Note from the Author: Please see (@Tone_LLT) for more timely updates throughout next week on price developments and latest charts.

Last Week’s Review

Last Week we concluded with the following:

Because just 14 months ago the price of a bitcoin was around US$100, the long term chart is still showing tiny signs that a reversal can come any week so we have to remain slightly bullish on that time frame. On the other hand, there is nothing positive to point to technically or fundamentally on a daily level. Demand from people going out and understanding Bitcoin along with buying a few to just to try remains pretty week. The daily price chart reflects this, so as much as we want to say that US$300 will hold the price up, the probabilities are saying otherwise. We are expecting for the price to fall back to US$300 and most likely hit our US$290 target before the start of the new year.

Two scenarios in order of higher probabilities

Bearish: In case the US$290 support breaks, we would be looking for the US$265-275 zone to create a double bottom with the yearly lows and also to match the bubble top of April 2013.

Bullish: There is some room for an immediate bounce right here to take us back to US$340 or even US$355 which is the area of the 50-day moving average. Getting there will most likely present a selling opportunity and only above those levels will we consider looking for additional bullish targets.

We were very bearish headed into this past week and rightly so, as stated in the bullish case, there was a possibility of a small bounce from US$320 to $340 (and perhaps a bit more) but it was to be seen as a selling opportunity. The bounce took us up only to US$335 before the selling resumed. There was one additional bounce on the heals of the Bitcoin Bowl which many like myself were expecting to have some more legs in the move, but even that was not meant to be. At the moment we are almost at the exact same place we were a week ago, but due to the week bounces constantly creating lower highs, last week’s bearish conditions have deteriorated even more.

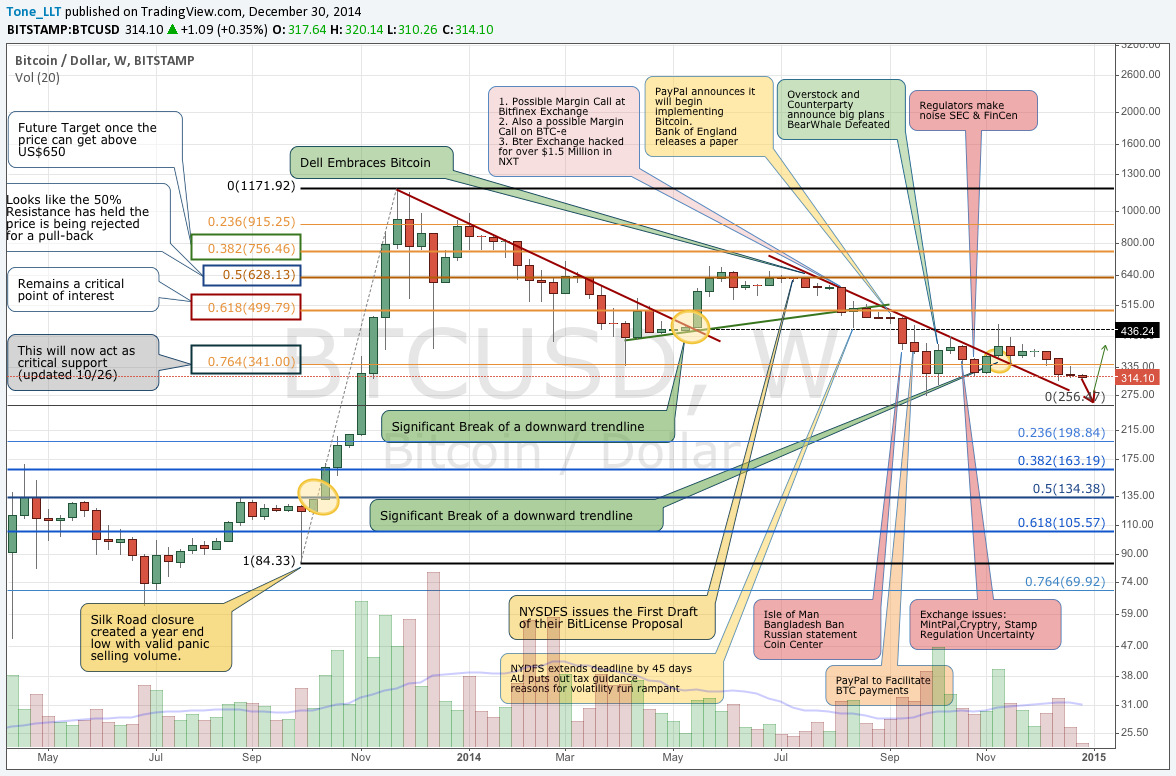

As usual we will look at the weekly chart, which is the only one left where we can point to some positive signs.

This past week was not as volatile as weeks past, which in normal circumstances is a good sign, but it was the 3rd week in a row where we finished the week lower than when it opened. We are still staying above the downward trend line, though if we are to hit it again before bouncing off, it would have to take place around the US$275 mark. The reason why we say this is our only bright spot is because of the unbelievable 100 times appreciation Bitcoin experienced in 2013, rising from around $13 to a high of over $1200 on Mt. Gox, which was still the dominant exchange at the time.

Because of this massive appreciation, Bitcoin would probably have to fall below US$200 before it would technically be considered as being on a long-term downward trend. Of course that would be very dangerous for the industry so let’s hope it does not come to that. In the meantime, as long as the 2014 low of US$275 holds, we are hopeful for a bounce any moment to maintain the long-term Bullish trend. As you will see later however, the daily charts are painting a completely different picture.

Fundamentals & News

Not that much took place this past week, though as usual we present 3 good round-ups for those too busy to keep up with it all:

- Cointelegraph Weekly Roundup by Armand Tanzarian

- Bitcoin News Roundup by Bitsmith on TheCoinsman

- Weekly News Roundup by Brave New Coin

This being the holiday, the only major buzz seemed to surround the Bitcoin Bowl. BitPay did a great job with the event and probably for the first time since most of us were kids, we were watching an event for the commercials as much as the event itself. Even the Supper Bowl commercials are loosing their luster, but there is always hope BitPay has some money in the budget to sneak one in there. Not sure how many readers remember the story of GoDaddy.com, but it sure worked for them about 10 years ago. Now that so many publications are proclaiming Bitcoin to be the worst investment of 2014 or ‘dead’ (Bloomberg, Quartz, Time) an unexpected catalyst is due to arrive in the very near future.

The only other topic worth mentioning is the conversation started by the following article: Coinbase is Tracking How Users Spend Their Bitcoins. To avoid additional controversy let’s begin by saying that everything here is an ‘educated’ opinion, but anyone who needed to read that article to realize the consequences of the convenience of 3rd parties holding your private keys, has to seriously consider taking additional time to learn what Bitcoin is all about. Perhaps even more time than they spent understanding how to use it, and then the first thing they should do is to move their wealth to a safe location which in reality means as far away as possible from Coinbase, Circle, or any company with a US stamp of approval or a potential stamp of approval.

Nothing here should come as a shock to regular readers of this weekly analysis. The United States is the most powerful nation in the world and it is also broke! The world is on the verge of a major transition, but this transition will take time. What gave the United States this massive global dominance is not its military; it was its economy and this is something that has been building for the last 150 years. A lot of people are saying that China is going to take over any day, but it’s not that simple. Perhaps China will one day sit on the Iron Throne, but that will only be achieved as people around the world begin moving their wealth to China for safety reasons.

However, as the world watches the value of the dollar rise, commodity prices like gold and oil fall, and with the United States stock market making new highs almost daily along with physical assets like art and high end real estate through the roof, it should be clear where the wealthy are still looking to move their money to the US. What most don’t realize however, is that the 100+-year Socialist experiment is coming to an end. This is not the first time nor will it be the last, but in the current era it was influenced by Karl Marx and so all these government systems of Fascism, Nazism, Communism, Socialism, and whatever the United States calls itself are all just variations of ‘government knows best’ (or Marxism).

As the Socialist systems in Europe, the United States and its immediate allies like Japan and Canada realize that 90% of their financial promises cannot be met, they will start to look for revenue in places most people cannot even dream about. We will leave it up to the reader to research this trend, but the signs are everywhere, from Civil Forfeiture Laws to unbelievable fees for any fine or government mandate like a license (aka barrier to entry).

So this brings us full circle to Bitcoin. In the eyes of the Government, it creates a perfect cashless society since cash is clearly becoming a problem from a tax perspective. Even though the government cannot control Bitcoin it will do everything it can to make sure it can see everything with the priority of identifying accounts, and the only way companies like Coinbase or Circle have a chance to exist is to fully comply with laws.

Every single law in relation to currency is only there for one single purpose: maximizing revenue for the government, and yes campaign contributions from the financial sector are part of it. Eventually this will lead to the downfall of this socialist system across the glob, but for now anyone in possession of bitcoins has to be extremely careful of how and where they spend them and, even more importantly, how they are acquiring them. When the hunt for revenue at all costs crosses your government identity, will you be ready? If only you and those you trust with your life know how many bitcoins you have stashed away, then you are, otherwise you are not.

“For the first time in this digital world, we are given the power to control our own wealth, but only those who control their own private keys are taking advantage of this ability. Do you know where your wealth is?”

- Tone Vays

2014 Year in Review

2014 has been a very interesting year for Bitcoin. Good detailed overviews can be found in the following 3-part series with the last to be released shortly.

Bitcoin Review 2014 Part I: Price and Commercial Activity

Bitcoin Review 2014 Part II: VC Investment and Regulatory Environment

Bitcoin Review 2014 Part III: Media Presence and Technological Climate

All in all, 2014 will probably go down as the year of merchant adoption. In a sharp contrast to 2013 when many were trying to buy bitcoins and having to constantly hear “so what are you going to do with them”, 2014 was quite the opposite. With notable names like Expedia, Dell, Dish Network, Microsoft, Time Inc. and many more now accepting bitcoins as payment, it is now easier to convince your friends and family that this is a significantly better form of payment on every level.

As explained in the section above, there are not a lot of free market thinkers left in the western world and clearly those that are have already embraced Bitcoin and what it stands for. 2015 will be a challenge to how to get the common people interested, even if it goes against their dependence on government-issued currencies and subsidies.

2014 can also be described as the year regulators took notice. The Charlie Shrem situation is beyond unfortunate and many should also realize that even though he was one of the first to get in serious trouble, he certainly won’t be the last. Ross Ulbricht will have his day in court soon so we will have more information to gage the Bitcoin temperature in the room. As for now most are still in a wait and see mode and as the wheels of bureaucracy continue to move at a slower pace every year, the Blockchain technology is sure to pass them by as many of us hope.

The price drop of over 60% this year is of course a disappointment but there are bright spots on the horizon. For one, it’s been another year of Blockchain stability without any major incidents or forks. The apocalyptic 51% attack had come and gone without even a hint that miners who spent incredible amounts of capital to secure the network would then use this computing power to destroy it. The number of transactions is still going up which means that people are still entering the system. But most importantly, all you need to do is talk to those that have joined the Bitcoin ecosystem in the last few years. Unless they happen to have spent all their disposable fiat when bitcoins were going for US$600-800, you will never get a fiat-to-Bitcoin convert to go back. Even if you talk to a person that lost every Satoshi at Mt. Gox, they are either already back in or looking to get back in any day. Once a person gets their bitcoins with the intention of using them in transaction, even as the price goes down a little bit, they are hooked. It is literally like handing someone a computer and letting them type an email to a friend then hearing them say “you know, I think I’ll just go back to writing letters by hand, only 2 people I know will ever read my email so what’s the point”. That just does not happen and until it does, the future for Bitcoin and other cryptos will remain bright.

For the sake of time-spent reading, we will talk about Bitcoin 2.0 another day. Next week, we will look into next year and what are the most likely scenarios in terms of adoption.

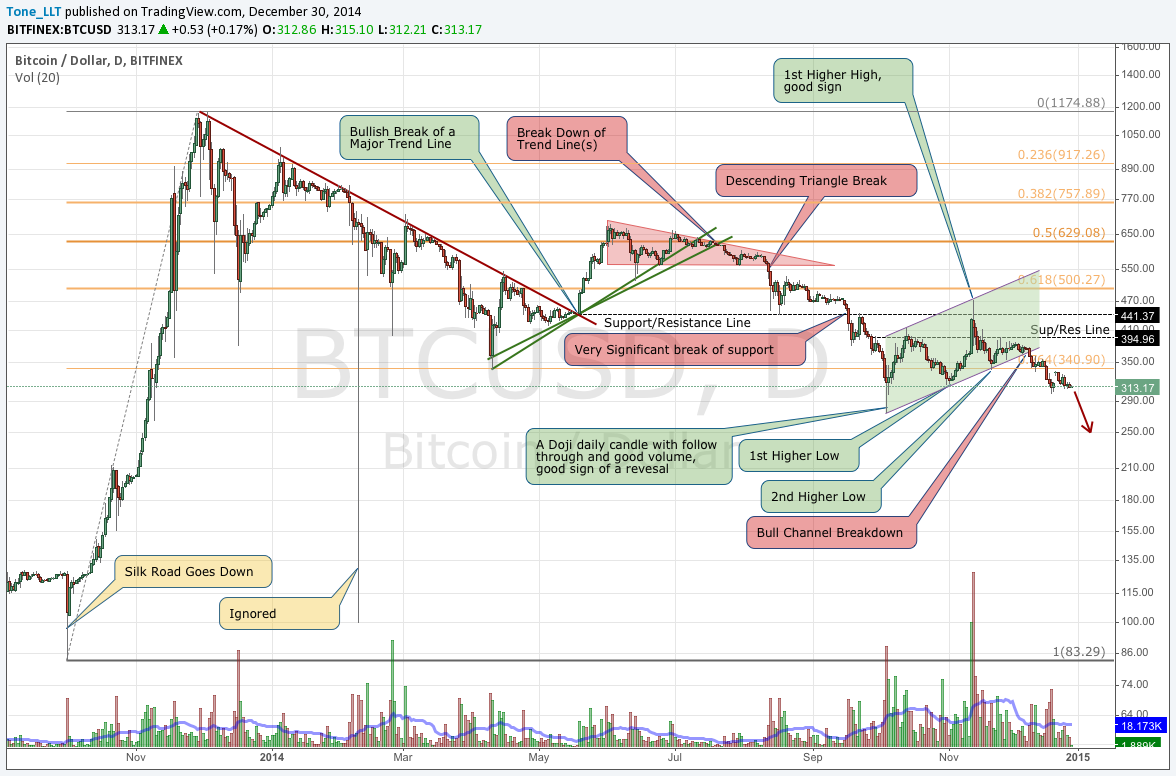

Daily Overview

As you will see, the daily charts have been switched to Bitfinex. For some time now it has been the more liquid exchange and seems to be the big driver of price. There were some irregularities in the pricing earlier in the year, which will be ignored. The charts are also a bit cleaner with comments since they had to be redone from scratch.

The breakdown of the bullish channel is now fully certain and is no longer in danger of being a bear trap. It’s not indicated on the chart, but if we take the difference between the two parallel lines (US$125) and subtract it from the point of the breakdown around US$375 we get a potential target of US$250. Usually there are several arrows on this chart which display a less likely scenario, which tends to be the complete opposite or at least some temporary move in the opposite direction. This week, there is nothing in this technical chart that is remotely suggesting increased prices. In fact there is a little worry that this might not get published in time before the breakdown since it’s already being written one day later than usual. The only positive thing to look for technically is the fact that when something looks completely obvious, the trading gods (or devils) have a tendency to make fools out of the slickest of chartists.

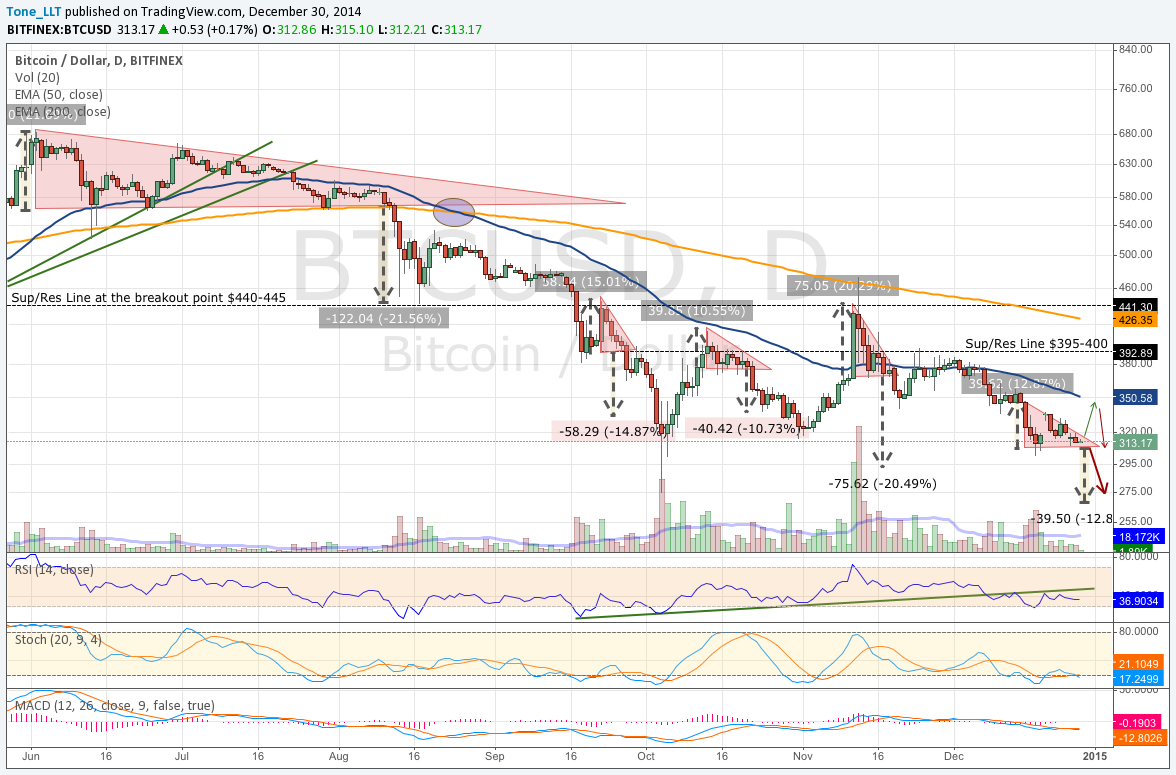

The short-term zoomed-in view is showing more distinct patterns. It’s starting to get very difficult to fit all of those Descending Triangles in, and up to this point almost all the targets have been hit. The most recent target from the triangle in mid-November pointed to a target of about US$290 and we came up just short of that a week ago. As of yesterday, another descending triangle has formed and this one is suggesting a target of around US$270. On this chart we give a little room for the possibility of this triangle breaking out to the upside and if it does the odds favor the up move to stop at the 50-day SMA currently around US$350. Descending triangles tend to break down only 66% of the time and all 4 previous ones drawn had done so hence we are really starting to push our statistical odds. Not to mention there is at least one additional descending triangle we could have drawn in Aug-Sep now that we have switched the source of the charts.

Conclusion:

While we acknowledge the fact that Bitcoin has made it so far in the last several years that if you had bought it 2 years ago and just now decided to take a look at the price, you are extremely happy, and it’s the only reason we remain long-term optimistic. As for the daily charts, everything is looking like an imminent collapse under US$300 reaching a target suggested in mid-November of US$290 (Even thought this analyst took this target off the table in late November when we started closing above the 50-day SMA). The additional target as of today is in the US$270-275 range which will match the 2014 lows and the highs set during the Cyprus crisis back in April 2013.

Two scenarios in order of higher probabilities

Bearish: Even though the primary case is already pretty bearish, we have to pay attention to a complete and utter disaster at this point. The breakdown of the bullish channel that was developing for several months is calling for a lower target of US$250 and if we go into that zone, there is no support and we can see US$200 or lower in the blink of an eye as panic selling sets in.

Bullish: Not much to cling to here, but we will consider a breakout back to the US$350 area as a possibility. It will not be anything to write home about and will most likely present a selling opportunity as it meets the 50-day SMA resistance. One other thing to pray for as mentioned earlier, is the possibility of the market doing the opposite of what is blatantly obvious in the charts. Hence if everything is saying it should collapse any day, it might look this way because everyone has already sold and there is no one left to drive it lower.

Reference Point: Tuesday Dec 30 1:00 am ET, Bitfinex Price US$315

About the author

Tone Vays is a 10 year veteran of Wall Street working for the likes of JP Morgan Chase and Bear Sterns within their Asset Management divisions. Trading experience includes Equities, Options, Futures and more recently Crypto-Currencies. He is a Bitcoin believer who frequently helps run the live exchange (Satoshi Square) at the NYC Bitcoin Center and more recently started speaking at Bitcoin Conferences world wide. He also runs his own personal blog called LibertyLifeTrail.

Disclaimer: Articles regarding the potential movement in crypto-currency prices are not to be treated as trading advice. Neither Cointelegraph nor the Author assumes responsibility for any trade losses as the final decision on trade execution lies with the reader. Always remember that only those in possession of the private keys are in control of the money.

Did you enjoy this article? You may also be interested in reading these ones: