The first ATM was born in London on June 27, 1967. With the rise of new technologies, its future looks bleaker.

Flashback to 1967

Just 50 years ago, a machine was distributing banknotes for the first time. It was a real revolution at the time when individuals around the world went to their bank's counter to collect cash.

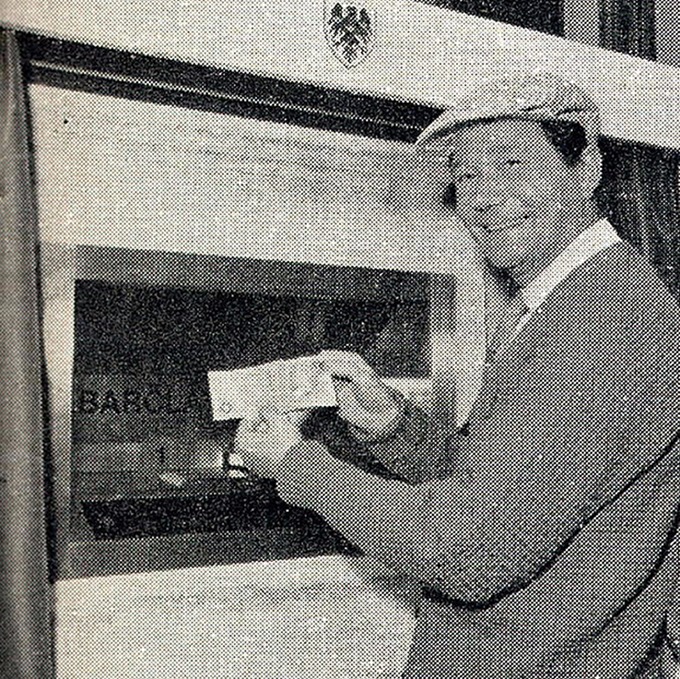

On June 27, 1967, the British comedian and actor Reg Varney was the first man to ever make a cash withdrawal in an automated teller machine, or ATM, installed on the outside wall of a Barclays agency in London. This first machine has since been modernized and, on its fiftieth anniversary, Barclays has covered it with a gold color.

- Actor Reg Varney was the first person ever to use a cash machine. Credit: PA Archive

John Shepherd-Barron, its inventor, had the idea of creating the cash machine two years earlier in 1965. Arriving too late on a Saturday morning to withdraw the cash he needed throughout the week, he had to ask his mechanic to give him money in exchange of a cheque.

“That night I started thinking that there must be a better way to get cash when I wanted it. I thought of the chocolate vending machine, where money was put in a slot and a bar dispatched. Surely money could be dispensed in the same way,” explained John Shepherd-Barron.

A worldwide success

The success of his invention was dazzling, as consumers appreciated being able to withdraw cash without having to go through a bank clerk. The planetary success that followed is well-known.

- People scramble to get a look at the world's first ATM. Credit: PA Archive

There are over three mln ATMs today. According to the World Bank, which has made it an economic indicator, the lowest density is in Afghanistan (one ATM per 100,000 inhabitants) and the highest in South Korea (278 ATMs per 100,000 inhabitants). There is even one in the American base of the South Pole in McMurdo, dubbed the “world's loneliest ATM.”

Towards more contactless and mobile payments

However, the future of the cash dispenser looks bleaker, with the rise of new technologies such as contactless technology and mobile payments. In some countries, the number of ATMs is already decreasing.

The UK Cards Association predicts that the contactless bank card payment, which is booming in the UK, should be the most common means used by buyers by the end of 2018 - ahead of cash payments. Although it seems to be a global trend, this grouping of professionals does not foresee the abandonment of cash any time soon, arguing that cash payments would still represent one-fifth of all payments within 10 years.

Raheel Ahmed, Head of Customer Relations at Barclays, notes:

“Although the last few years have seen an impressive take-off of online banking and card payments, cash remains an integral part of everyday life, whether for shopping or paying for coffee.”

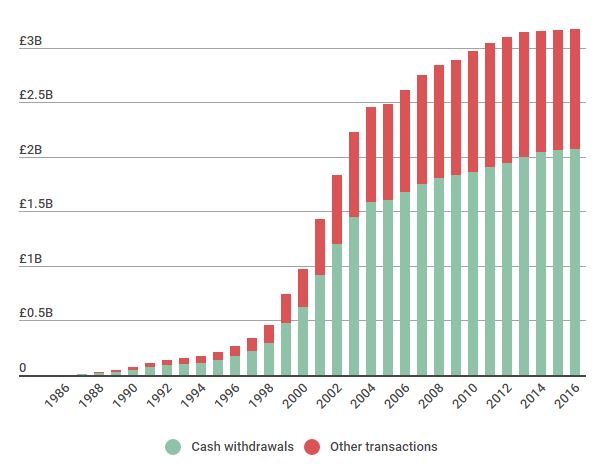

The following graph shows how spending habits have changed over the last 30 years. So, with society adopting new ways of payment, how can ATMs remain useful and relevant?

- Debit and credit cards are being used more than ever, although cash is still the main way people pay for things. Credit: Which?

Reinventing ATMs

ATMs must reinvent themselves. Today, they offer four or five options among which withdrawal of money, consultation of balances or money transfers. Tomorrow, they could allow to make an appointment with one’s banker or open a new account.

Many innovative initiatives have already been rolled out by various banks. Barclays lets users withdraw up to £100 without putting their card in an ATM. This contactless cash service was part of pilot test carried out at 100 ATMs in the UK. Its success led Barclays to take the decision of expanding the service to 1,336 in-branch machines across just over 500 branches.

Other notable cardless implementations include the NatWest mobile app “Get Cash.” The service allows users to withdraw up to £130 from an ATM only by entering a pin code on its app, which can be particularly useful for urgent situations when one has forgotten or lost his wallet.

The Spanish bank Santander has also bolstered its cash machines by allowing customers to deposit cash and cheques, transfer money and change their pin code, all through the ATM interface. The bank’s head of ATM channel, Antonio Encinar, announced Santander’s plans on surfing on the trend that further connects ATM with mobile.

Michael Somerville from Which? notes:

“In the US, Chase Bank has already rolled out thousands of card-free ATMs where customers can access money through their phone app. It also allows far higher withdrawals – up to £2,325. In Spain, it’s possible to buy tickets for Barcelona FC home games at an ATM and you don’t need a Spanish bank account to do so. And in typical glitzy style, an Abu Dhabi cash machine dispenses gold bullion bars for those not content with cash. Customers feed dirham notes, the local currency, into the machine and it exchanges it for gold.”

Furthermore, branch automation could be next big disruptor in the banking sector. Andy Mattes, CEO of Diebold, says the ATMs of tomorrow will replace human bank tellers. They are expected to execute 99 percent of what human beings can do. New machines will be able to identify people and scan documents to carry out more sensitive processes, such as loaning a car. For banks, this could also be a lucrative opportunity since a transaction at the teller costs about 65 cents, while an operation using a machine only costs eight.