European leaders seem to have finally come to a consensus that the innovative technology underlying crypto-assets “has the potential to improve efficiency and inclusiveness of the financial system and economy more broadly,” as emphasized at the G20 summit in Argentina in March 2018.

However, when it comes to regulation, the lack of consensus among global leaders made it impossible to enact broad legislation. Various European representatives pushed for coordinated legislation to restrict cryptocurrencies during the G20 summit with no success. Instead, there was agreement to set a July 2018 deadline for regulatory proposals.

The hang-up over regulation may be due to governments and financial leaders recognizing that legislation will only be effective if pursued as a joint venture with other European countries.

Government organizations, politicians, regulators, and central banks that were present at the gathering discussed the instability of cryptocurrency markets and the potential for criminal activity. But the major developments to come from the summit were the characterization of crypto-holdings as property for tax purposes; required compliance of crypto firms with standards set by the Financial Action Task Force (FATF); and, of course, the July deadline.

Most nations initially understated the potential of Bitcoin and allowed cryptocurrency activity with little resistance, but now governments are taking a second look at how cryptocurrency and Blockchain tech will affect future labor markets, digital infrastructure, and financial institutions.

Many countries may be moving to regulate and restrict cryptocurrency use, but European financial actors are also leading the research and development of Blockchain tech in preparation for institutional and mainstream adoption of virtual marketplaces.

The vice president of the European Commission recently urged EU countries to be politically and financially supportive of developing Blockchain tech because “Europe is best positioned to play a leading role.” The Commission proposed a 23-point action plan to integrate the development of Blockchain with the financial sector around the same time it proposed two new digital tax rules at the G20 summit last month.

Similar to the US based R3 consortium, the European Central Bank has experimented with the potential use of distributed ledger technology as a securities settlement mechanism since December 2016. Switzerland and Netherlands based financial groups have since successfully used R3’s Corda platform to transfer nearly $30 bln in securities, proving its commercial utility.

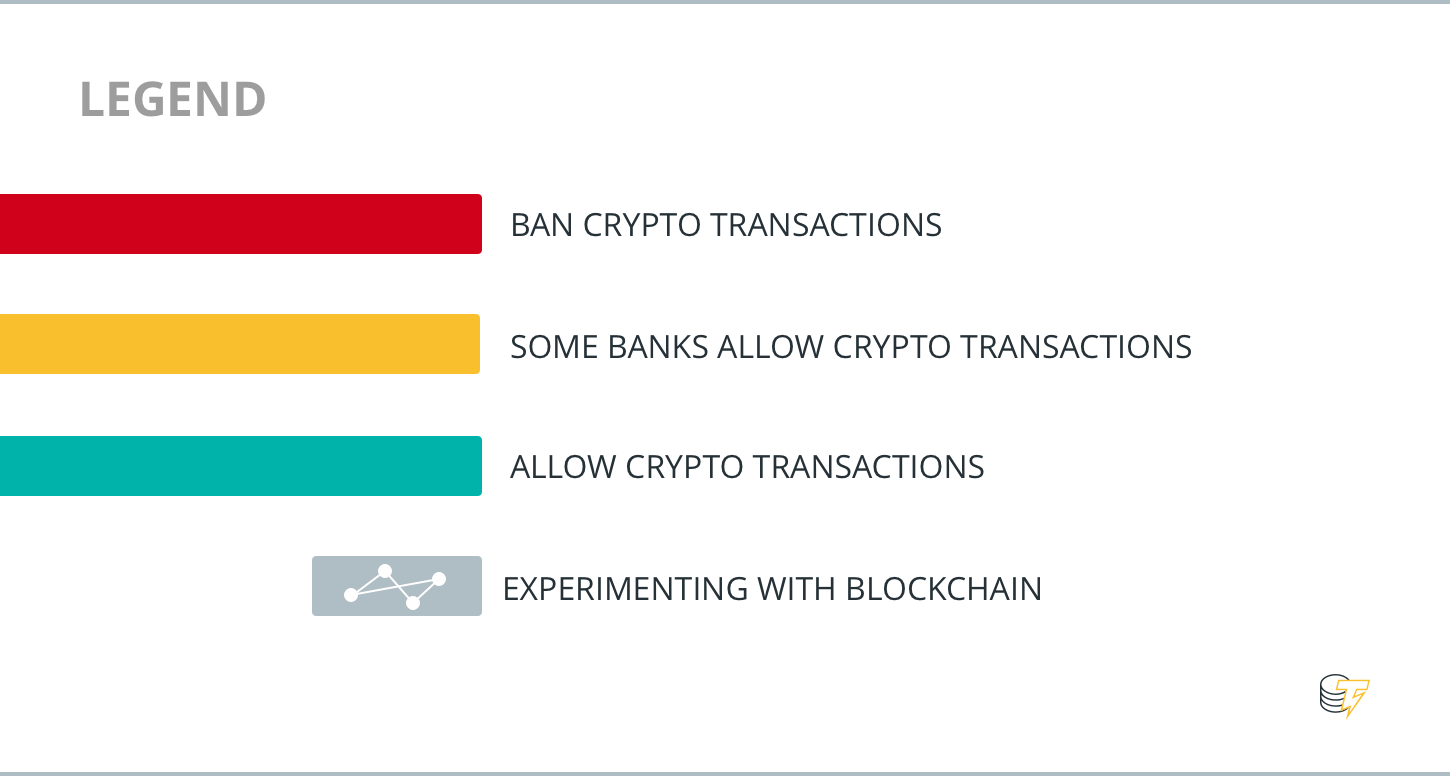

The list below is based on thorough news research, but should in no way be considered complete. If you have more detailed information on banks and the crypto relationship in your country, we encourage you to share it in the comment section.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The U.K.

The UK Treasury established a cryptocurrency task force in March that aims to mirror the regulatory action of the US Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC). The task force, which comprises the Bank of England and the Financial Conduct Authority (FCA), is part of a larger strategy to facilitate crypto markets in the UK, especially as the country exits the EU.

The FCA also created a global fintech sandbox in March, which aims to promote collaborative fintech regulations and initiatives among global leaders.

The FCA, Britain’s financial watchdog, requires crypto firms to apply for e-money licensing before operating in the country. The FCA is primarily concerned with ensuring that licensed firms comply with regulations. Coinbase is the first firm to be granted an e-money license to work with Barclays and plans to make fiat exchanges more accessible in Britain.

Still, many analysts believe the FCA is seeking positive regulatory changes aimed to attract cryptocurrency investors to the UK, especially if European regulators propose strict legislation for cryptocurrency markets.

Mike Carney, governor of the Bank of England, is a vocal critic of cryptocurrencies in England but says banning exchanges is not the best approach. Rather, placing regulations and standards in the market is the most effective way to protect financial institutions. Similarly, other financial actors in Britain are focusing their attention on the development of distributed ledger technology (DLT) instead of mainstream cryptocurrency adoption.

As for the banking sector, Britain’s Lloyds Banking Group and Virgin Money banned the purchase of cryptocurrency with credit cards earlier this year, following the lead of US giants JP Morgan Chase and Citigroup.

The Royal Bank of Scotland warned investors to avoid investing in Bitcoin and characterized the crypto market as a ‘frothy investment bubble.’ The bank began rejecting accounts associated with cryptocurrencies in early March.

Ireland established its own cryptocurrency, Irishcoin, in 2014, which aims to promote tourism in the country. Ireland’s Сentral Bank hasn’t presented any regulations for the market except that cryptocurrency dealings are subject to taxation as stocks and bonds under the country’s tax code.

The Central Bank of Ireland, along with other groups from the private sector, has established research groups to experiment with Blockchain tech for trading and data reporting. The Irish Computer Society and the Blockchain Association of Ireland held an informational conference in March to address legal inquiries and other relevant interests of the technical, social, and political implications of Blockchain tech in the U.K.

Russia

The Russian Ministry of Finance first proposed a digital assets regulation bill in January, which would establish regulatory procedures for the market and lend legal status to cryptocurrency.

But in more recent events, a group of Russian deputies headed by the chairman of the State Duma Committee on Financial Markets submitted a bill on March 20 that establishes a regulatory framework for cryptocurrencies and initial coin offering (ICOs).

In line with the security concerns of other nations, the bill redefines virtual currency as financial assets and only allows trading on authorized exchanges. The bill also requires compliance with the Anti-Money Laundering (AML), Know Your Customer (KYC), and Counter Terrorist Financing laws. The Russian government’s approach contrasts the Central Bank of Russia’s desire to ban ICOs and crowdfunding all together.

Though there is some division among Russians about regulation, active involvement in Blockchain tech persists. The Central Bank of Russia’s FinTech Association has experimented with its Masterchain software for cross-border financial communication with the Eurasian Economic Union. The software may potentially replace existing international payment systems.

Furthermore, it was reported that a Russian polling research center used Blockchain tech to monitor the exit polls of the presidential election last month. This is not the first instance of Blockchain involvement in electoral practices, which is seen as a push to add security and transparency to Russia’s highly contested election process.

Recent reports show that the Russian government banned nearly 20 mln users from the popular encrypted messaging app, Telegram. However, many users have been able to circumvent the block, which serves as a reminder that the government has a critical hold on the cryptocurrency industry in Russia.

France

The Bank of France proposed a ban on investment companies in March to keep financial institutions from involvement in the cryptocurrency market until proper regulations are enacted. The bank issued a report that characterized virtual exchanges as invitations for money laundering, cyber attacks, and criminal enterprises.

The Ministry of Economy created a task force earlier this year aimed at examining possible regulations for the market to address tax evasion and terrorism funding. The task force was also created to develop possible international legislation of the cryptocurrency market.

Therefore, many speculated that the task force would propose aggressive international regulations at the first meeting of the G20 summit earlier this year, but no joint declarations came from the international forum.

In an unexpected move, French financial market regulators announced a proposal for legislation outlining rules for ICOs in March. The favorable proposal is seen to encourage the use of ICOs as legitimate investment opportunities.

The French government also allows financial institutions and FinTech companies to trade securities using Blockchain platforms in an effort to compete with neighboring tech hubs London and Germany.

Finland

The promising cryptocurrency industry in Finland is being threatened by banks that refuse to conduct business with the country’s largest virtual wallet service provider, Prasos Oy.

Finnish banks are blocking transactions from major crypto-exchanges after rapid increases in transaction volume have left them concerned about their ability to determine the origins of funds and comply with AML laws due to the anonymous nature of the exchanges.

Sweden

Riksbank in Sweden is notorious for being ahead of the fintech curve. Many predict the country will be the first “cashless economy” as Riksbank revealed plans to launch its own cryptocurrency, e-krona, last November. But the Bank for International settlements (BIS) has issued a warning to central banks to reconsider the impact and unknown risks associated with the cryptocurrency market.

The report issued by BIS, however, praises distributed ledger technology and emphasizes its potential for security trading among global financial institutions.

Switzerland

Switzerland is a global hub for the cryptocurrenct industry with droves of entrepreneurs flocking to the business-friendly country every year. Four of the six biggest ICOs occurred in Switzerland, which has around 200 Blockchain companies in operation, including Ethereum.

The risks associated with unregulated ICOs was addressed by Finma, the country’s financial watchdog. Finma established regulatory guidelines for ICOs to require more transparency in their fundraising techniques.

Finma also oversees businesses compliance with AML and KYC regulations. Payment 21 was the first Bitcoin business to receive an operational license from Finma in Oct. 2017.

However, Swiss banks are divided on this issue. Some have successfully experimented with cryptocurrency products, crypto-asset management, and trading services. But two of the largest Swiss banks, UBS and Credit Suisse, remain skeptical of virtual currencies and warn customers of the volatility and scam risks associated with transactions. Still, these large banks are experimenting with Blockchain tech for scalable uses.

Liechtenstein

In early March, one of the largest family-owned private banks in the world, LGT, based in Liechtenstein, announced it will allow clients to directly invest in Bitcoin, Litecoin, Ripple, and Ether. As one of the first of their kind, the bank is pioneering scalable security and trading solutions for influential global clients.

Poland

The Polish Blockchain Technology Accelerator team operating under the Ministry of Digitalization announced the development of a national cryptocurrency, Digital PLN, in Jan. 2018. The team created a working version of the currency, but the Polish government has been slow to enact regulations that would make scalable uses of the tech feasible.

Poland recognized buying and selling Bitcoin as ‘official economic activity’ in early 2017, although crypto assets are still regarded as property under the country’s tax code. The government has waited almost a year to regulate virtual currencies under pre-existing AML laws.

Many believed the Polish government held progressive views in regard to developing the crypto industry, but it was recently discovered that the Central Bank of Poland funded anti-cryptocurrency campaigns on social media in an effort to delegitimize its use.

Italy

The Italian Treasury Department of the Ministry of Economy and Finance recently announced a decree that stipulates new reporting requirements for cryptocurrency service providers. The Ministry addressed legal concerns of service providers’ compliance with AML laws in a legislative decree in May 2017.

The decree requires any business or entity related to crypto operations to report activity to the Ministry of Economy and Finance. The Italian government’s call for transparency is seen as an effort to understand citizen engagement with cryptocurrency before the new industry impacts the national economy.

But the growing cryptocurrency industry in Italy remains virtually unhindered by government involvement. The most recent decree does not levy taxes or regulate exchanges, and businesses increasingly accept Bitcoin as payment. Furthermore, the country’s tax authority declared that the purchases of virtual currency does not generate taxable income and is not subject to capital gains taxes.

The Blockchain Education Network Italia began organizing conferences and initiatives centered around Blockchain development in 2014. The growing association is comprised of over 200 university students. An entrepreneurial initiative, BlockchainLab, has since been created to provide in-depth analysis of the technology and connect dedicated Italian researchers.

The call for more education on the new technology was answered by an Italian TV show, which garnered national attention when the show’s name, Codice, became the number one trending Italian hashtag on Twitter. The show focuses on Italian Blockchain leaders and specialists who share simplified explanations and accounts aimed to grow public awareness and acceptance of Blockchain.

In more recent events, Italian leaders have been open to experimenting with Blockchain technology. The London Stock Exchange Group announced a partnership with IBM to creating a platform for digitally issuing shares of Italian companies.

Germany

Germany was the first country to accept Bitcoin as a currency back in 2014, and officially recognized Bitcoin as a legal tender in March. Financial leaders have since hinted at international regulations for cryptocurrency, but the future of the industry in Germany remains in contention.

The German government first warned cryptocurrency investors of the volatile market and scam ICOs last November. Many speculated that Germany would approach European leaders with a unified plan for regulation at the G20 summit earlier this year. However, little progress was made at the summit where it seemed German leaders tiptoed around the topic of cryptocurrency.

While the cryptocurrency industry in Germany awaits further instruction, many operations are continuing business as usual. A subsidiary of the country’s second largest stock exchange announced plans to launch a cryptocurrency trading app, Bison, earlier this month. Bison will make trading with virtual currencies more accessible and is the first ever trading app to be backed by a traditional stock exchange.

The first volume of our Banks and Crypto Evaluation was about Asia — you can read it here.