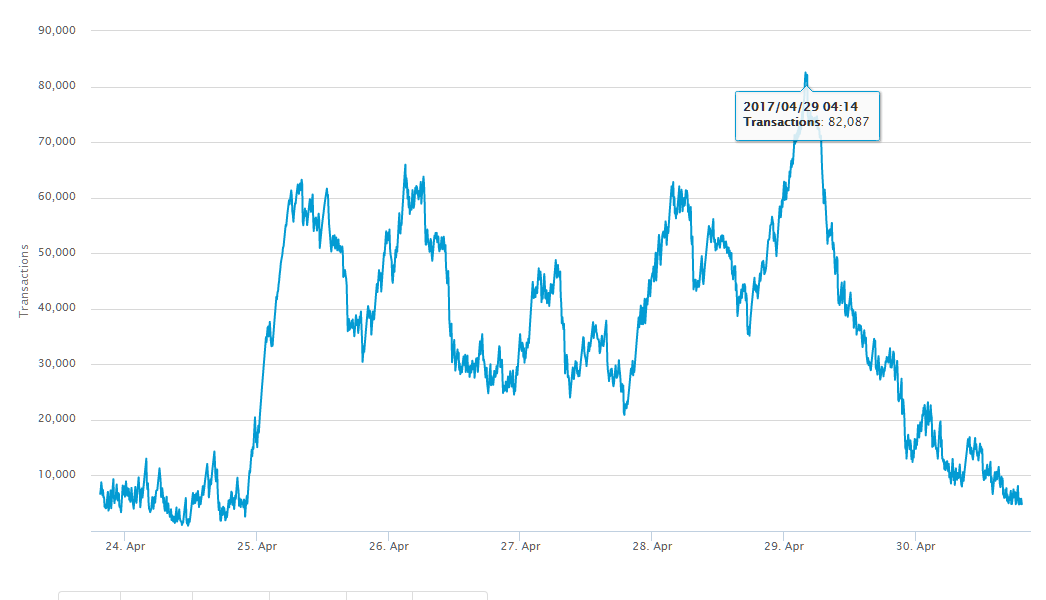

On April 29, the Bitcoin mempool, the holding area for unconfirmed and pending transactions, recorded more than 82,000 transactions. Most transactions were delayed for up to 48 hours.

When a Bitcoin transaction is signed and sent to the network, it is first verified by the Bitcoin network’s nodes. Once the transaction successfully passes the first stage of verification, it then sits on the mempool awaiting for miner confirmation. After several confirmations from Bitcoin miners, the transaction is broadcasted to the public Blockchain of Bitcoin.

During the second verification phase, miners prioritize transactions with high fees. In order to have transactions confirmed faster, transaction initiators attach higher fees to incentivize the miners. Even though a transaction with a higher fee is initiated long after a group of transactions with lower fees, miners tend to prioritize the transaction with a higher fee and broadcast it to the network.

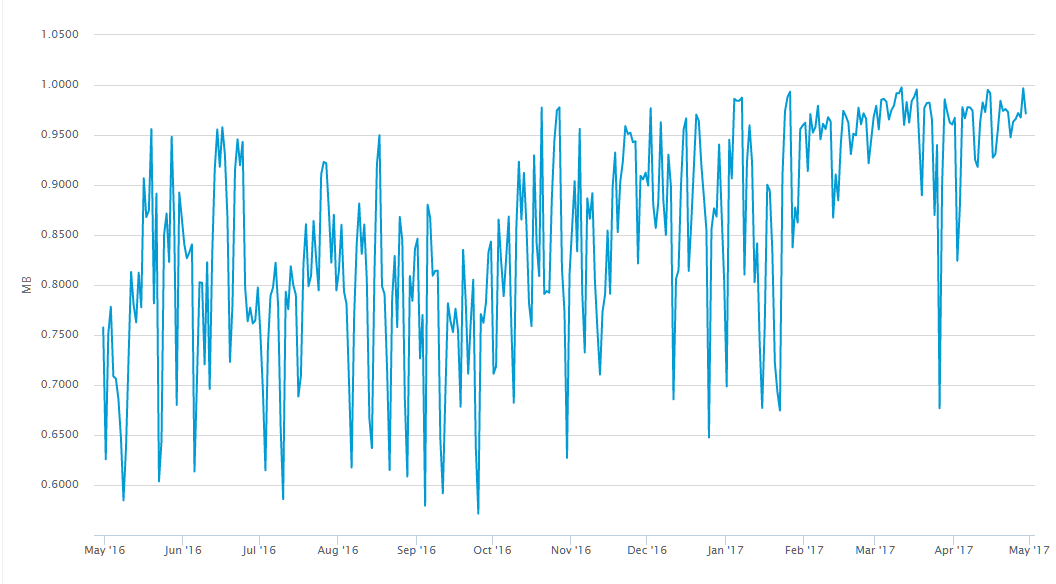

Currently, Bitcoin’s block size is capped at one MB. According to Blockchain.info, the average block size as of April 29 is 927 KB, which is extremely close to the maximum capacity of Bitcoin’s one MB block size cap.

The Fee Market in Bitcoin - what it is like

The increasing size of Bitcoin blocks are leading to a larger amount of delayed transactions stuck in the Bitcoin mempool and the growth of the fee market. In Bitcoin, fee market is referred to an ecosystem wherein users compete to add higher fees to have their transactions confirmed at a faster rate.

Until a Bitcoin scaling solution such as Bitcoin Core’s Segregated Witness, Andrew Lee’s Extension Blocks and Bitcoin Unlimited is activated to increase the capacity of the Bitcoin Blockchain, the fee market will continue to exist.

To ensure that the recipient of the transaction does not suffer from long confirmation period that could range up to 72 hours, it is important to utilize Bitcoin wallet platforms with appropriate fee estimation features.

World’s most popular Bitcoin wallet platform

Blockchain, the world’s most popular Bitcoin wallet platform with over 12 mln users, have an accurate fee estimation feature which allows users to predict when the transaction will be confirmed.

For instance, when a fee is attached, Blockchain provides its users a certain time period, such as 10 minutes one hour, until the first confirmation is secured. Once the first confirmation is secured, it will take approximately 10 minutes for additional confirmations. On Blockchain, three confirmations is the standard for all users.

There are various innovative platforms such as 21 Inc’s Bitcoin Fees that allows users to find the optimal transaction fee for their transactions. Since the optimal transaction fee could vary depending on many variables such as the size of the transaction, 21 Fees note that 140 satoshis/byte is the optimal fee for Bitcoin transactions.

On average, the Bitcoin transaction size is 226 bytes. Thus, a $0.4 fee would allow a user to secure its first confirmation within 10 minutes.

Samourai Wallet, a privacy-focused Bitcoin wallet platform, is currently working to release the full version of its application that features Peter Todd’s replace-by-fee function, which allows recipients to add fees on top of the initial fee attached by the sender to speed up the confirmation process.