Schiff-ting Sands

As markets tumbled, goldbug anti-Bitcoiner Peter Schiff repeatedly slammed the crypto community for advancing the narrative of Bitcoin as a store-of-value.

Bitcoin promoters claim #Bitcoin has proven itself to be superior to #gold as a safe haven and store of value. This is nonsense. Bitcoin hasn’t been around long enough to prove anything other than P.T Barnum right. There’s a sucker born every minute and many of them own Bitcoin.

— Peter Schiff (@PeterSchiff) February 25, 2020

And this week, the notorious antagonist got what he wanted: a crypto bloodbath of epic proportions. He apparently reveled in the havoc wreaked on crypto markets:

If any institutional money ever actually went into #Bitcoin it’s about to come out, never to return. Bitcoin has finally proven conclusively that it’s neither a store of value, a safe haven, nor a non-correlated asset. The Bitcoin chain letter has finally run out of links!

— Peter Schiff (@PeterSchiff) March 11, 2020

What explains why other people’s misery can be so satisfying for Schiff, whose obsession with gold puts him on par with Thorin, son of Thráin, son of Thrór?

Is it schadenfreude — literally, delighting in other’s misfortune? Or is it simply an attempt to divert attention from his own numerous failings as a prognosticator?

You see, it turns out the crypto-naysayer has left an embarrassing string of bad predictions in his wake. For those kinds of people, there is a premium on occasionally being right.

Let’s Take A Trip Down Memory Lane…

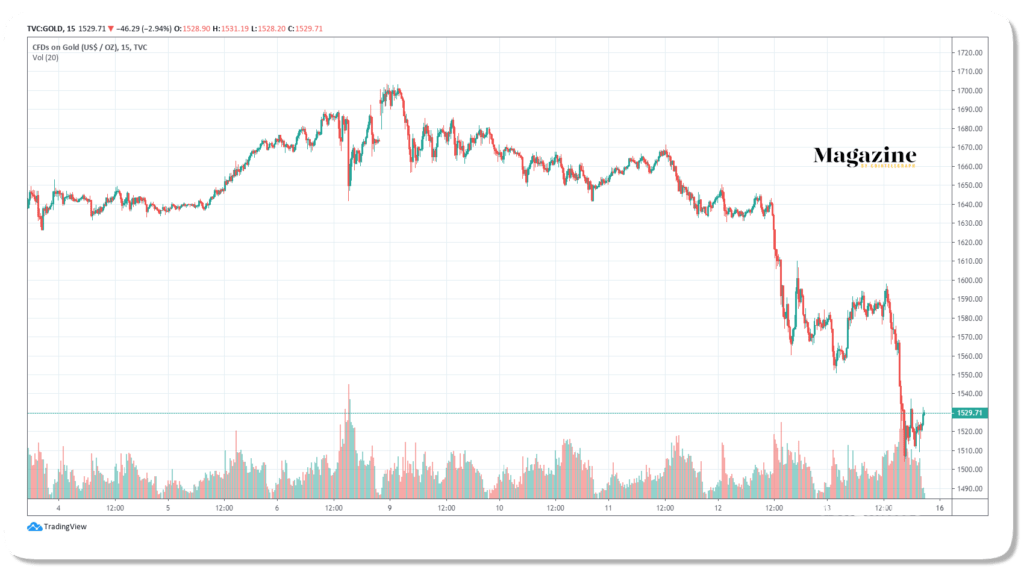

Late in 2012 the Schiff of Wall Street predicted gold would reach $5,000 an ounce within two years due to excessively easy monetary policy. It lingered this week in the wake of coronavirus fears… at around $1,530.

Oops!

By pure coincidence, his sixth book, the non-alarmist “The Real Crash: America’s Coming Bankruptcy – How to Save Yourself and Your Country” was published the same year and updated in 2014. For ~0.00262 BTC you can download the Kindle version from Amazon.

In a sign that people will shamelessly flog off anything on the e-commerce site, used paperbacks go for under ten bucks.

The epic fail of that prediction in 2012 caused the noted gold buff considerable reputational harm. To walk it back, a few months after the release of the updated financial apocalypse book mentioned above, Schiff told CNBC, “obviously it’s going to take a little bit longer than what I believed at the time.”

(To this date, that particular statement remains his most accurate.)

To dig himself as deep into that same hole as possible, the sage boldly asserted that, “It’ll go through $2,000 very quickly, and people will be upset that they didn’t buy gold at $1,700.”

That was circa October 2014. Almost six years on, the golden opportunity remains.

Absolutely Full of Schiff

Schiff’s predictive skills probably peaked when he estimated his own odds on running for the Senate at 50/50. When your prediction capabilities have you sitting on the fence about a decision over which you have full control… maybe fortune-telling is not your game.

He did eventually run for the Senate, losing the Republican nomination. But on the campaign trail, Schiff left us with no doubt over his confidence in his own entitlement to prophesize (and everyone else’s obligation to listen):

“Unlike everybody else, I pretty much predicted everything that would happen in 2008 in specific and exact detail.”

Now that’s pure gold. Peter Schiff may accidentally prove right about Bitcoin, though I won’t be putting any money on it. Insights from a dude who can’t tell a PIN from a password are best overlooked.

In the meantime, Schiff would be well-advised, for everyone’s sake, to observe the ancient Egyptian proverb translated into English as “Silence is golden.”

Because we’re too polite to point out what STFU stands for.

Strong Hands in a Bloodbath

It hasn’t been a great week for cryptocurrency markets. It hasn’t been a great week for any markets. As it finally dawned on the US public that their administration is so incompetent they failed to use a month-long buffer to prepare for the coronavirus, risk-on assets took a beating.

From a high of 29,551 on February 12th the Dow plunged to 21,200 a month later, enduring one of the worst weeks in history for the index. Globally, stocks have retreated in fear of a forthcoming recession.

Crypto markets have fared even worse. Bitcoin started the week around $9,000. It is now trading at close to $5,000. Ether has lost almost half its value since Sunday. In the first ever test of its safe haven properties during wider bearish sentiment, Bitcoin failed to live up to its digital gold credentials.

Hats Off to the Faithful

Amid the crisis the steely nerves demonstrated by hodlers deserve credit. The cryptocurrency asset class has never before faced current levels of uncertainty. Bitcoin has suffered precipitous drops in the past, but they have never been accompanied by rampaging falls in equity markets.

Safe haven fiat currencies like the US dollar, the Yen, and the Swiss Franc are the only assets to have held their value over the past week. But with massive fiscal and central bank measures announced in the wake of coronavirus fears, pronounced monetary debasement is in the making.

Holding onto falling knives is no less painful than catching them. That is especially true for hodlers… some of whom may even fall into the red. But digital assets are here to stay.

The value of grit is becoming more widely recognized. If you’re still able to perceive the reality that Bitcoin is a sound alternative to fiat money, you proved that this week.

Bravo, or brava.

Opinions expressed in this column are those of the author.