With the controversial debut of Zcash, decline of Ethereum and the stumbling value of Monero, the Altcoin market has had a relatively underwhelming week in terms of trading volume, price volatility and development. Meanwhile, Bitcoin has shown consistency over the past week, hovering at $736 in most major markets.

Underwhelming performance of Altcoins

A few of the most highly anticipated and supported cryptocurrencies or assets are Ethereum, Zcash and Monero. Similarly, the three digital currencies or assets have strong development communities and cryptography that supports their networks.

However, each network has been dealing with issues that have resulted in the failure of decentralized applications, decline in community support and limited growth in user base.

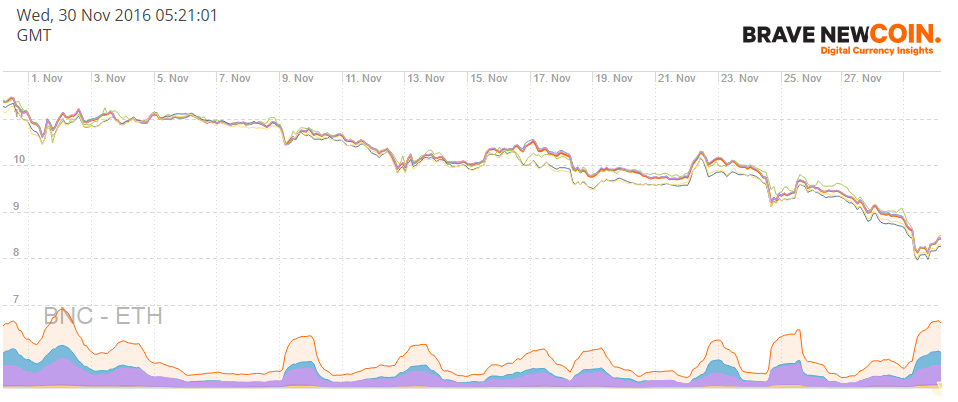

Only a month after Cointelegraph’s report on the improving performance of Ethereum’s Ether, the network began to face some serious security issues and transactional delays. The inability of the network to deal with and develop resilience to external attacks have led the Ethereum development team to execute yet another hard fork, making the latest “Spurious Dragon” the fourth hard fork of Ethereum within six months.

On Oct. 27, Cointelegraph author Evander Smart reported that Ethereum was set to become the world’s best performing cryptocurrency or digital asset in 2016, overtaking Bitcoin in terms of growth rate. Unfortunately, various issues with the network have led to a substantial decline in the value of Ethereum.

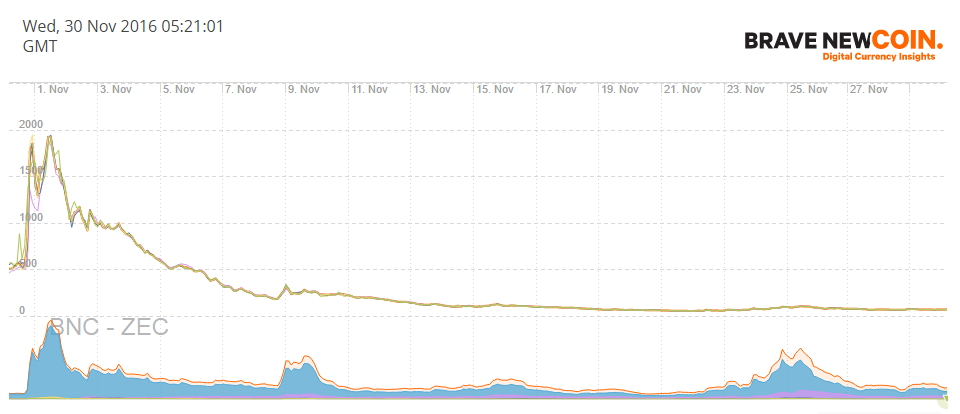

Zcash, a cryptocurrency designed to provide an unprecedented level of anonymity and privacy to its users, has also had a rough start despite its strong cryptography. Users and developers are yet to find security or transactional issues with the cryptocurrency but are hesitant about the obligation to provide Devmine share to the development team, which ultimately affects the income of miners.

While Zcash had a highly anticipated debut with coverage from the mainstream media and support from reputable cryptocurrency experts, it has struggled to find the right timing to bounce back and recover.

Bitcoin’s substantial growth

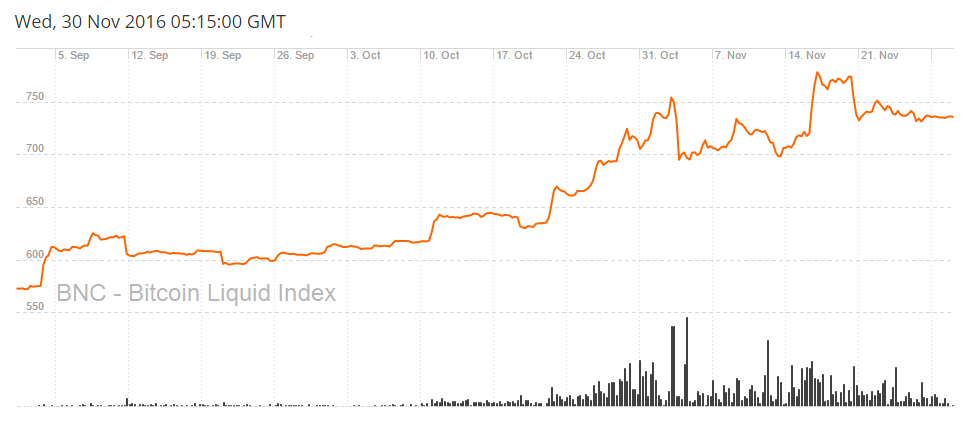

Global market instability and economic turmoil of major economies like China and India have consistently increased the demand for Bitcoin over the past few weeks, allowing Bitcoin to increase in market cap. The surge in demand has also pushed the volumes of over-the-counter markets, in which most high-profile and large-scale investors purchase and sell Bitcoin.

In a 90-day period, Bitcoin demonstrated a substantial increase from the $550 region to $750, showing the rising interest and demand for Bitcoin worldwide.

As long as individuals continue to see Bitcoin as a safe haven asset and alternative investment amid economic instability and market turbulence, experts predict that the value of Bitcoin will continue to increase. Although it is difficult to speculate future performance of dominant Altcoins, at this time Altcoins are struggling to demonstrate stability.