We’d better wait for the NEO/USD pair to hold above the $93 levels in the next leg down to start purchasing it.

EOS/USD

We had forecast that the $6.5 to $7.4 zone will act as strong support, and on February 6, EOS bottomed out at $5.7917.

Right now it is trading inside a tight descending channel. If it breaks out of the resistance line of the channel, it’ll possibly rally to the $10.7 levels, where both moving averages converge.

If the EOS/USD pair holds above $7.5 levels in the next fall, we may place purchase orders.

The market data is provided by the HitBTC exchange; the charts for the analysis are provided by TradingView.