Countless experts and pundits, including Chase CEO Jamie Dimon, have proclaimed that Bitcoin is in a massive bubble right now, and it certainly could be. Yet these “experts” fail to consider one possibility that some in the Bitcoin community are beginning to suspect: mass adoption may be imminent.

Permanently high plateau

First, let’s get something out of the way. Yes, with every bubble there are people who insist that it really isn’t a bubble. It’s “the new normal” or “a new paradigm.” Perhaps the most infamous such example is that of Yale economist Irving Fisher. At the height of the 1929 stock market bubble, just before the crash, a jubilant Fisher proclaimed:

“Stock prices have reached what looks like a permanently high plateau.”

He couldn’t have been more wrong.

Bubbles throughout history

History is replete with examples of financial bubbles that popped disastrously. Britain’s South Sea bubble came about in the early 1700s, when investors became convinced that the South Sea Company, which was given a monopoly on trade with South America, would produce enormous profits. Their hopes were dashed, and the entire economy shaken, when the bubble popped and the value of South Sea Company stock bottomed out.

The Mississippi bubble was caused when financier John Law convinced the French regent of a plan to pay off France’s massive debts. In 1716, Law’s Mississippi Company agreed to assume the entire French national debt in return for a complete monopoly on all trade and mineral wealth in France’s Louisiana territory.

Seeing no way to lose, and spurred to a frenzy by Law’s marketing, investors drove the price of Mississippi Company stock sky high. When Law realized the bubble had gotten out of hand, he tried to gradually deflate his stock price. Unfortunately, this resulted in a complete collapse of the company and wrecked the French economy.

Tulip mania is arguably the most famous bubble in history. In the 1630s, Dutch traders drove the price of tulip bulbs to absurd levels. As prices kept rising, retail investors got involved in futures trading, betting on the price continuing to rise. At the bubble’s peak, the price of a single tulip bulb was equal to the price of a riverfront home in Amsterdam.

Eventually the price stopped going up, people began to sell, and the price of tulip bulbs dropped to near zero. The panic was so severe that the Dutch government offered to buy underwater futures contracts for 10% of the contracts’ value, but continued price declines forced the government to withdraw its promise.

Recent bubbles

The two most famous bubbles of recent times are the dot-com bubble of the late-1990s/early-2000s and the housing bubble of the mid-2000s.

In the case of the dot-com bubble, people were so drawn to the potential of the Internet that they invested in any company with a “.com” in its name. Venture capital and over-subscribed IPOs loaded these companies with so much cash that they didn’t have to turn a profit right away.

Often with no business model at all, dot-com companies believed that if they attracted enough users, they would eventually find a way to profit. They were wrong, and the vast majority of them went bankrupt, tanking the value of the NASDAQ index.

The recent housing bubble was triggered by government policies and loose credit, enabling people to buy houses that were far beyond their financial means. Seeing the demand, banks created derivatives which gave investors more ways to get exposure to the growing housing sector. These derivatives added more fuel to the housing boom, as banks saw they could make outsized profits so long as the market continued to rise.

Lenders loosened credit restrictions even further, and anybody that said they wanted to buy a house was given a mortgage. Virtually no questions were asked and no documentation required. Such mortgages were labelled “NINJA” loans: no job, no income, no assets were required to borrow money.

Eventually buyers began defaulting on their mortgages en masse, causing a massive drop in housing prices and bringing about the Great Recession.

On S-Curves--why it really might be different this time

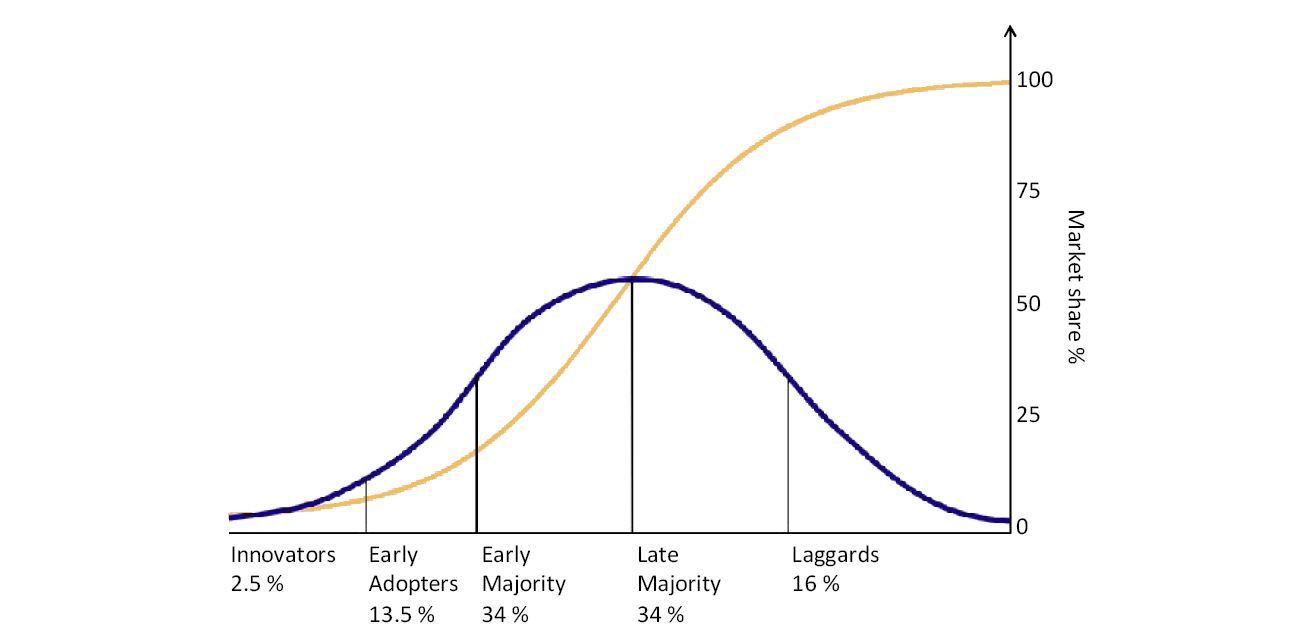

The adoption of new technologies over the last century has resembled an S-Curve. As the technology is introduced, it takes time for people to learn about it and realize its potential. Once public awareness reaches a critical mass and the technology is perfected, adoption occurs extremely rapidly, resulting in exponential growth. Finally, once everybody has adopted the technology, the curve flattens out again.

Key questions and bubble follow-up

Below is a picture of the Bitcoin market since late 2013. See how even the “massive” bubble of November/December 2013 is dwarfed by the current one?

What happens if today’s Bitcoin bubble isn’t a bubble at all, in the traditional sense? What happens if we are actually on the cusp of that massive near-vertical adoption uptake? A look back at the dot-com bubble and the housing bubble might shed some light on current circumstances.

What happens if today’s Bitcoin bubble isn’t a bubble at all, in the traditional sense? What happens if we are actually on the cusp of that massive near-vertical adoption uptake? A look back at the dot-com bubble and the housing bubble might shed some light on current circumstances.

On March 2, 2015, the NASDAQ index hit an all-time high, surging above the 5,000 mark as it finally surpassed its peak price, reached at the top of the dot-com bubble. Today, the index stands at 6,449. It took 15 years, but the markets fully recovered, eventually reaching new highs.

Likewise the Case-Shiller index of housing prices is approaching its pre-bubble heights. The index stopped at 198 in 2006 and is now back to 194. As the economy continues to improve, it’s likely that home prices will continue to rise above their 2006 peak.

What’s the difference?

Why did the South Sea bubble, Mississippi bubble, and Dutch tulip mania all eventually go to zero, never to rise again? Why did Internet companies enjoy a new resurgence and eclipse past bubble levels? Why do housing prices seem to be following the same path?

More important, what does all this have to do with Bitcoin?

It’s simple. The bubbles of old were driven by hype, with nothing of value actually backing them. A tulip bulb has zero intrinsic value, and absolutely no potential to become something more. The South Sea company was backed by a worthless monopoly, since South America was under Spanish control. The Mississippi company never could exploit the wealth of the new world, because unlike Spanish territories, Louisiana had no gold or silver to export.

Internet companies like Amazon, Facebook, PayPal and the others are completely different. The Internet offers unmatched potential for growth, with world-changing consequences. Yes, things got overheated in the early 2000s, but prices recovered and the upward trajectory was renewed. Housing prices went out of control in the mid-2000s, but as the population grows, housing is always in demand. A house represents a real asset with real value that meets a real need.

Bitcoin represents a sea change in the way business is conducted on the Internet. It is the world’s first decentralized, non state controlled, truly global currency. Bitcoin is a promising monetary technology that seems more apt to follow the path of an S-Curve than that of a boom-and-bust.

Bitcoin could still be overpriced for this stage of its development. It could be in a bubble that deflates before rising again in a few years. But if Bitcoin is what I think it is, then at some point (maybe even now) we will rapidly shoot up that S-Curve to prices that are presently unimaginable.