The Federal Deposit Insurance Corporation (FDIC) reports that there have been 527 bank failures in the U.S since the invention of Bitcoin in late 2008. While billions of dollars have been lost due to bank failures and hackings, the Bitcoin protocol itself has never been hacked.

Eric Voorhees, the founder of Shapeshift, tweeted recently:

Can we take a moment to reflect on the fact that the Bitcoin protocol STILL hasn't been hacked? One of the greatest comp sci accomplishments

— Erik Voorhees (@ErikVoorhees) May 13, 2015

Since 2009 through 2013, bank failures resulted in a total loss of at least US$65 billion, according to the FDIC. The largest bank failure in the history of the U.S. was the collapse of savings bank holding company Washington Mutual, which fell in 2008, taking with it over US$22 billion in losses. At the time, Bloomberg reported that “Washington Mutual, nicknamed WaMu, will lose about $21.7 billion from mortgages through 2011, more than the US$12 billion to US$19 billion that the company forecasted.”

Bankrate.com stated that the FDIC closes more banks each week. The number of bank failures have exponentially increased and have resulted in more than US$100 billion in losses over the last decade.

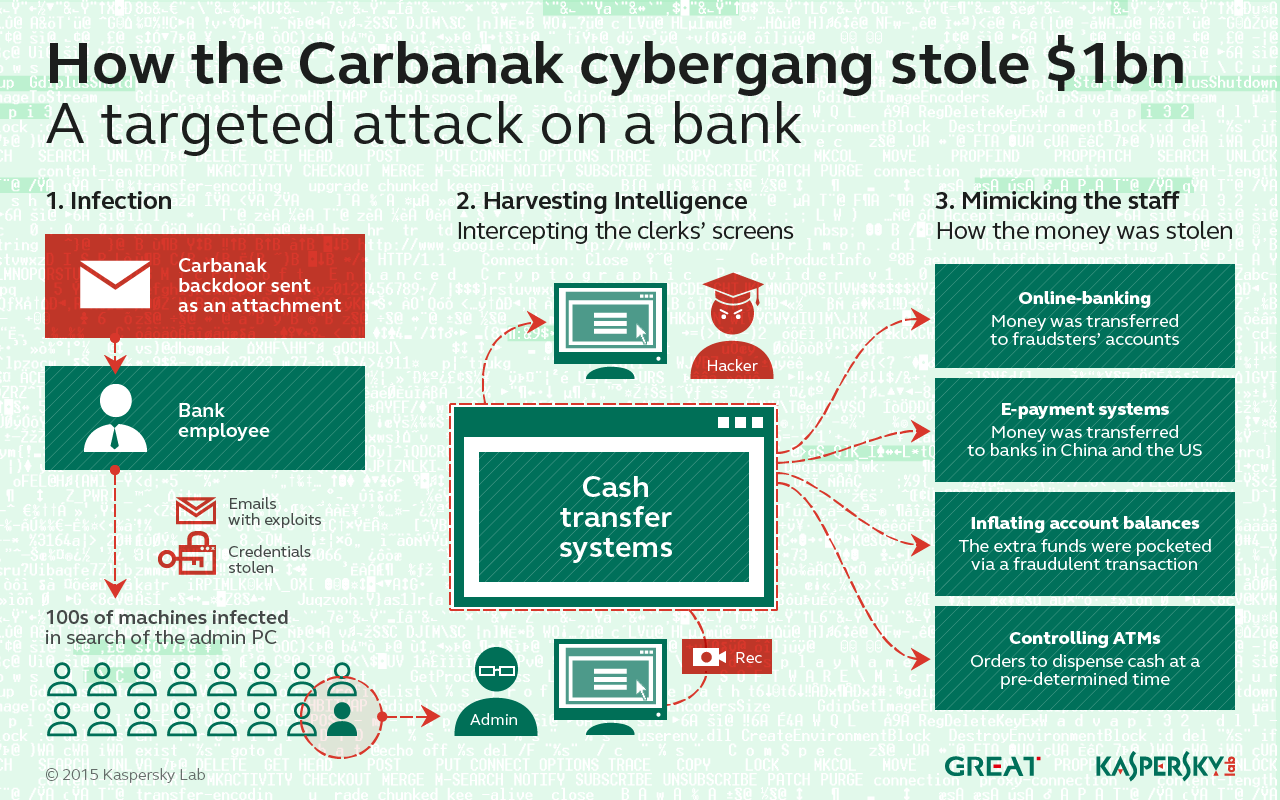

In February of 2015, international software security group Kaspersky Lab investigated a recent bank-security failure that resulted in US$1 billion in losses. Kaspersky reported that a cybergang called Carbanak hacked into 100 different financial institutions and stole up to US$10 million in each raid.

The cybergang used spear-phishing tactics to infect the computers of employees within well-established financial institutions. After months of surveillance, the hackers used their Carbanak malware to gain control of the banks’ internal networks and access the computers of administrators. They achieved access to bank operations and records, and they replicated the database accessible by employees in order to “mimic staff activity to transfer money and cash out.”

Bitcoin to Disrupt the Banking Systems

Although banking systems have continued to collapse and fail over the last decade, the protocol of Bitcoin has not been hacked since its launch in 2008.

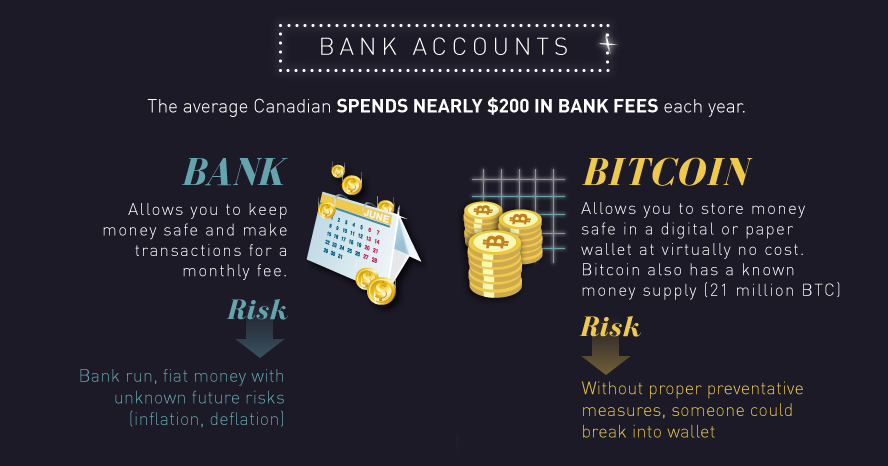

Bitcoin mining is decentralized and the security of the Bitcoin network purely depends on it. For an individual or an organization to corrupt the Bitcoin blockchain or initiate an attack, they must gain control of over 50% of the network’s mining power, achieving what is known as a “51% attack.”

In June of 2014, a mining pool called Ghash.io’s hashing rate reached almost 51%, which according to Andreas Antonopoulos could have allowed Ghash.io to “execute a double-spend” for a couple of blocks. Not long afterward, Ghash.io’s hashing rate returned to around 36%.

While the Bitcoin network has never been hacked, major wallets and exchanges, including Bitstamp and Mt. Gox, have suffered from hacking and internal failures, but these have been due to flaws internal flaws within their systems, not to flaws in the Bitcoin protocol.

The Bitcoin network and services built upon it continue to strengthen security through technologies such as multisignature. The numbers of bank failures and internal hackings, at the same time, are exponentially increasing.

If banks continue to crumble at such a high rate, Bitcoin will continue to have an edge in the traditional system. We will increasingly hear senior banking officials like Gareth Murphy of the Central Bank of Ireland cite Bitcoin for “[posing] new challenges to central banks’ control.”