Apple’s widely-expected announcement of mobile payments technology is a step closer to confirmation, but once it debuts, just how flexible will the advancement actually turn out?

Apple embracing mobile payments

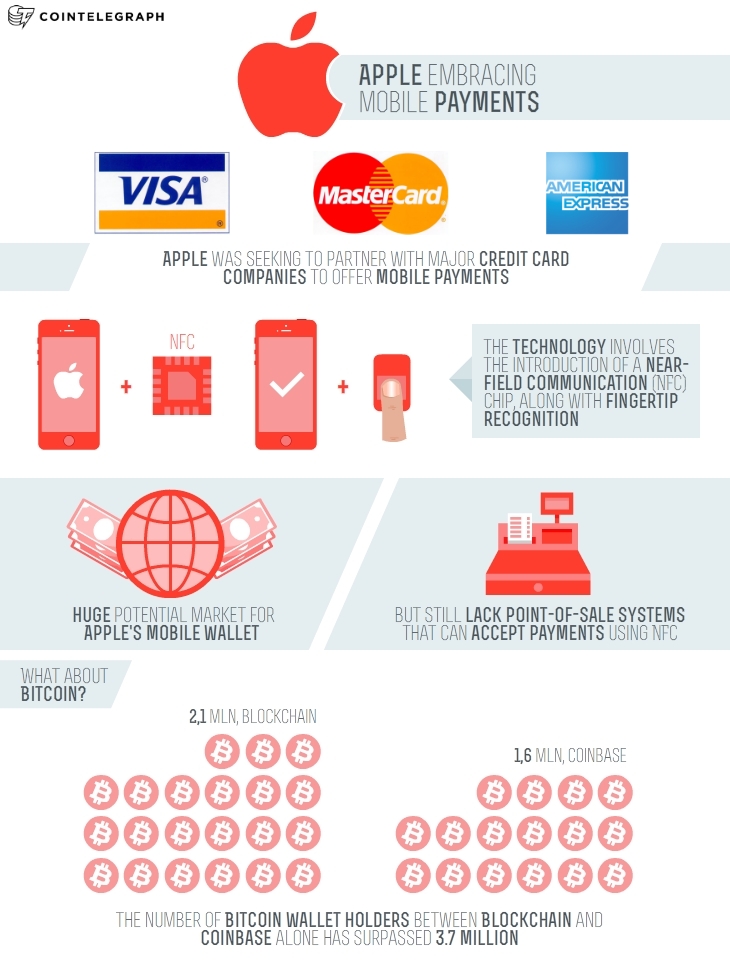

Back in July, Cointelegraph reported on widely-held speculation that Apple was seeking to partner with major credit card companies to offer mobile payments as part of its upcoming iPhone 6 release this fall. Bloomberg now writes that the proposals have been cemented, with agreements signed with Visa, MasterCard and American Express.

While details of the agreement have yet to be revealed ahead of the September 9 launch, it is known that the technology involves the introduction of a near-field communication (NFC) chip, along with fingertip recognition in order to facilitate secure contactless POS payments for iPhone users. The latter enhancement was already rolled out on the most recent iPhone release.

However, while the potential market for Apple’s mobile wallet, as it is now known, is huge, potential teething problems have already been unearthed. For example, The Verge suggests:

“Many retailers still lack point-of-sale systems that can accept payments using NFC chips built into phones, and if Apple can't convince companies to make the costly upgrades to support the new payments system, it will likely fail to catch on.”

This would be a shame indeed, as Richard Crone, chief executive officer of Crone Consulting LLC told Bloomberg that “a frequently used mobile wallet application could generate about US$300 a year per user from advertising.” Simply multiplied by the iTunes market, let alone the retail market, the potential for gain needs no explanation.

What about Bitcoin?

If its success comes down to convincing retailers to invest in “costly upgrades” in order to support the technology, however, would this likely occur at a rate fast and enthusiastic enough for the wallet to gain momentum faster than, say, Bitcoin wallets?

The equipment required to accept BTC transactions, while not free, is certainly more flexible for smaller retailers than a mainstream offering likely would be, often taking the form no more complex or costly than a standard tablet. A good example of this, aside from the major players such as Bitpay and Coinbase, is Cisonius, a processor built from the ground up by two high school students and which handles traffic just as seamlessly.

Meanwhile, the number of Bitcoin wallet holders between Blockchain.info and Coinbase alone has surpassed 3.7 million, statistics resource bitcoin pulse reports.

Meanwhile, details are slowly emerging of a suspected hacking of Apple’s iCloud resource, with 4chan users writing that compromising photographs of celebrities were taken directly from their accounts with the service, to later be offered online for cash.

The Verge reports that the service had previously come under fire for its “confusing” layout, with the publication’s editor-in-chief retweeting in May, “JLaw: "My iCloud keeps telling me to back it up, and I'm like, I don't know how to back you up. Do it yourself.”

Expert comments

To gauge the sentiments on these developments, we decided to post the following question for our community:

Apple is poised to unveil agreements with credit card companies for its mobile wallet. Given retailers would need to make costly upgrades in order to accept it, however, do you think there is scope for the equivalent Bitcoin wallet technology to make gains since it is cheaper?

CEX.IO:

“It is still not clear what their goal is. At a certain period of time they were leaning towards a decentralized currency, but now I am not quite sure. I am pretty sure we can have companies use the Bitcoin wallet, as an alternative, however Bitcoin is facing some serious regulation issues, and until they are resolved in the favor of Bitcoin - it will not go mainstream. But that is just a matter of time.”

Nathan Wosnack (CEO of CryptØMiners and CryptØYouth):

“It appears that Apple's new phone is using NFC (Near Field Communication) to allow for transactions via MasterCard, using Touch ID finger prints to add some extra layer of security.

Android Devices already allow this, and there are solutions for Bitcoin (See: here and here). The Touch ID technology is also a questionable security layer since CCC - Chaos Computer Club - security researchers out of Germany defeated this technology last year for the iPhone 5S (See: here).

So to have this on iPhone will not be that difficult I can imagine since the codebase can be simply ported over from Android to iPhone with these Bitcoin wallet services.”

Richard Boase (Contributor for CoinDesk):

"Unfortunately, The trustless Bitcoin monetary network is not a competitor to the legacy system of banks, credit card companies and their associated trust-based fiat money system which we've inherited. It is a parallel financial exo-system that 'mimics' money and behaves in a similar way to gold. The short answer to your question is, in my opinion: No. Unfortunately for Bitcoin holders, retailers cannot legally and in full confidence, adopt Bitcoin as an alternative to credit card payments using Apple's consumer offering: yet."

David Duccini (Executive Director at doabitofgood.com):

"I agree with the first part of this but not the later. Apple barely supports repudiation of their own iTunes store -- just try and get your money back sometime. If Apple can make a few bits of coin on a Cryptocurrency transaction you can bet they will.

Rumors still swirl that the iPhone 6 will have a Near Field chip in it which is really the next gen of payment platforms -- forget "chip and pin" credit cards IMHO. People are more concerned about having their phone on them then they are their wallet -- and it acts as a perfect stand in for a multi-factor authorization -- something you have (the phone), something you know (a pin or password) and something you are (your finger print)"

Juan S. Galt (Social Media Manager at Bitcoin Expo):

"All merchants need to accept Bitcoin is a web browser. If the Apple wallet and point of sale technology is more expensive than opening a website, than there's an argument for the better value of accepting Bitcoin. Not to mention credit card fees and charge back risk."

Iman Mirbloki (CEO & Founder at SpaceChain Space Program):

"Do the questions need to be asked? It's like reinventing the wheel..."

Tim Pastoor (Foundation Chairman at Eetbaar Heemskerk):

"I think that more secure wallets, combined with faster transactions AND cheaper costs... yeah, that it could work. It'll just need some more time. Rome wasn't built in a day neither."

Troy Bradley (Former Infusionsoft Consultant at FirstMed):

"Another illustration of how no matter how hard they try, they'll never improve the legacy system to the point it's superior to Bitcoin. The problem is, Bitcoin needs to be [many times] superior in order to foster widespread merchant addition. It's not ... yet.

Did you enjoy this article? You may also be interested in reading these ones:

Coin HR - the best way to find a perfect bitcoin job or an applicant for your vacancy. We connect talent with opportunity!