Note From the Author: Please follow me on Twitter (@Tone_LLT) for additional updates to the state of Bitcoin’s price volatility

Last Week’s Review

In last week’s post we concluded with the following statement:

We are as neutral across the board as can be, with the Long-term chart looking borderline Bearish once again. What looked like a great buying opportunity and continuation of momentum from early October has fizzled away. There are definitely positives to point to in that the demand in early October was something we have not seen in 6 months and if we turn right here at these US$330-340 support levels we should have established that textbook higher low that we were hopping for prior to the move up to US$420. The ideal course of action right now might be to just wait and see if this week’s lows are here to stay.

Since we are calling the current conditions 50/50, here is what to watch for in no particular order:

Bearish: A fall bellow the US$340 will likely bring about lower prices. Support levels under that are $330, $300 and the US$265-275 zone… don’t even want to think about what happens below that.

Bullish: The first small hurdle is the US$363-$365 area that has been touched on two small rebounds this past week. Once that is broken to the upside some momentum should set in and the next level of resistance is the US$385-400 zone where we got stuck for almost an entire week. Breaking that takes us to new highs at the US$440-450 resistance zone

Last Sunday we were completely 50/50 as to which direction the price would go. We identified a range between US$340 and US$363 and concluded that if one of these lines ware to be crossed, there would be a continuation of the move. On October 29, we fell bellow US$340 and even though there was a small rebound the next day from US$330 to US$350, it was too little too late and the prices proceeded to fall all the way to about US$315 soon after. This move has left Bitcoin’s price in a very vulnerable position as some are now beginning to lose confidence as to whether this technological experiment going into it’s 6 year would be the revolution early adopters expected.

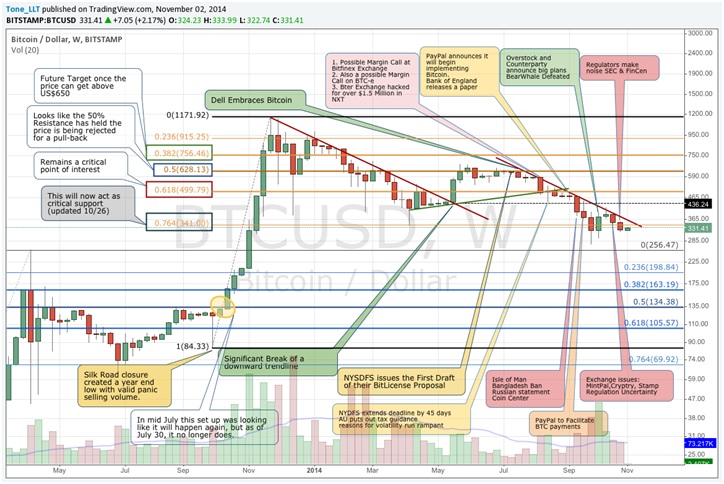

Let’s take a look at the long-term chart, which after a very promising 2 weeks with buying volume not seen since the 2013 days, has once again resumed its Bearish trend.

Last week we reserved one additional week to allow some hope for the price to appreciate a bit, but once US$340 support was lost, the Long-Term view was once again considered Bearish. At this point there is not much technical support left that is going to keep it from crossing under US$300. The only positive still left to consider is that a lot of big players got in when the price dipped about a month ago and if some of them sold a bit for profit they might buy big again just above US$300 in order to keep their earlier position in the money.

On the flip side however, some of those big players might consider taking whatever profit they can get right here just above US$300 so that all that effort spent tacking down the BearWhale does not come at a loss. If that turns out to be the case, Bitcoin can drop under US$300 quickly and then accelerate the fall into the mid US$200

US$340 support was lost, the Long-Term view was once again considered Bearish. At this point there is not much technical support left that is going to keep it from crossing under US$300. The only positive still left to consider is that a lot of big players got in when the price dipped about a month ago and if some of them sold a bit for profit they might buy big again just above US$300 in order to keep their earlier position in the money.

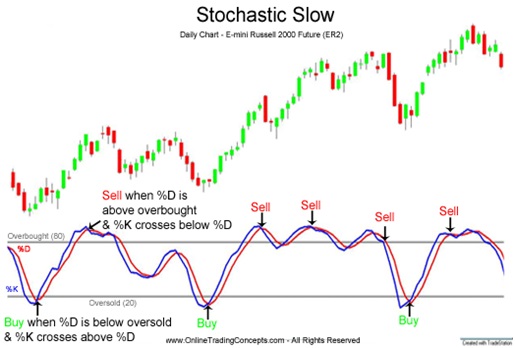

Education (Indicators pt. III - Stochastics)

Stochastics (ex: Full, Slow, Fast) is the last indicator we will cover in this series for now, but readers are also encouraged to look at other popular indicators like ADX & CCI out of perhaps hundreds out there.

The most common uses of Stochastics are also to identify overbought oversold conditions as well as indications of momentum. As always we point the education to Chart School on StockCharts.com though many other sources explain this well. The concepts are very similar to the other indicators explained in prior weeks and just like those, this one can also be used to spot divergence.

Fundamentals & News

This week’s news was dominated buy all things and people that do not actually contribute to Bitcoin’s Fundamental Factors. Here are the usual roundups that this analysis never misses to close out the week.

- Cointelegraph Weekly Roundup by Armand Tanzarian

- Bitcoin News Roundup by Bitsmith on TheCoinsman

- Weekly News Roundup by Brave New Coin

It is probably best to start from the top though it will end with another rant on regulation, which is one of the reason the price of bitcoins are down, but of course this is all speculation and opinion. It is impossible to quantify physiological mass trends that result from Government interference in the free market.

FinCEN has released additional guidance to make it perfectly clear that if you operate any kind of business that facilitates the movement of bitcoins you are breaking the law unless you get the proper paperwork, which in turn deputizes the company for being a financial policeman.

The bigger regulatory capture event came from the rumor that the SEC has sent out probing letter to every company involved in any kind of activity they deem a security offering. The saddest part of course is that if the rumors are true then these letters came with a gag order, which is another brilliant example of the United States attempt to be transparent.

The IRS of course has been quiet lately but it’s not expected to stay that way; they will go for their pound of flesh from these companies when they realize no one in possession of their own private key’s is going to volunteer sending anything their way. Ironically enough we have not yet heard from the CFTC even thought right now it’s the trading that is driving a significant part of volatility and if you ask any trader what Bitcoin reminds them off, the immediate answer would be “Commodity.”

Speaking of private key’s, it was nice of Coinbase to finally provide people with control over their own funds by instituting a multi-sig wallet, but for privacy advocates this move might be too little to late to remove the stigma of full identification of the Bitcoin users for enforcement agencies. Yes this is a primitive view that 99% of the people do not agree with, but when the economy turns down in the near future and all Socialist leaning Governments from EU to North America cannot sell their debt to foreign nations, the Hunt for Cash will be on, so this analyst will ask the readers again:

“Do you know where the Private Key to your savings is? And how many agencies feel it’s their right to take this Private Key?”

The revolving door is starting to emerge between major tech players in the Bitcoin space and regulators as a former SEC chairman joins two organizations. This may seem like a necessary move, but that’s because we are still living in a world where Politics (& Regulation) supersedes technology. A recent statement by Jim Harper of the Bitcoin Foundation indicates just that: “you don’t want everyone to start a Bitcoin business.” This of course makes perfect sense since it appears anyone can simply start a Bitcoin Organization to then dictate who can or can’t participate within the ecosystem.

Contrary to popular belief of Bitcoin needing regulation, all the news above is Bitcoin Price negative. There were also reports about attempts to peg Bitcoin to the US Dollar and a common one we have not seen in a while about a need for a central bank. Current systems of Government and Regulators are incompetent at best and the more Bitcoin integrates into the current fiat financial system the bigger the risk in another 2008 crisis scenario.

Yes it’s possible that some time next year price will go to the moon as all these small bitcoin companies are shutting down due to unaffordable lawyer and compliance fees and big financials can pick up the pieces. However, in that scenario, current governments get their wish of a global digital currency of which every ‘satoshi’ is monitored while all the recent computer science graduates looking for work are being scared out of the ecosystem.

Encouragement of the Week: Comes to us once again from Japan as their Central Bank is ready to Buy Every new Bond the Government Issues. Stories like this are very encouraging because it starts with countries not trusting each other to buy debt then the people will stop believing in it as well, as they finally sit down in front of a search engine and educate themselves on a bitter financial system. Regular readers will know that the tide is turning when someone they don’t expect calls them and asks them for help acquiring their first bitcoins.

Daily Overview

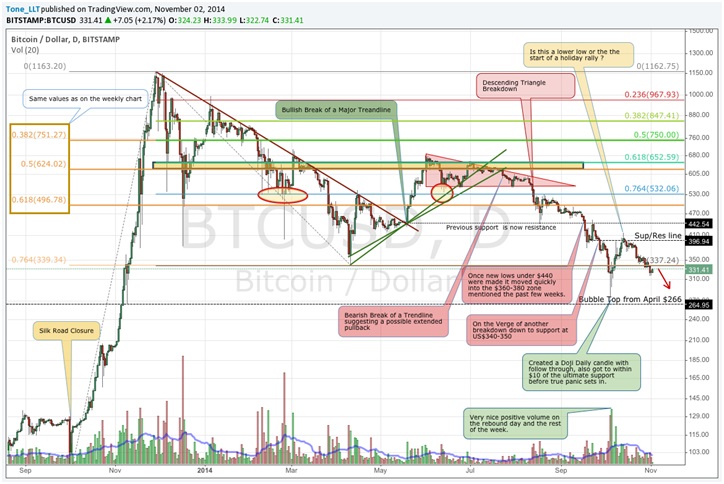

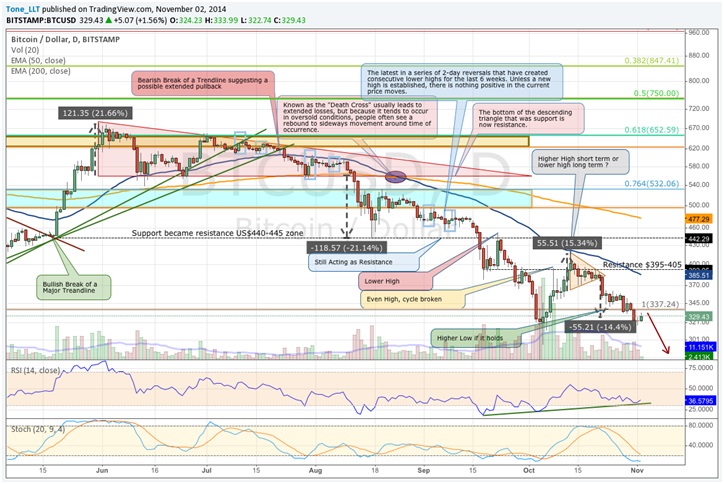

Here is our 1-year Daily chart still referencing Fibonacci Retracements and a few Trend Lines broken back in July:

This chart has once again deteriorated into a full bearish look. Had the price stayed above US$330 there would be more hope, but looking at it here in the US$320’s having already put in a low in the teens, there really is NO technical support and it can really take a dive any day. Some minor support stands just above US$300 and if we go under all we can do is hope that enough people consider prices low enough to load up.

Bitcoin is in a very tough state right now because all of those that got into it for moral reasons to prove a point (or those looking to circumvent certain law) are already in and it’s a question of what will drive the average user so traders do not have such an influence on the price swings. Right now those new users entering the ecosystem are few and far between and with the price dropping, it’s actually even harder to convince them to jump on board.

The Shorter-term chart might be showing a little sign of life, but the upside at the moment is very limited. At best we would look for a move back to US$340 with additional resistance around US$380 and the down sloping 50 day SMA. Downside is much more open with only US$300-308 minor support and then it’s free and clear to the US$265-275 zone for a possible double bottom and matching the price reached during the April 2013 exponential rise.

Readers should also not forget the global news during that time. Those were the days when the Cyprus banking system shut down and wealth was confiscated, or in Bitcoin Analysis speak: “the best case scenario.” We do not recommend people run out and buy bitcoins now, but as the famous saying goes: “rather have it and not need it, then need it and not have it.”

Conclusion

We have now turned Bearish across all time frames. Until proven otherwise any bounce is expected to just be new lower high until we can get back above US$420. What we thought was a nice positive move on amazing volume a month ago that took us from US$275 to US$420 was not enough to get the masses on board. A reasonable bounce to $340 is very possible but we are now looking for prices to reach low US$300’s and if that support goes, there is not much holding it up until we match 2014 lows in the US$265-275 zone.

We will also remain diligent of the following situation:

Bearish: As if our primary view was not negative enough we are now looking at possibilities of where a reversal is most likely if we fall below US$265. We will discuss this next week if the price does fall from current levels.

Bullish: This will be a tall order; all the resistance mentioned in the weeks prior to the BearWhale event are still there and now we are putting in more of them. First micro-sign of a reversal is a move over US$340 and staying above that value for a day or two, then the US$350-360 zone, US$385, US$400 and US$420. So until all of those are behind us, the overall trend remains down.

Reference Point: Sunday Nov 2nd 11:30 pm ET, Bitstamp Price US$330

About the author

Tone Vays is a 10 year veteran of Wall Street working for the likes of JP Morgan Chase and Bear Sterns within their Asset Management divisions. Trading experience includes Equities, Options, Futures and more recently Crypto-Currencies. He is a Bitcoin believer who frequently helps run the live exchange (Satoshi Square) at the NYC Bitcoin Center and more recently started speaking at Bitcoin Conferences world wide. He also runs his own personal blog called LibertyLifeTrail.

Disclaimer: Articles regarding the potential movement in crypto-currency prices are not to be treated as trading advice. Neither Cointelegraph nor the Author assumes responsibility for any trade losses as the final decision on trade execution lies with the reader. Always remember that only those in possession of the private keys are in control of the money