SegWit2x was supposed to be a SegWit derivative that doubled the amount of data a block could hold from 1MB to 2MB. The SegWit2x plan came into being at the 2017 Consensus conference in New York. At this event, 58 Bitcoin-related companies signed an agreement proposed by the Digital Currency Group - the company behind $GBTC. This agreement proposed that SegWit be activated as soon as possible, and that it be followed up by a block size increase in mid-November. The agreement came to be known as the New York Agreement (NYA).

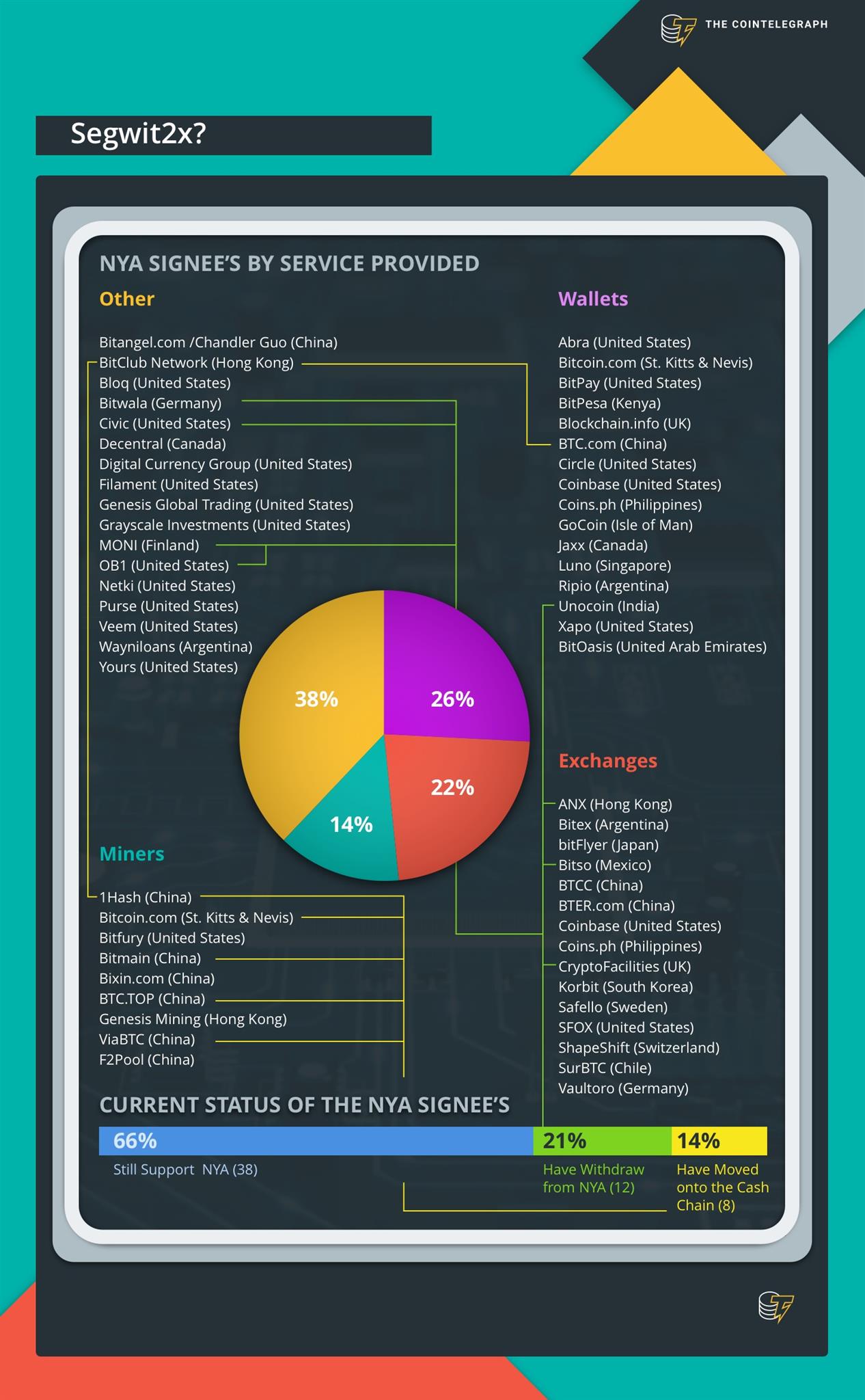

Cointelegraph was able to collect data on 57 of the original 58 companies that signed the NYA. Sixteen companies were wallet providers,15 were exchanges, nine were miners and 17 businesses can be classified as “other.” In this case, “other” means that they are businesses that provide goods or services in the cryptocurrency space.

As time passed, a number of companies began to withdraw from the NYA or decided to focus their resources on the Bitcoin Cash chain instead of Bitcoin and the proposed SegWit2x upgrade. As of early November, 12 companies had withdrawn from the NYA, eight had focused their resources on the Bitcoin Cash chain, and 38 of the original 58 companies still supported SegWit2x.

Reneging

Of the 12 companies that withdrew, one company was a wallet provider, three were exchanges and eight were “other.” No miners formally withdrew from the agreement, although F2Pool stopped signalling for SegWit2x in mid-October. Every company that withdrew from the NYA publicly announced their reasons.

SurBTC, a Bitcoin and Ethereum exchange in Chile, Columbia, and Peru said their reason for leaving was:

“Even though we would be happy to have moderately larger blocks to accommodate growing demand, we feel that Bitcoin needs (at least a majority) of Bitcoin's core developers' support in order to do this responsibly. We have not seen this support and we do not like what we are currently seeing on the btc1 code repository in terms of technical considerations and open source collaboration.”

SegWit2x received a lack of support from both the Bitcoin core developers and the wider crypto-community. Both the core devs and many in the community thought that it was too soon to upgrade the Bitcoin network. SegWit2x was planned to occur in November, barely three months after the network had upgraded to SegWit.

California-based Civic took to Twitter just a few days before SegWit2x was cancelled to express their reasons for withdrawing from the NYA. Vinny Lingham, CEO/Founder of Civic, said:

In light of the recent death threats that I have received, I realize that Segwit2x is a bad idea and I publicly revoke my support for it.

— Vinny Lingham (@VinnyLingham) November 2, 2017

SegWit2x suspended

On November 8, 2017, Mike Belshe published a statement supported by Wences Casares, Jihan Wu, Jeff Garzik, Peter Smith and Erik Voorhees:

“It is clear that we have not built sufficient consensus for a clean blocksize upgrade at this time...we are suspending our plans for the upcoming 2MB upgrade.”

Many agreed that SegWit was a sufficient solution in the short-term for solving the congestion problems the Bitcoin network was experiencing. This congestion had led to high transaction fees and slow confirmation. However, 2X supporters believed that the implementation of SegWit merely postponed another network overload taking place. They thought that doubling the block size would give the network a little more breathing room until a permanent scaling solution could be implemented.

Although SegWit makes transactions more efficient, the Bitcoin network continues to experience significant congestion, with 115,000 unconfirmed transactions at press time. Transaction numbers are growing rapidly, and SegWit by itself has not proven sufficient to handle the load.

Market goes crazy

The morning SegWit2x was suspended, the price of Bitcoin sat at $7,200. Many have speculated that investors had increased their Bitcoin position to receive more 2X tokens. Indeed, those who received large amounts of Bitcoin Cash in the August 1 split found themselves to be well-rewarded financially. This led many to believe that forks were essentially “free money” and that all they had to do was line up to receive it. Of course, they neglected to realize the existential threat that a chain split between legacy Bitcoin and Bitcoin 2X could have brought about.

Immediately following the announcement of SegWit2x’s cancellation, the price of Bitcoin jumped to $7,800 before rapidly retreating. At first, it seemed that the cancellation of a dangerous hard fork had increased investors’ confidence in the Bitcoin network. Since the split didn’t occur, the network was more unified in terms of hash power and cooperative nodes, which both play a vital role in the Bitcoin Economy.

Yet by November 10, the price of Bitcoin dropped as low as $6,400. Why? With the fork suspended, investors may have felt like they pumped up their position in Bitcoin for no reason, since they wouldn’t end up receiving this “free money” after all. It’s also likely that the remaining “big blockers” decided to leave Bitcoin altogether, perhaps migrating to Bitcoin Cash or Dash.

Ultimately the price of Bitcoin dropped as low as $5,500 before rebounding to about $6,600 at press time. While the price of Bitcoin dropped, that of Bitcoin Cash surged from $600 to $2,600 in a matter of days. The alternative currency has since lost half its value, and sits at about $1,300.

What next?

Although the plan to implement SegWit2x may have been a bit hasty, scalability is definitely going to be an issue for the Bitcoin network in the future. The volume of transactions that occur on the Bitcoin network is increasing everyday and transaction fees are skyrocketing. Many have placed their hopes on the lightning network which is expected to move many transactions off-chain, increasing the network’s capacity. As of yet, lightning network has not been deployed, and use of the Bitcoin network is prone to delays and high expenses.