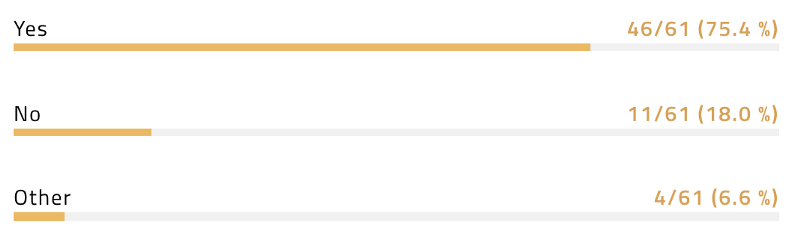

The vast majority of respondents favored SegWit over Bitcoin Unlimited. 75.4 percent of the Blockchain and Bitcoin experts community expressed their support for Segwit activation and 70.5 percent of the community turned down Bitcoin Unlimited.

The survey was conducted by 21 Inc, a Bitcoin company which operates a micropayments marketplace and pay-by-completion network. The respondents included Blockchain, Bitcoin and Ethereum executives and influencers, for example, Blockstream CEO Adam Back, Digital Currency Group CEO Barry Silbert, Coins.ph CEO Ron Hose, Kraken CEO Jesse Powell, and Litecoin creator Charlie Lee.

The results of the survey

The main purpose of the survey was to evaluate the popularity of certain digital currencies and their applications, and the possibility of either Segregated Witness (SegWit) or Bitcoin Unlimited of being activated.

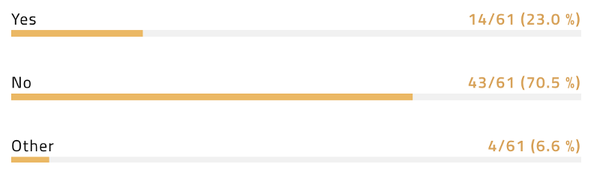

Do you want miners to activate Bitcoin Unlimited?

Do you want SegWit to be activated by miners?

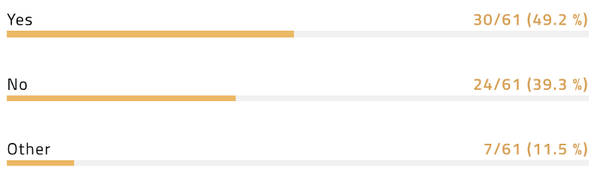

Are you in favor of a non-SegWit-based blocksize increase, via hard fork or otherwise?

The support rate for SegWit and the Bitcoin Core development team significantly increased after the two bug exploitation cases of Bitcoin Unlimited. The hashrate support for SegWit particularly began to increase after the Bitcoin Unlimited team released a closed source update to their code to immediately resolve an issue derived from a bug exploitation. The majority of the community rejected such development philosophy of Bitcoin Unlimited, which is evident in the support rate of SegWit shown below.

The most compelling part of the survey was when the community was asked about a potential non-SegWit blocksize increase solution. Surprisingly, 49.2 percent of the community stated that they are in favor of a non-SegWit based blocksize increase solution and they intend to support it if introduced in the future.

Alternatives to SegWit & Bitcoin Unlimited

Currently, most businesses, companies and organizations within the Bitcoin industry are rejecting Bitcoin Unlimited due to its contentious nature. If forked, it will inevitably lead to a split chain and lead to both economic and technical issues which will be difficult to deal with in the future.

However, there exist non-contentious hard forks that are well measured and planned. An example of this is Ethereum Classic’s recent hard fork execution to eliminate Ethereum’s original inflationary monetary policy and add a Bitcoin-like monetary policy that provides its token ETC with scarcity and rarity. Essentially, Ethereum Classic’s hard fork was a move by its development team to promote its token as a digital currency, rather than an asset designed solely for development.

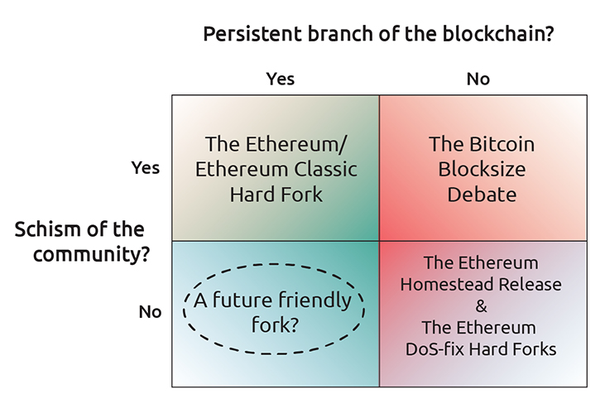

As reported by Cointelegraph earlier this month, ZCash CEO Zooko Wilcox also provided his criteria of a safe and non-contentious hard fork. In the chart shown below, Wilcox explained that not all hard fork solutions are dangerous and a hard fork could allow a network to update more efficiently than a soft fork solution if executed properly.

Ethereum on the rise

The same survey also asked the community on their portfolio of digital currencies. The top three digital currencies were Bitcoin at 98.4 percent, Ethereum’s Ether at 65.6 percent and Zcash at 37.7 percent.

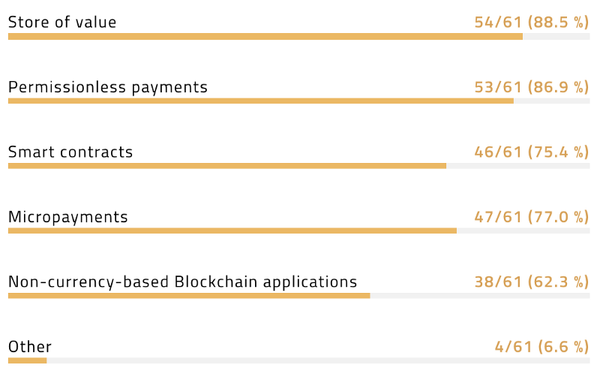

Which of the following applications of digital currency is exciting to you?

Interestingly, each currency has their own merits. Security-focused Bitcoin enables users to settle payments within a secure peer to peer protocol with transparency.

Ethereum, which prioritizes flexibility and functionality, allows users to send fixed-fee payments without having worry about Blockchain congestion. Lastly, ZCash permits users to send and receive transactions with full anonymity, providing the community with an unprecedented level of financial privacy.

The popularity of Ethereum coincided with the community’s interest in the smart contract. With the emergence of the Enterprise Ethereum Alliance and the involvement of some of the world’s largest corporations and financial institutions, the hype around Ethereum and its smart contract-based protocol are increasing rapidly.