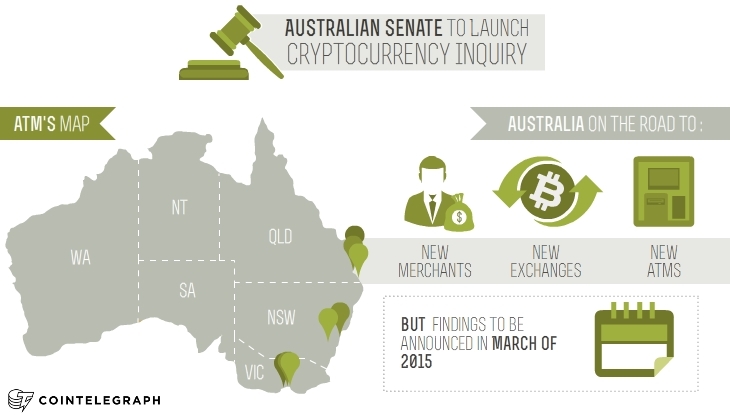

The Australian Senate has announced a hearing on virtual currencies scheduled to begin soon, with findings to be announced in March of 2015.

Not too long ago Australia seemed to be heading toward widespread Bitcoin acceptance with new accepting merchants, exchanges and Bitcoin ATMs (or BTMs) cropping up in major cities across the country.

But the mood Down Under cooled about a month ago when the Australian Tax Office (ATO) ruled that cryptocurrency earnings would be treated as “non-currency assets”, which basically means that non-commercial cryptocurrency transactions will not attract a tax bill unless they exceed the AUD$10,000 Capital Gains limit. There is a good possibility though that the Australian Senates newly announced hearing on virtual currencies that are scheduled to begin soon, with findings to be announced in March of 2015.

The hearing was spearheaded by the Senate Economic Reference Committee’s Chairman, Sam Dastyari and upon conclusion of the hearings in March, the findings will be turned over to the Parliament with its recommendations and Parliament will begin to debate and then act on the recommendations, which could take several more months. The good news is that

Australia has never been outwardly hostile to cryptocurrencies and seem to be serious about protecting all sides in the issue, including both the cryptocurrency community and traditional financial sector.

Ron Tucker, Chairman of the Australian Digital Currency Commerce Association (ADCCA), told Cointelegraph via email that he was optimistic by the newly announced hearings, stating:

“I am pleased the inquiry announced today will look at tax treatment issues, which I hope will lead to a correction of the current interpretation of Bitcoin as taxable supply”.

Tuckers concern is not necessarily for the present as current cryptocurrency penetration into the retail sector is relatively light and it is unlikely that many people would approach the AUD$10,000 limit before taxation. But Capital Gains taxes are higher than regular taxes and with wider acceptance and more people approaching and exceeding that limit it will eventually mean much higher taxes for anyone using Bitcoin, which will certainly hamper its growth. Tucker explained:

“Treating Bitcoin as a currency would benefit most consumers as they could use the technology as a medium of exchange without having to worry about GST issues. Currently a cumulative annual spend of $10,000 in Bitcoin would attract GST. Should Bitcoin be widely used as a medium of exchange in the future, $10,000 would not be a very high spending limit for most consumers in a year.”

When compared with the New York State BitLicense proposal, which requires all Bitcoin transactions to be reported by merchants, while at the same time allowing credit card companies and banks to not report transactions under US$10,000, it is obvious that there is an enormous advantage granted to legacy payment systems – it’s almost impossible to pick which one of these drafted regulations are worse for Bitcoin.

We can only hope that both the ADCCA and Senate Committee recommend fair and balanced regulations, which, in light of the Committee’s seeming fixation with protecting the interests of the financial sector, might be a struggle.

Tucker feels that the best Australian agency to oversee new regulations was AusTrac, the Australian criminal finance auditors. AusTrac is somewhat similar to the American FinCEN with the major difference being that FinCEN is part of the US Treasury Department while AusTrac is part of Australia’s Justice Department. AusTrac has said on several occasions that they do not currently consider cryptocurrencies to be a security threat, unlike many similar agencies around the world. Tucker’s reasoning is simple:

“There isn’t one single agency that could regulate digital currencies. ADCCA has engaged a number of different bodies including the Australian Taxation Office, the Australian Competition and Consumer Commission, the Australian Crime Commission, the Reserve Bank of Australia and quite a few others."

The Senate is of the same mind and considers the bigger danger of virtual currencies to the retail and banking sectors because it could “disrupt payments,” which is only partly true. While it is possible that virtual currencies could disrupt traditional payment systems, banks, wire transfer services etc., merchants will actually save large amounts because of the higher fees charged by banks and credit card companies when compared to cryptocurrencies. Alternatively, the ADCCA believes that cryptocurrencies will actually encourage innovation, entrepreneurship, which will create more jobs.

Did you enjoy this article? You may also be interested in reading these ones:

- Australia’s Tax Office Guidelines Open Door to Double Taxing, Other Problems

- Australian Tax Official: Bitcoin Could Be ‘Money’ if Growth Continues